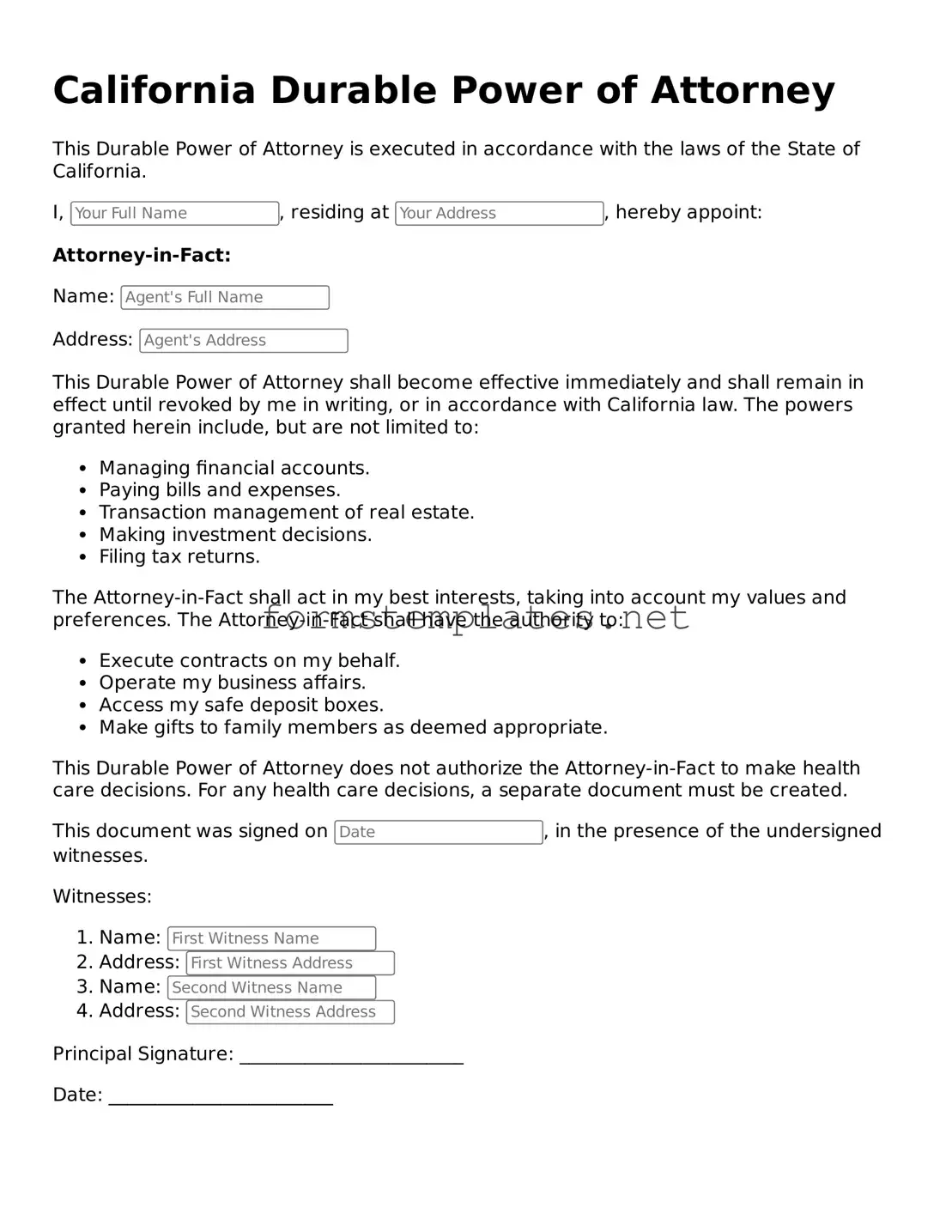

Attorney-Approved California Durable Power of Attorney Template

A California Durable Power of Attorney form is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so. This form ensures that your financial and healthcare matters are handled according to your wishes, even when you cannot communicate them. Understanding its importance can empower you to make informed decisions about your future.

Open Editor Now

Attorney-Approved California Durable Power of Attorney Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Durable Power of Attorney online — simple edits, saving, and download.