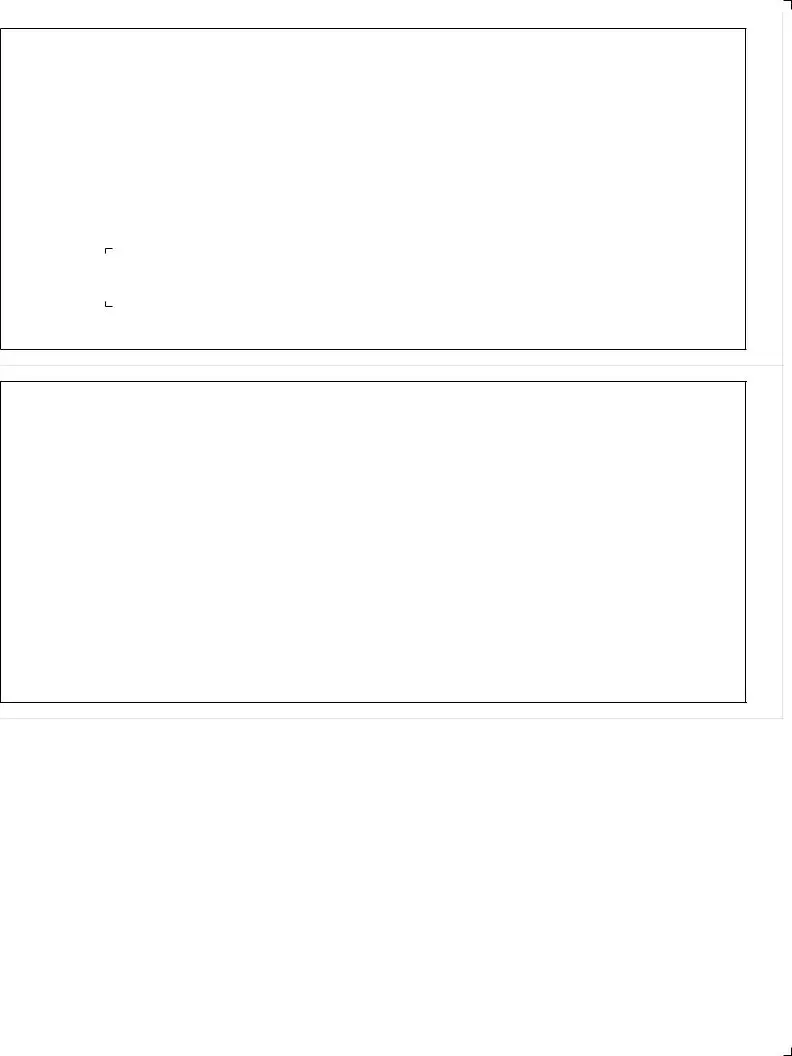

Free Auto Insurance Card Template

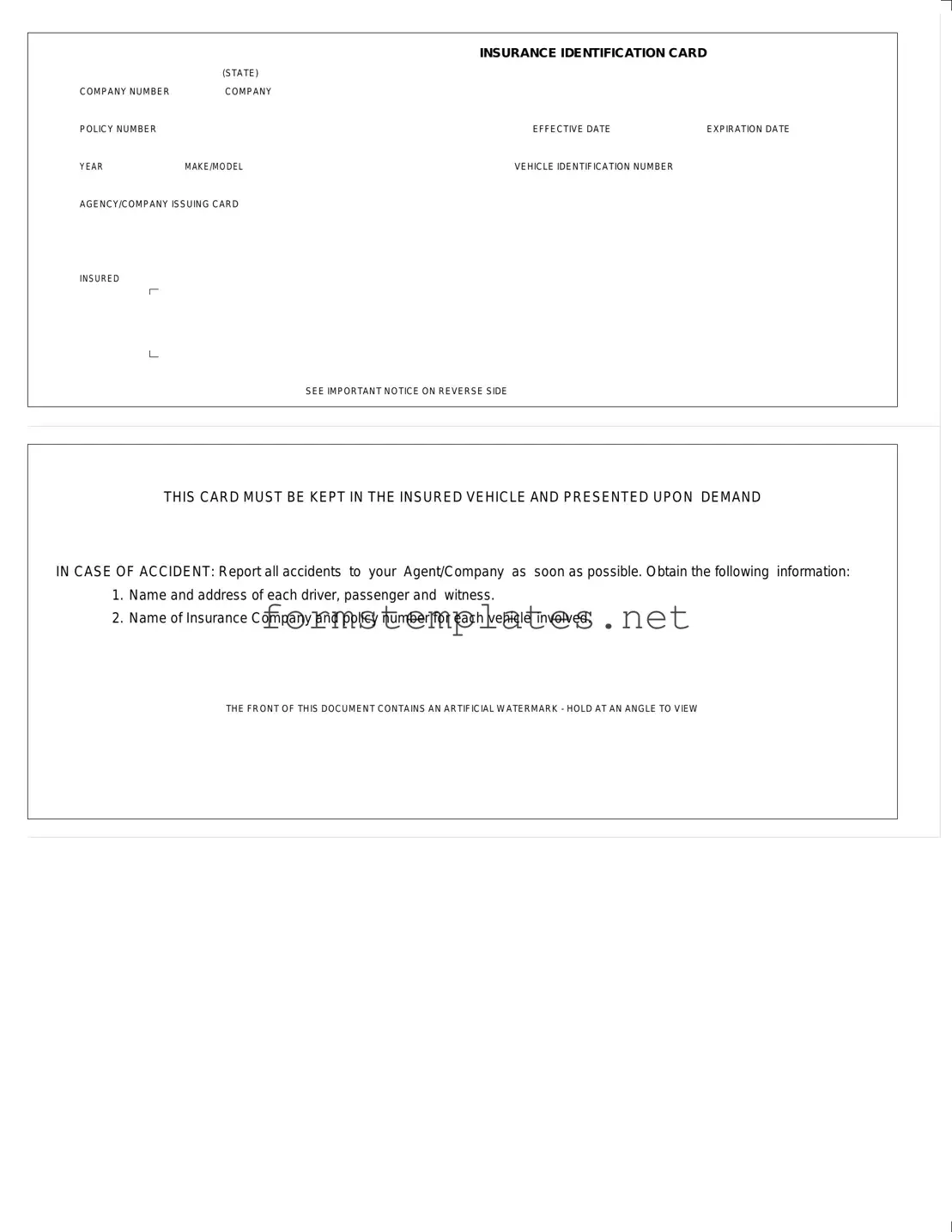

The Auto Insurance Card is a vital document that provides proof of insurance coverage for a vehicle. It includes essential details such as the insurance company name, policy number, and effective dates. This card must be kept in the vehicle at all times and presented upon request in the event of an accident.

Open Editor Now

Free Auto Insurance Card Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Auto Insurance Card online — simple edits, saving, and download.