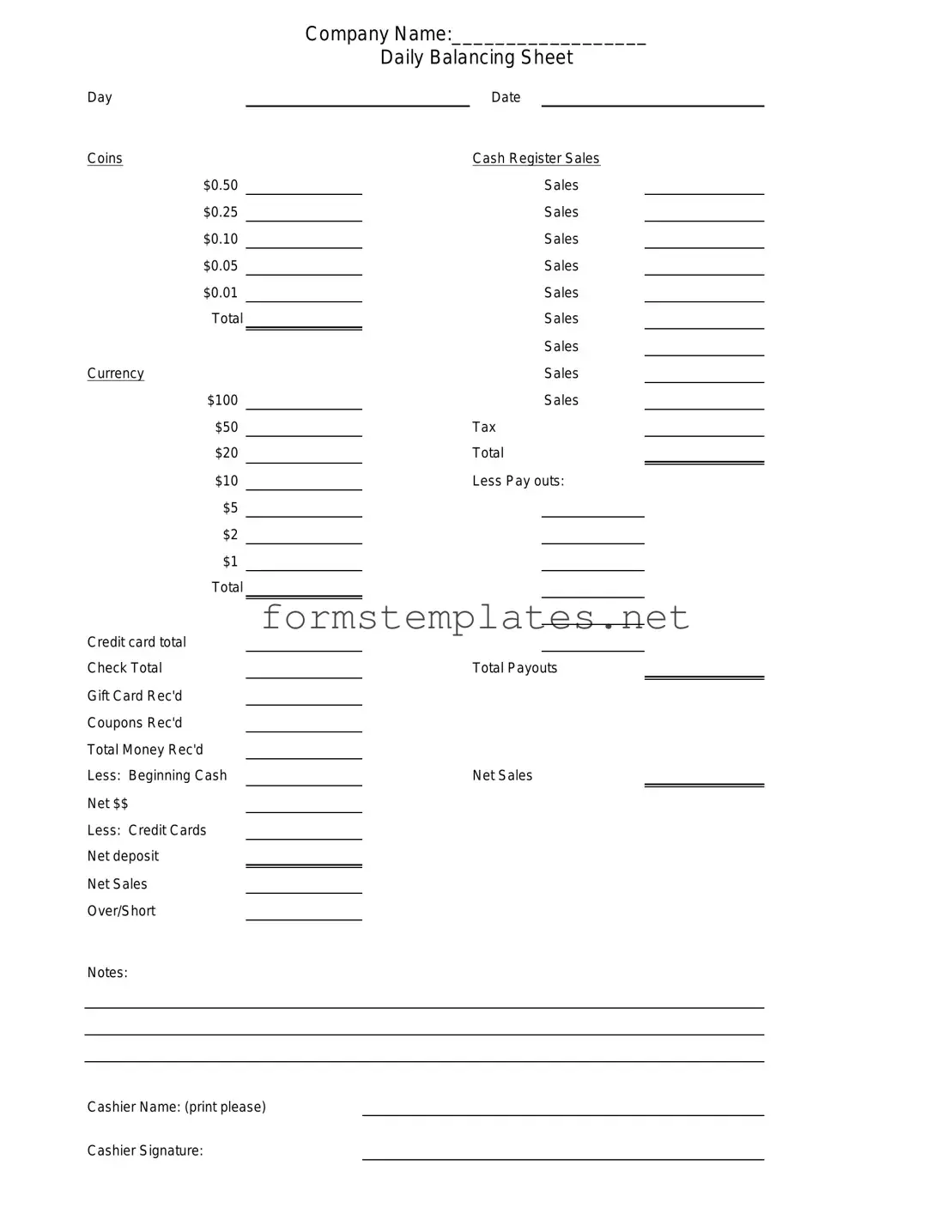

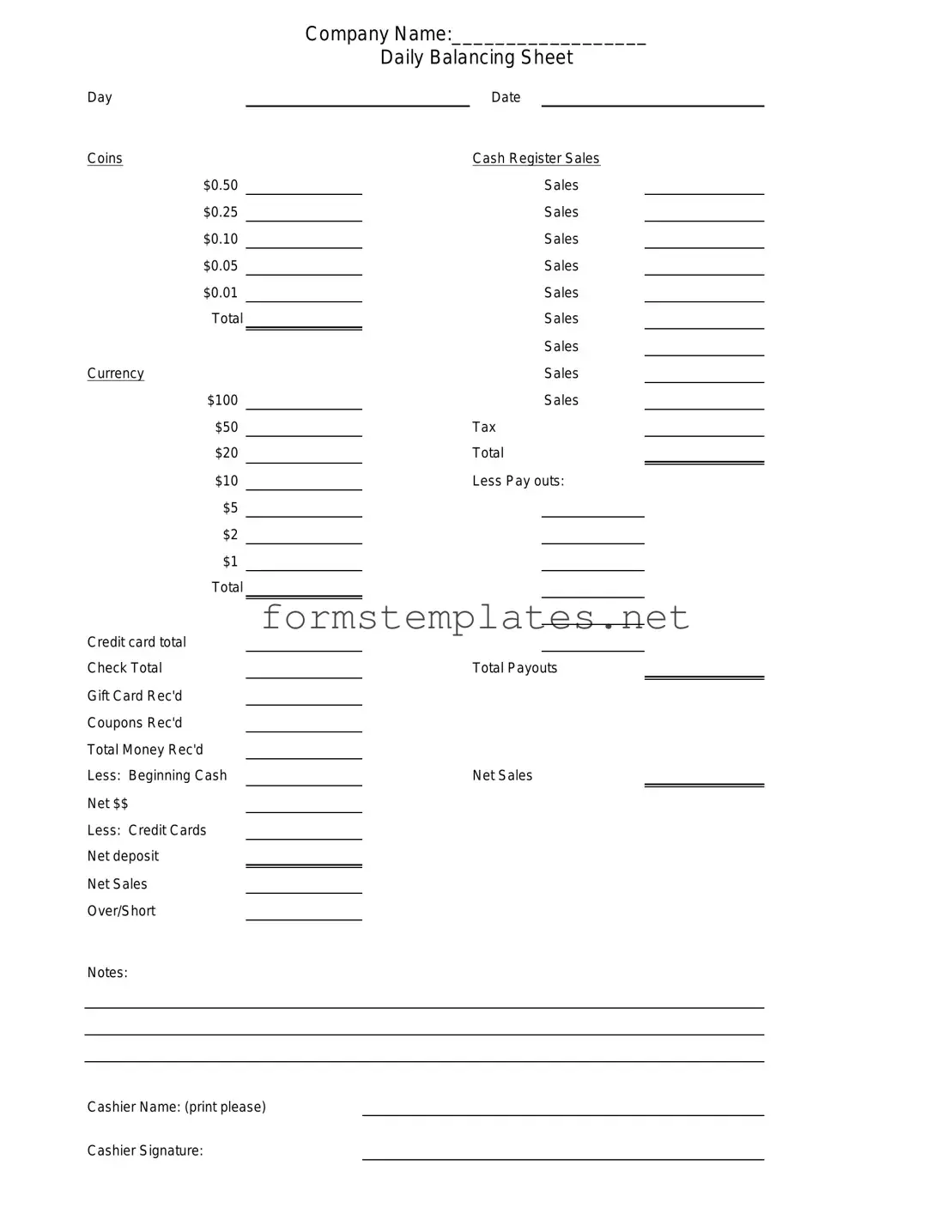

Free Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is a vital document used by businesses to track the amount of cash in a cash drawer at the end of a shift or business day. This form helps ensure accurate accounting and prevents discrepancies that could lead to financial loss. By systematically recording cash totals, businesses can maintain transparency and accountability in their cash handling processes.

Open Editor Now

Free Cash Drawer Count Sheet Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Cash Drawer Count Sheet online — simple edits, saving, and download.