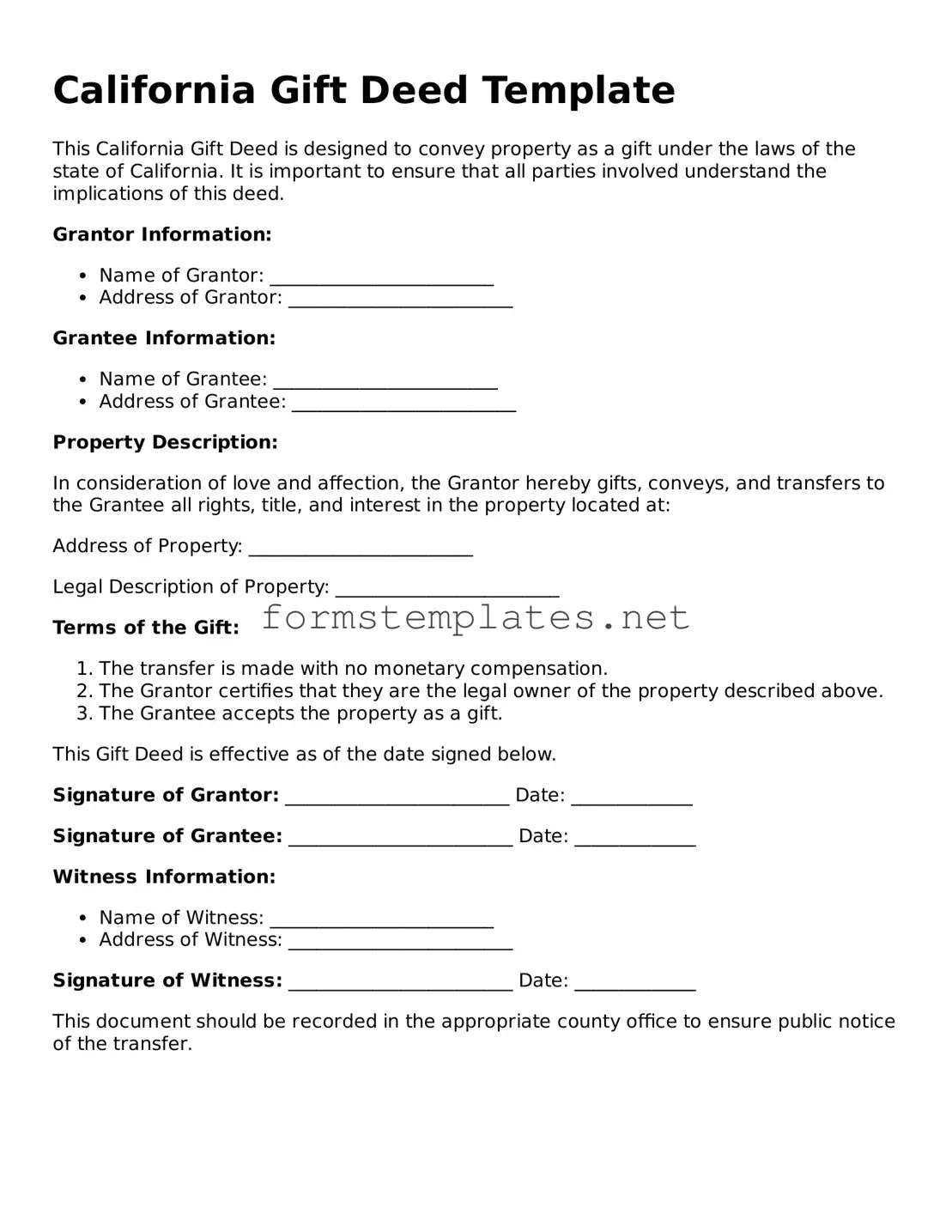

Attorney-Approved California Gift Deed Template

A California Gift Deed is a legal document used to transfer property from one person to another without any exchange of money. This form allows the donor to give real estate as a gift, ensuring that the recipient holds clear title to the property. Understanding the requirements and implications of this deed is essential for both parties involved in the transaction.

Open Editor Now

Attorney-Approved California Gift Deed Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Gift Deed online — simple edits, saving, and download.