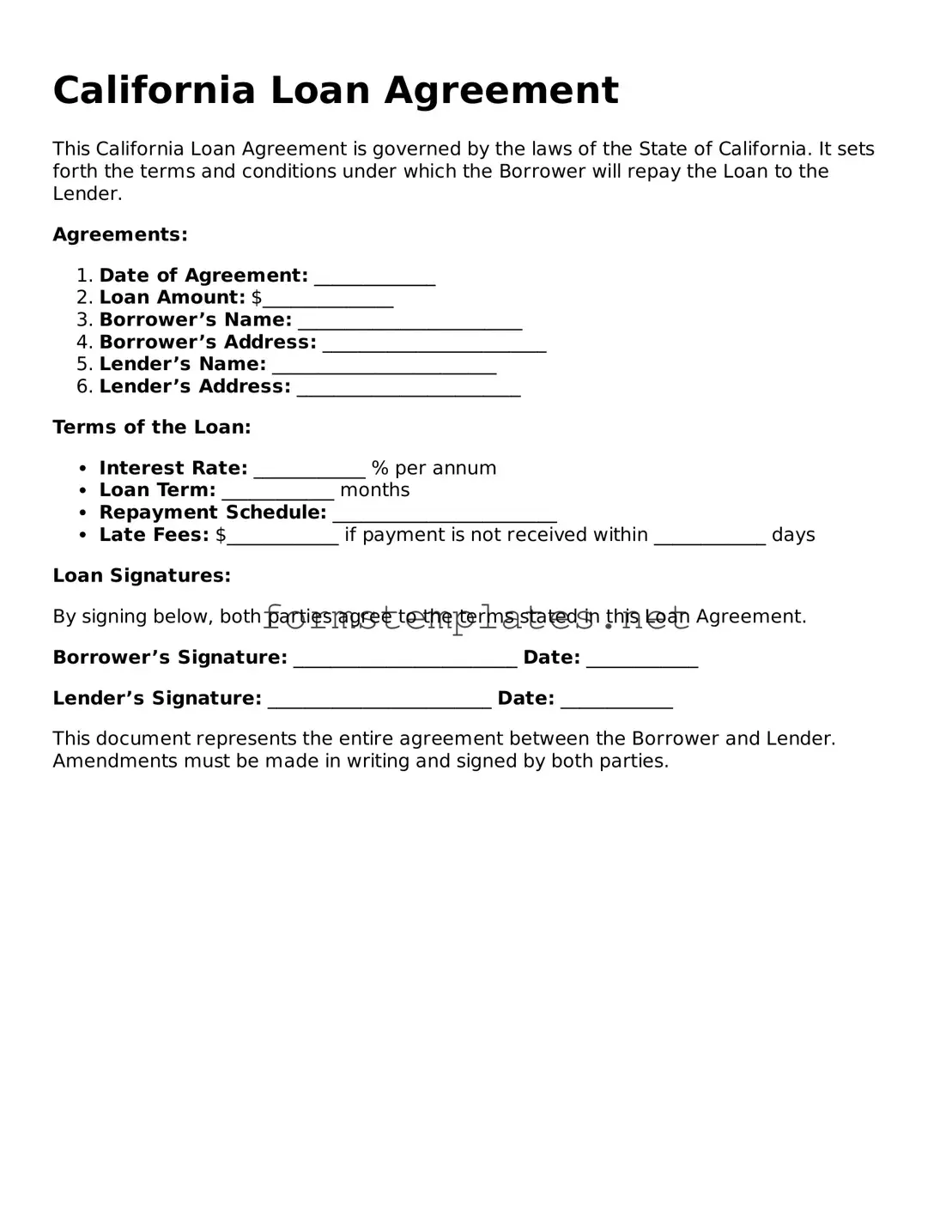

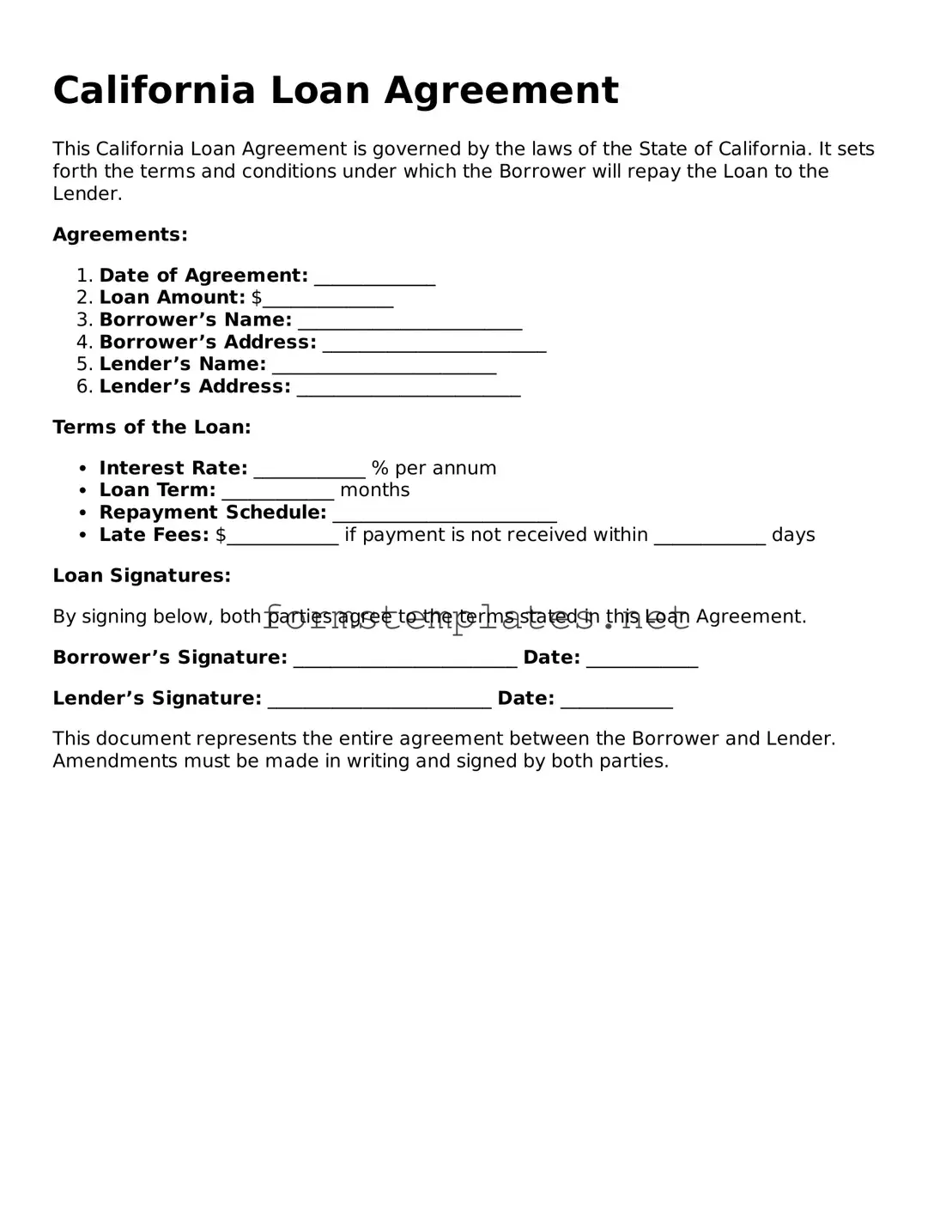

Attorney-Approved California Loan Agreement Template

A California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form ensures both parties understand their rights and obligations regarding the loan. By clearly defining the repayment terms, interest rates, and any collateral involved, the agreement helps prevent misunderstandings and disputes.

Open Editor Now

Attorney-Approved California Loan Agreement Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Loan Agreement online — simple edits, saving, and download.