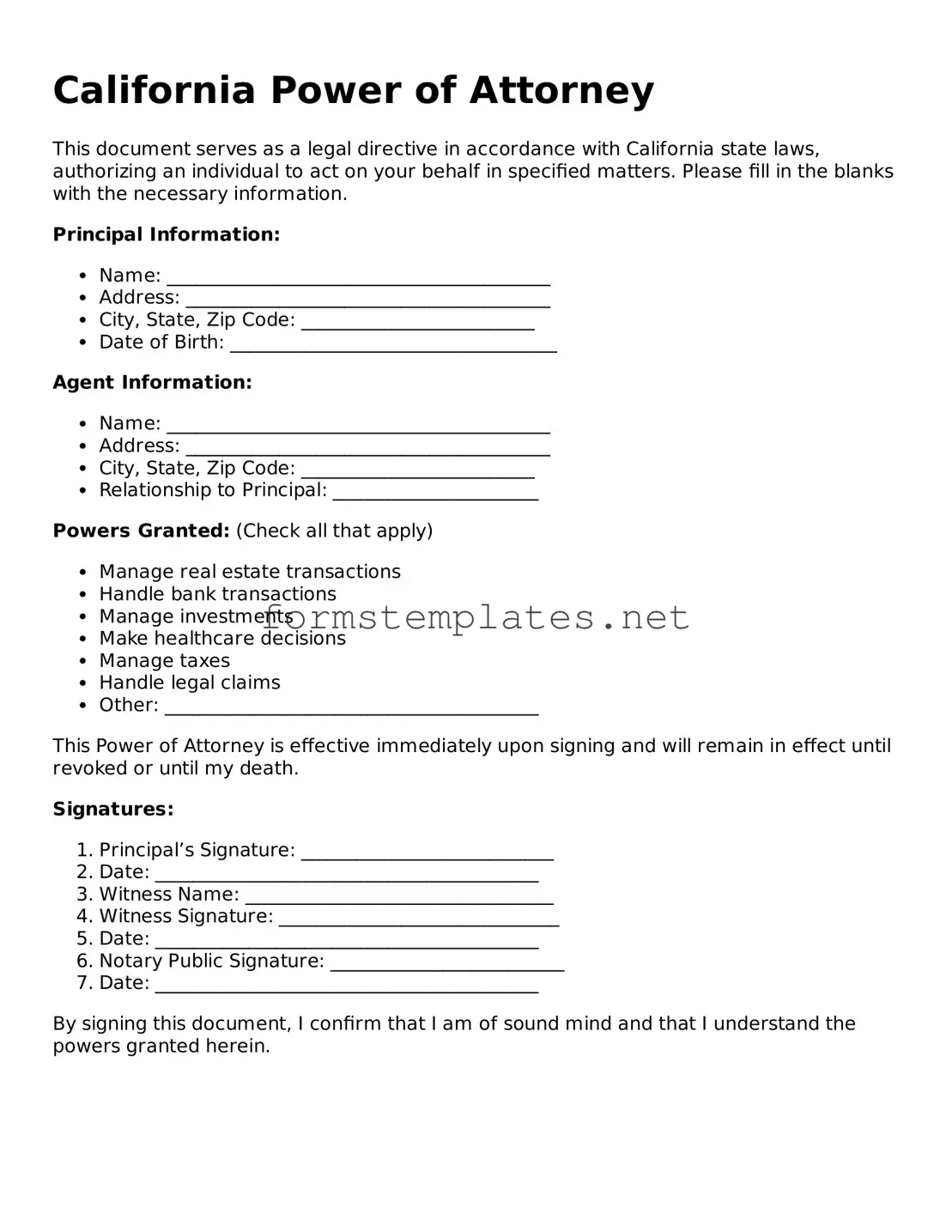

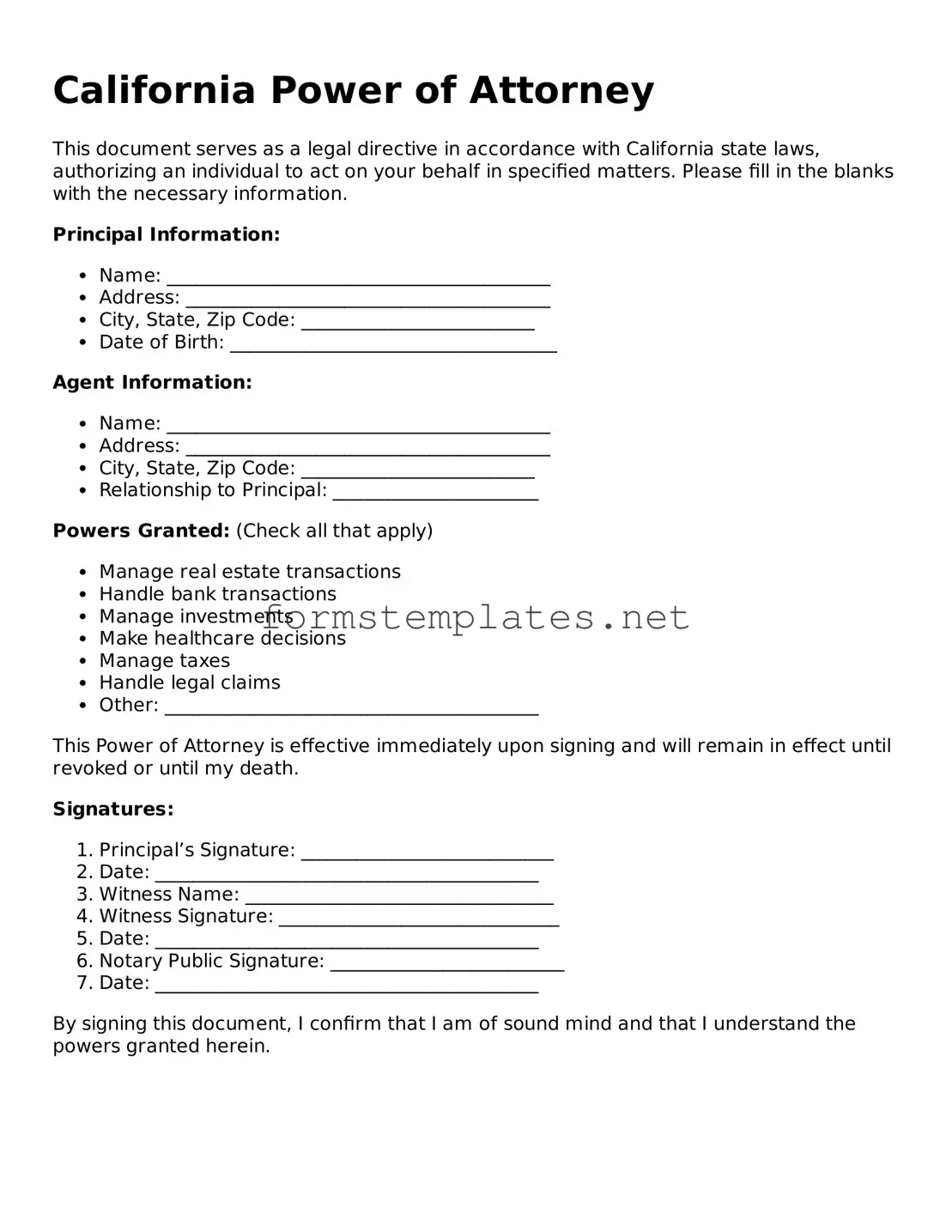

Attorney-Approved California Power of Attorney Template

The California Power of Attorney form is a legal document that allows one person to grant another the authority to make decisions on their behalf. This form is crucial for managing financial matters, healthcare decisions, and other important aspects of life when an individual is unable to do so. Understanding its components and implications can help ensure that your wishes are respected and followed.

Open Editor Now

Attorney-Approved California Power of Attorney Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Power of Attorney online — simple edits, saving, and download.