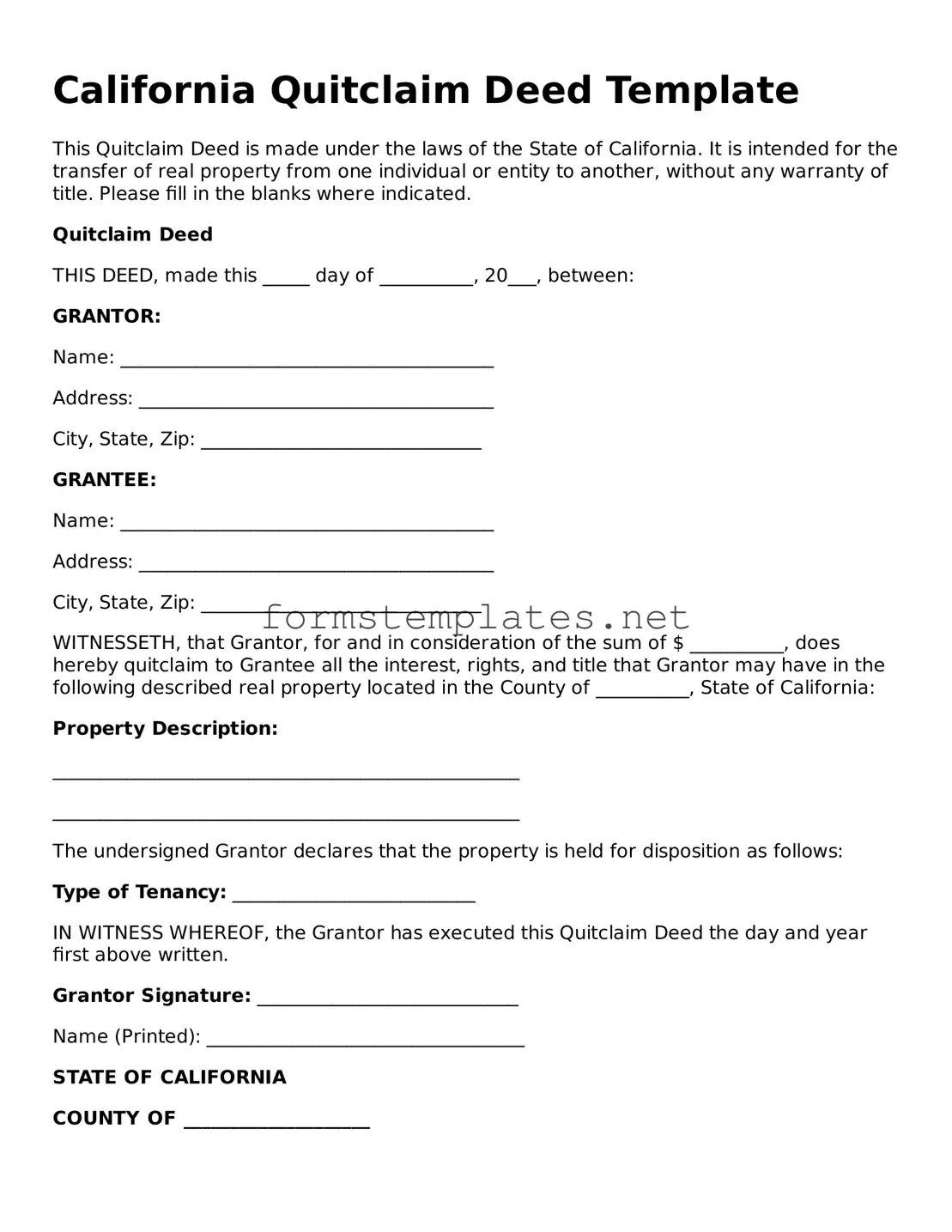

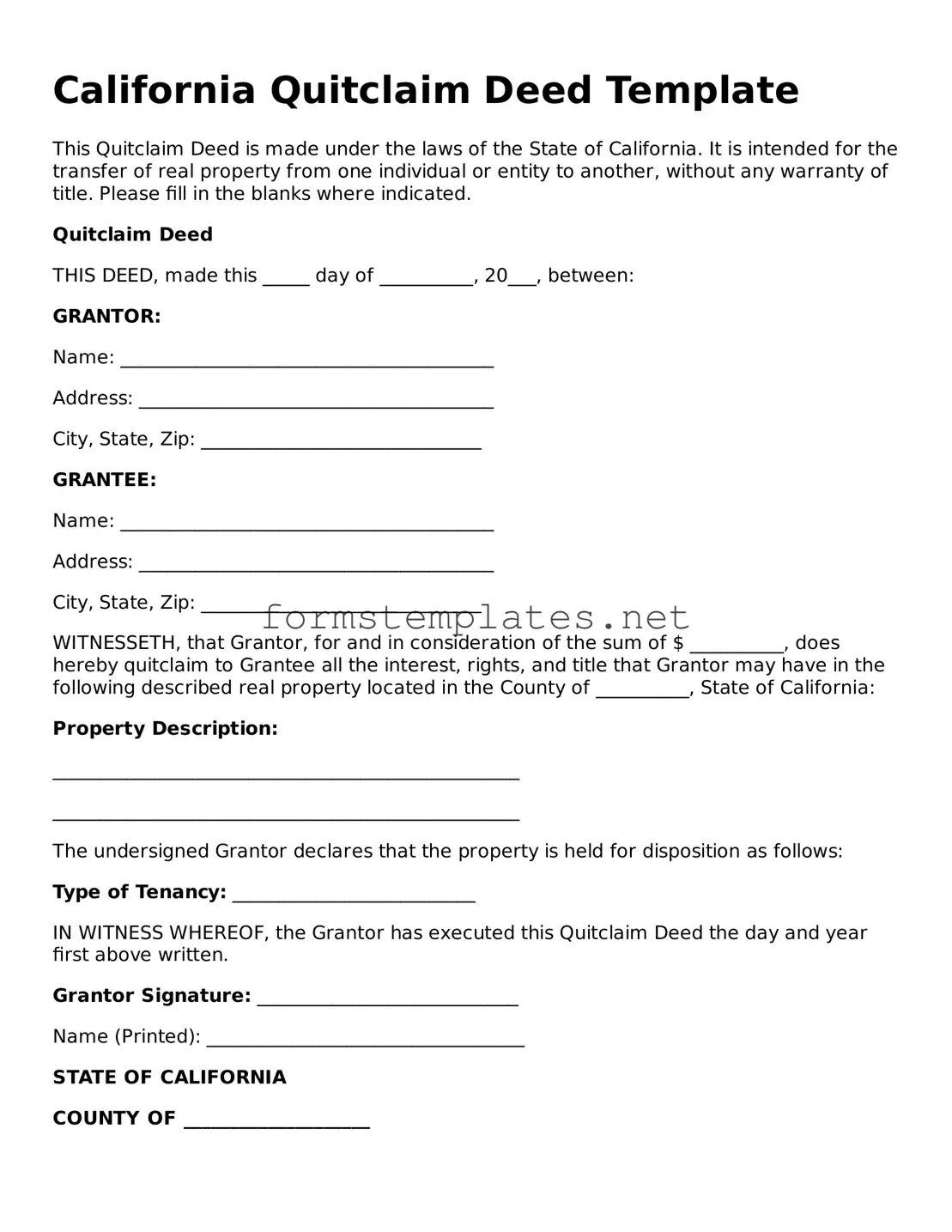

Attorney-Approved California Quitclaim Deed Template

A California Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without making any guarantees about the title. This form allows the grantor to relinquish any interest in the property, providing a simple way to convey property rights. It is commonly utilized in situations such as divorce settlements, property transfers between family members, or clearing up title issues.

Open Editor Now

Attorney-Approved California Quitclaim Deed Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Quitclaim Deed online — simple edits, saving, and download.