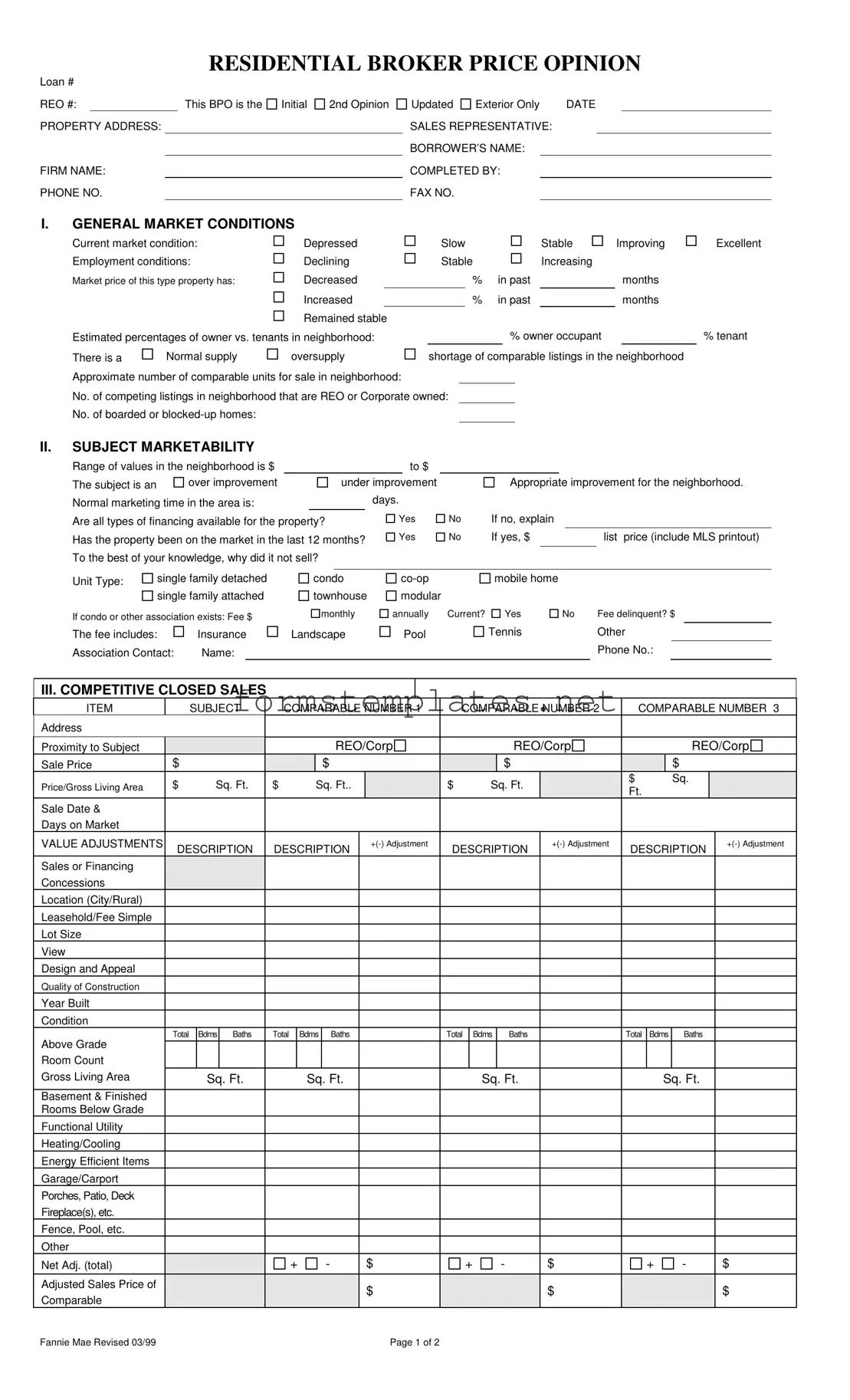

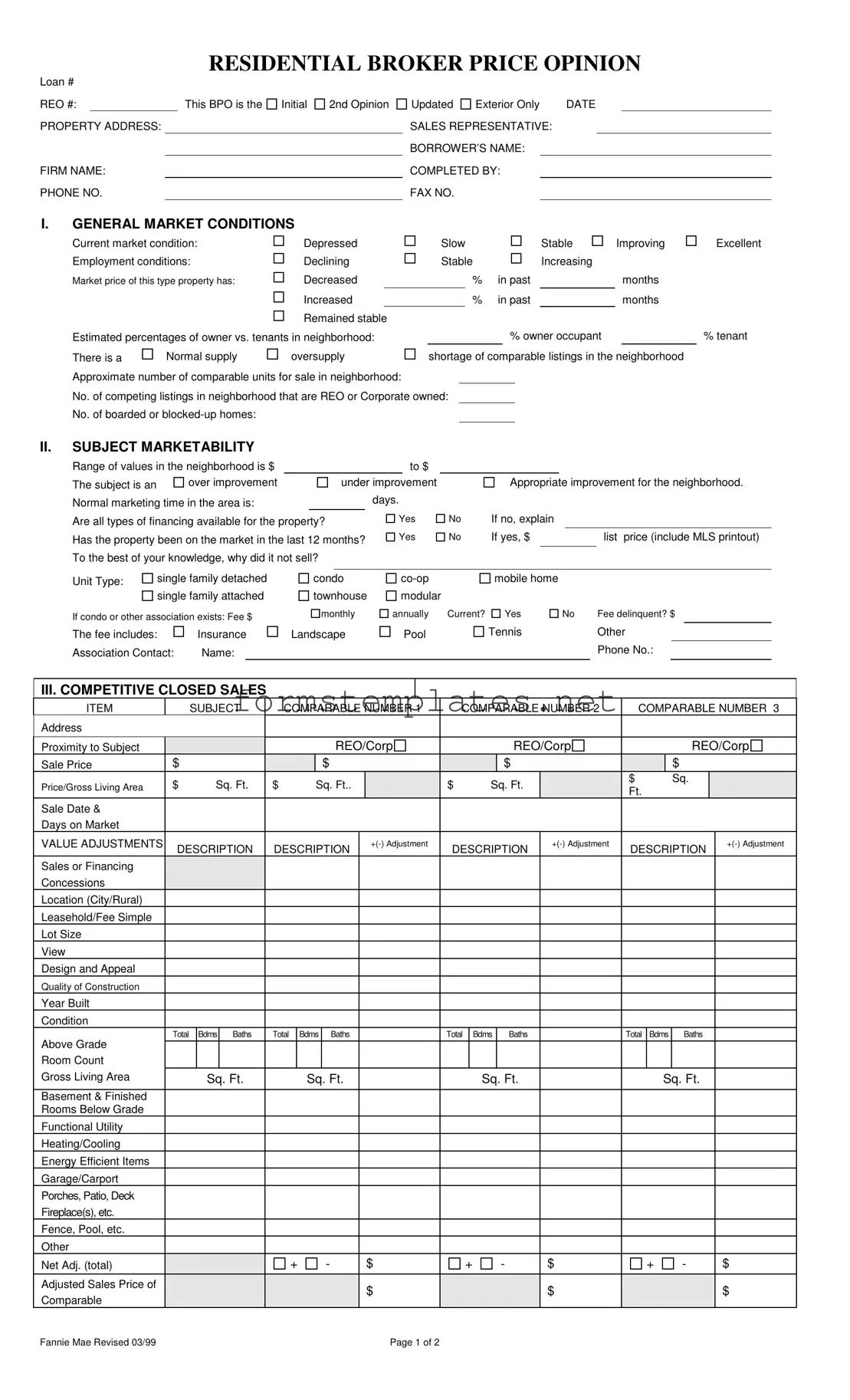

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is a professional opinion provided by a licensed real estate broker or agent regarding the value of a property. It is often used by lenders, investors, or real estate companies to assess the market value of a property, especially in situations like foreclosures or short sales.

When is a BPO typically requested?

BPOs are commonly requested in various scenarios, including:

-

Foreclosure proceedings

-

Short sales

-

Loan modifications

-

Real estate transactions where a formal appraisal may not be necessary

A BPO form generally includes details about the property, such as:

-

Property address and loan information

-

Market conditions and employment statistics

-

Comparable sales data

-

Estimated repairs needed

-

Marketing strategy and occupancy status

While both a BPO and a formal appraisal aim to determine property value, they differ in several key aspects. A BPO is typically less detailed and less expensive than an appraisal. Appraisals require a licensed appraiser and follow strict guidelines, whereas BPOs can be completed by real estate agents without such formalities.

What factors influence the value determined in a BPO?

Several factors can influence the BPO value, including:

-

Current market conditions

-

Comparative sales data from similar properties

-

The condition of the property

-

Location and neighborhood characteristics

-

Economic factors affecting the local real estate market

Who uses BPOs and for what purpose?

BPOs are utilized by various parties, including:

-

Lenders assessing collateral for loans

-

Investors evaluating potential purchases

-

Real estate agents determining listing prices

-

Property management companies managing rental properties

How accurate are BPOs compared to appraisals?

BPOs can provide a reliable estimate of property value, but they may not be as precise as formal appraisals. The accuracy of a BPO largely depends on the experience of the broker and the quality of the data used for comparison. While BPOs are useful for quick assessments, appraisals are often required for legal or financial transactions.

Can a BPO be updated or revised?

Yes, a BPO can be updated or revised if there are significant changes in market conditions or if new comparable sales data becomes available. It is essential to ensure that the BPO reflects the most current information to provide an accurate property valuation.

What should I do if I disagree with a BPO?

If you disagree with the value determined in a BPO, you can gather additional data to support your position. This may include recent sales of comparable properties, information about market trends, or details about the property's unique features. Presenting this information to the requesting party may lead to a reconsideration of the BPO value.

Unknown

Unknown

Investor

Investor