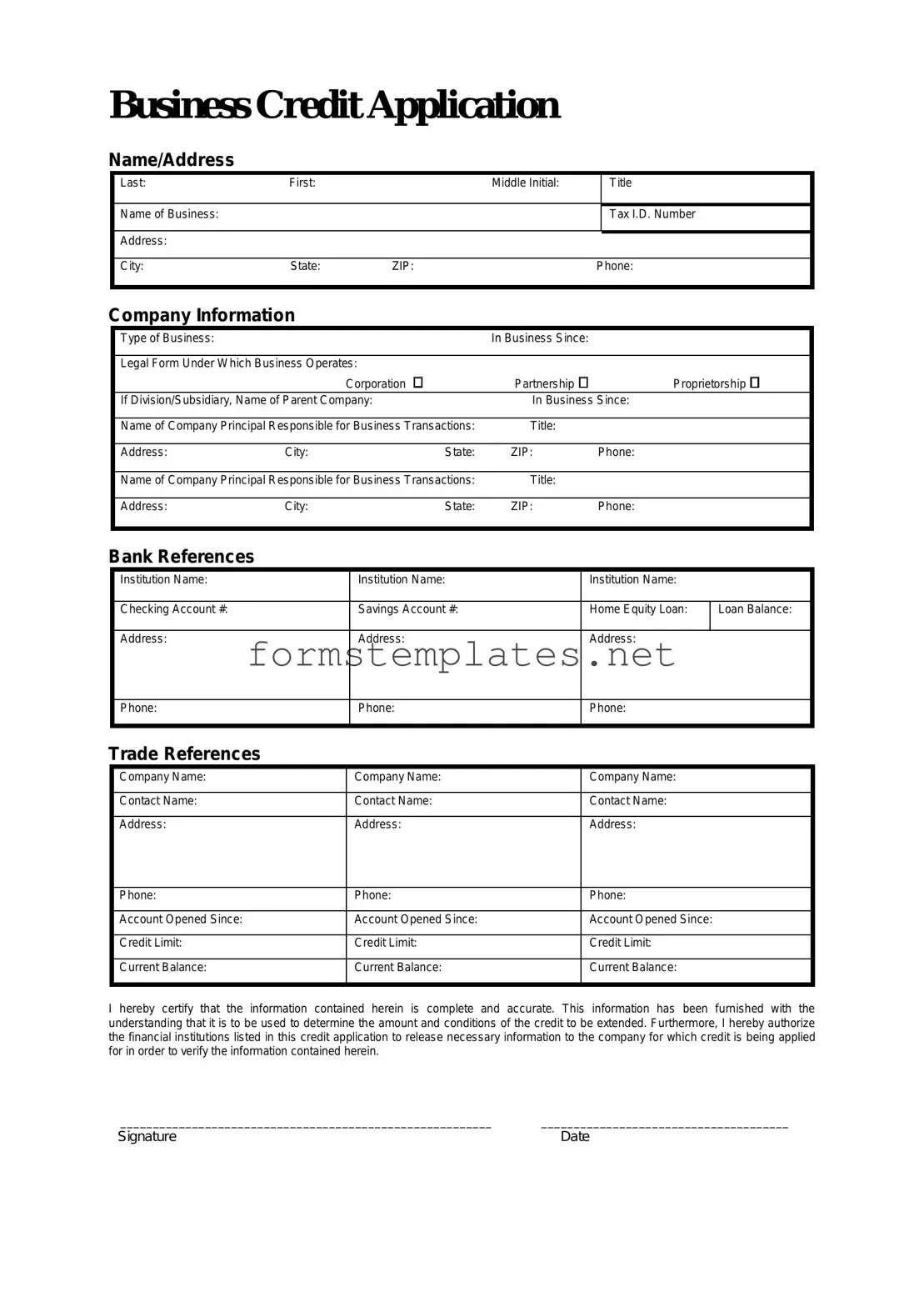

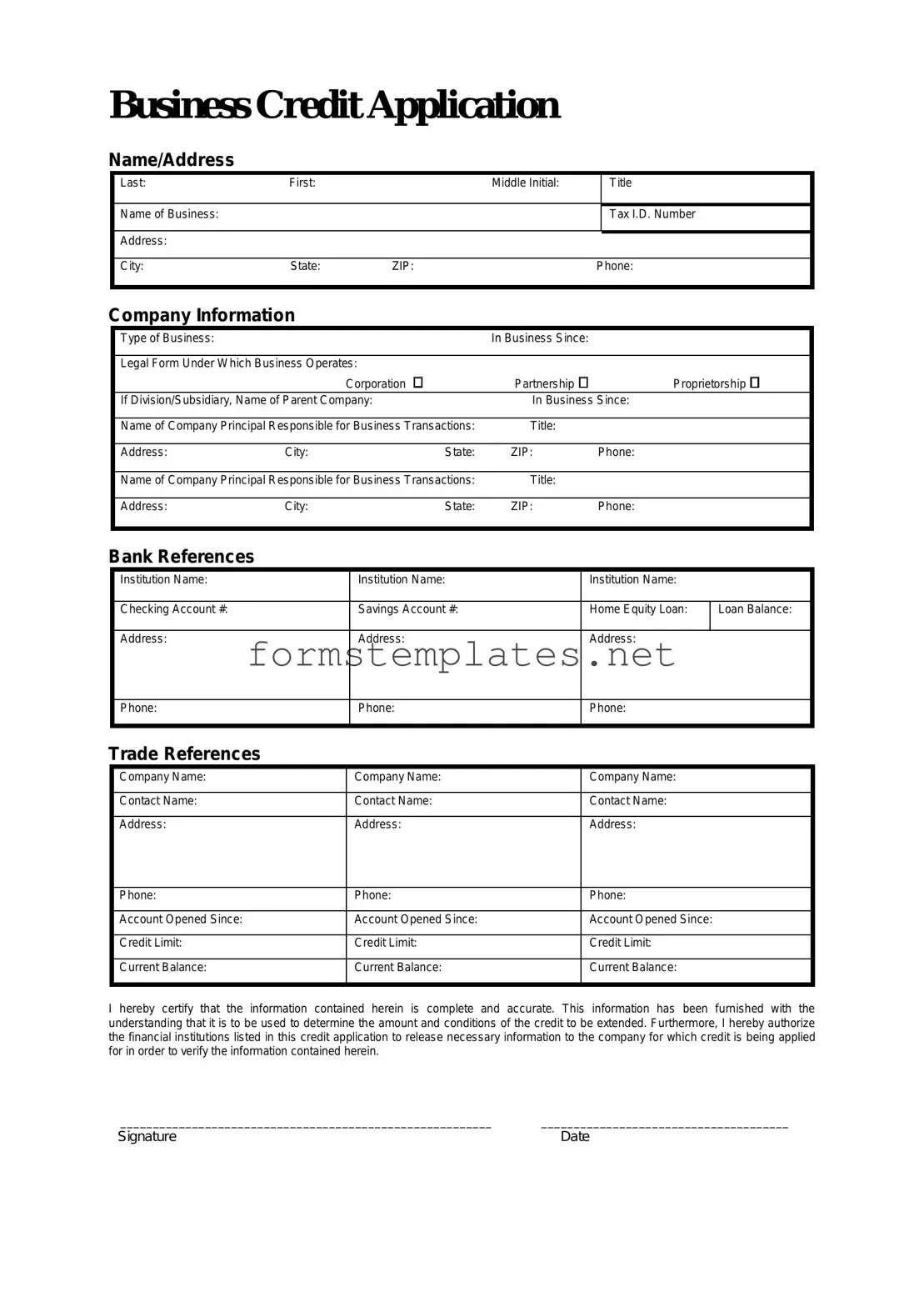

Free Business Credit Application Template

A Business Credit Application form is a crucial document that companies use to apply for credit from suppliers or financial institutions. This form collects essential information about the business, including its financial history and creditworthiness. Completing this application accurately can pave the way for better financing options and stronger business relationships.

Open Editor Now

Free Business Credit Application Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Business Credit Application online — simple edits, saving, and download.