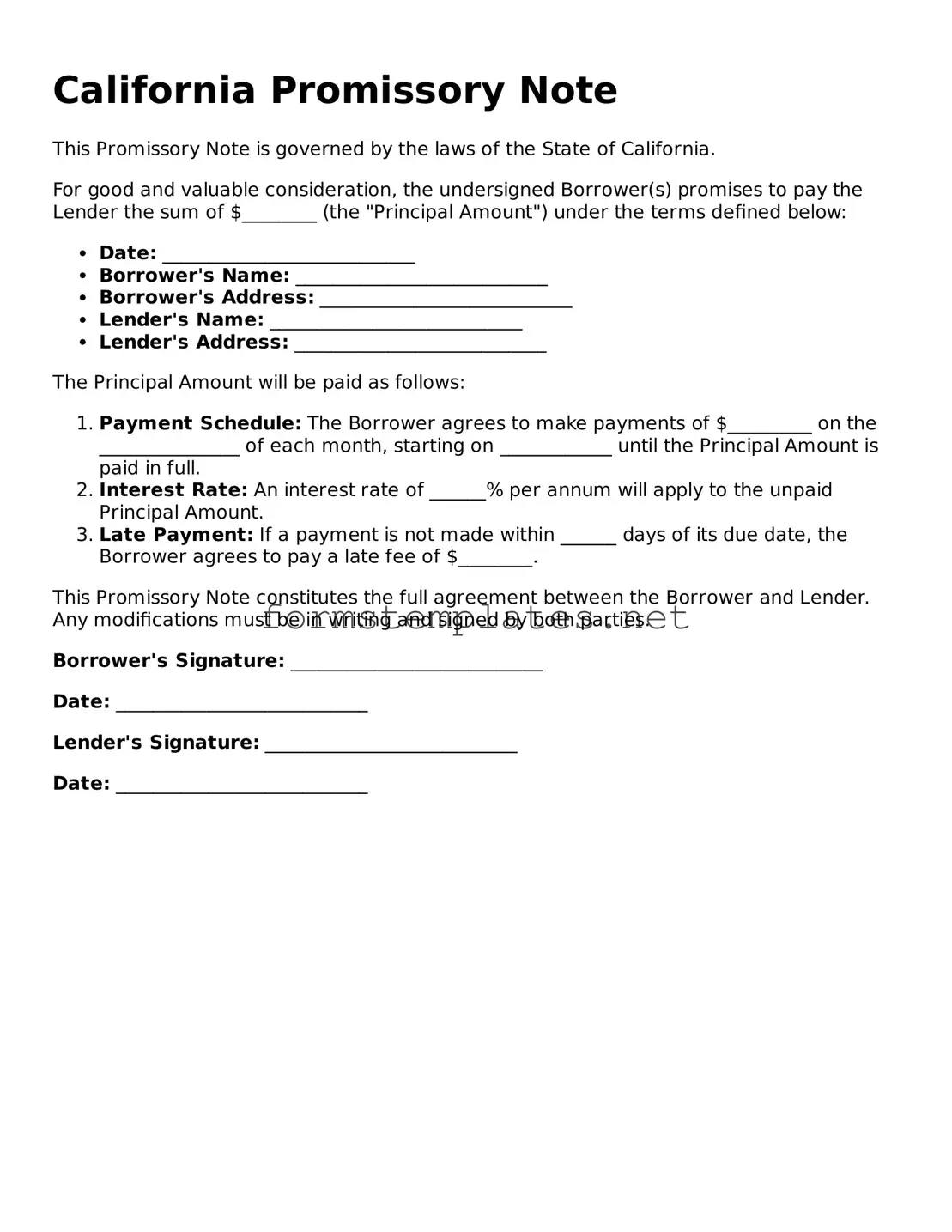

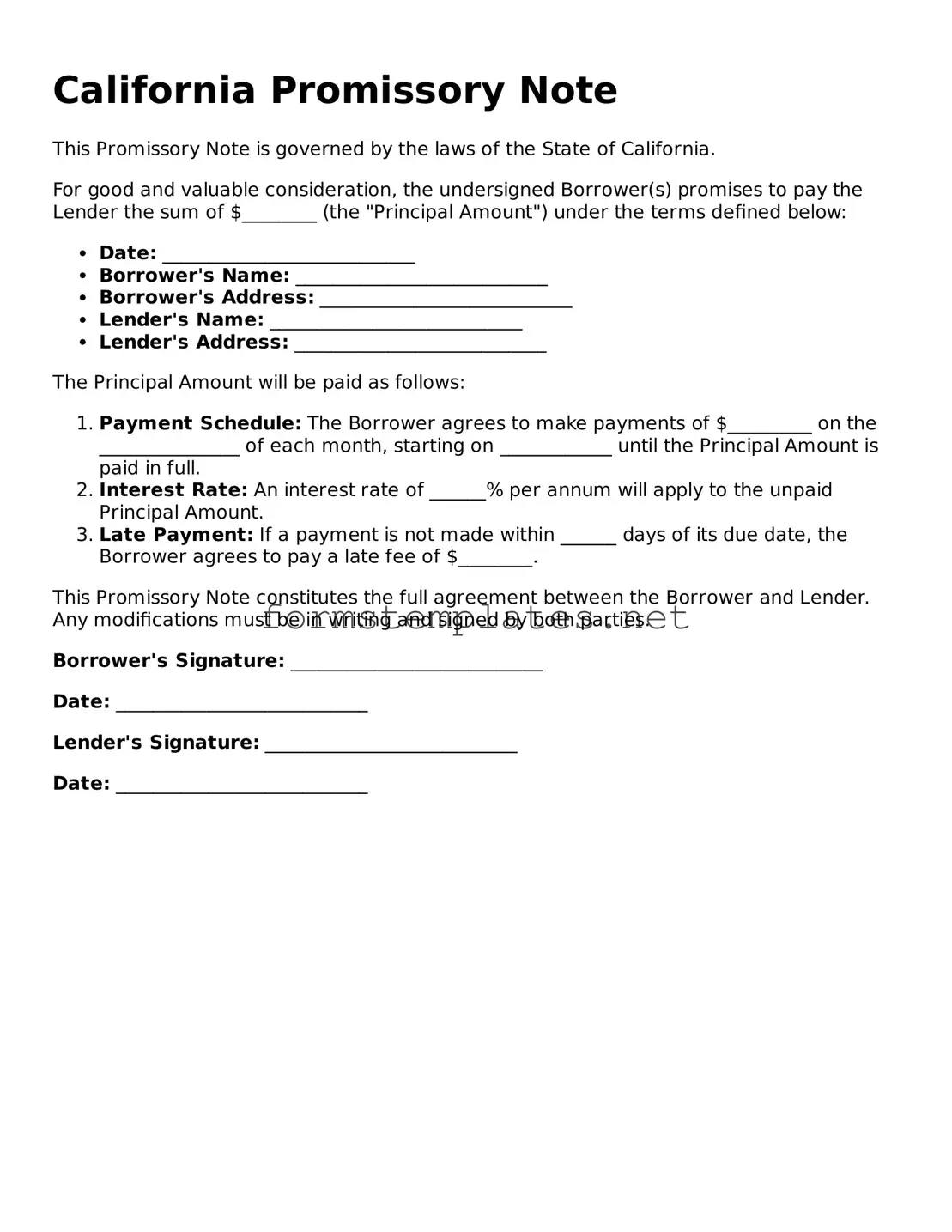

Attorney-Approved California Promissory Note Template

A California Promissory Note is a written promise to pay a specified amount of money to a designated party under agreed-upon terms. This document serves as a crucial tool in financial transactions, ensuring both parties understand their obligations. Understanding the key elements of this form can help individuals navigate lending and borrowing with confidence.

Open Editor Now

Attorney-Approved California Promissory Note Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Promissory Note online — simple edits, saving, and download.