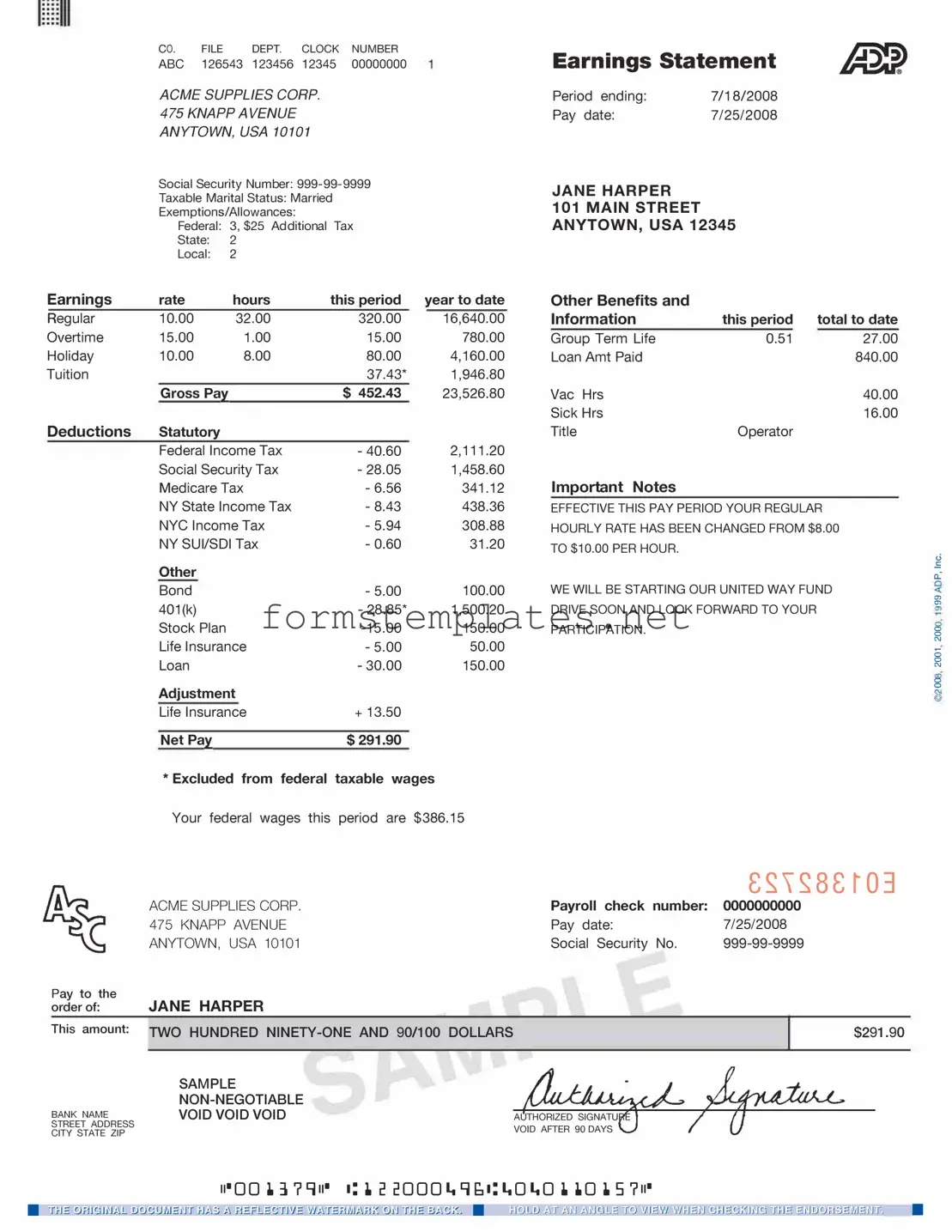

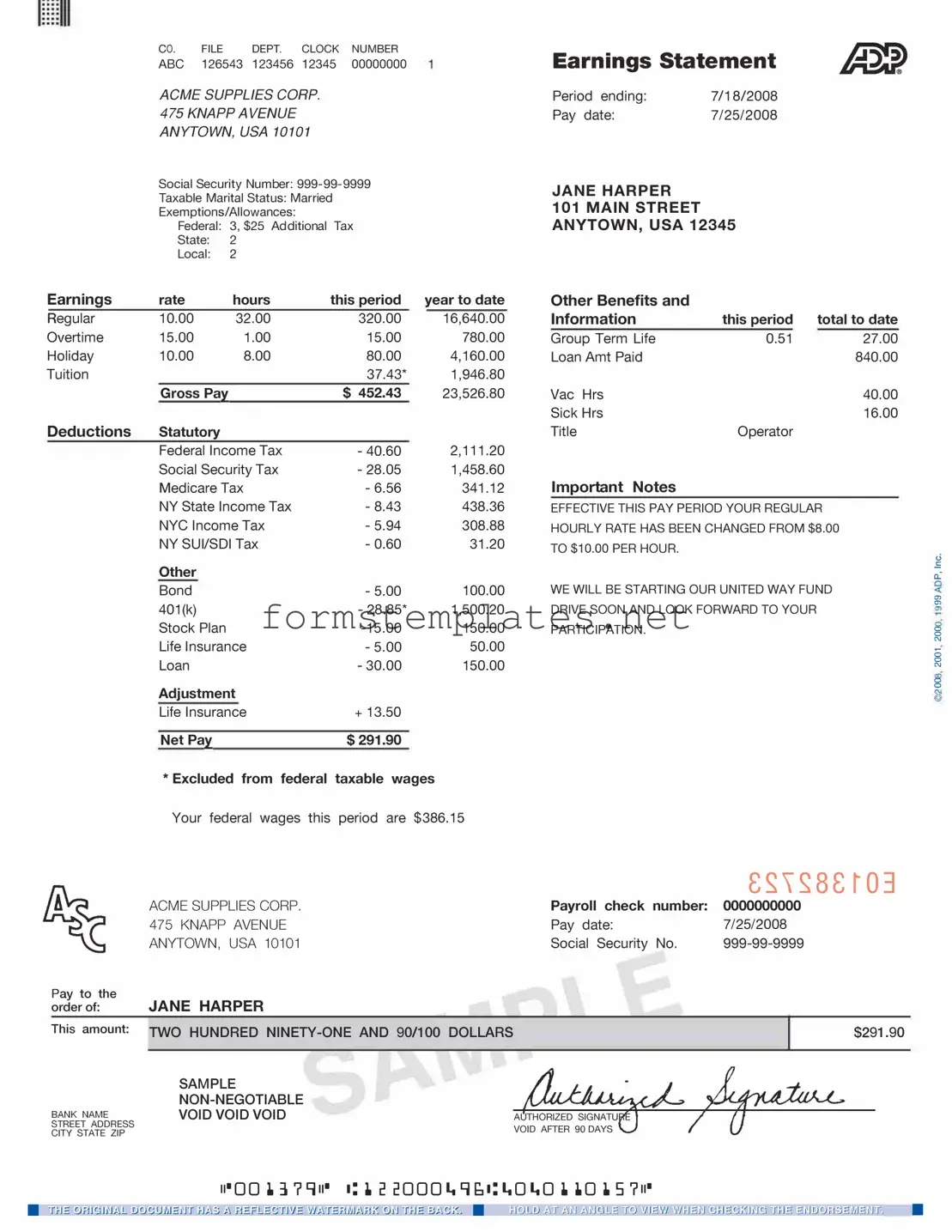

Free Adp Pay Stub Template

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. This form is essential for understanding your paycheck and ensuring that all calculations are accurate. By reviewing your pay stub, you can keep track of your income and verify that taxes and other deductions are correct.

Open Editor Now

Free Adp Pay Stub Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Adp Pay Stub online — simple edits, saving, and download.