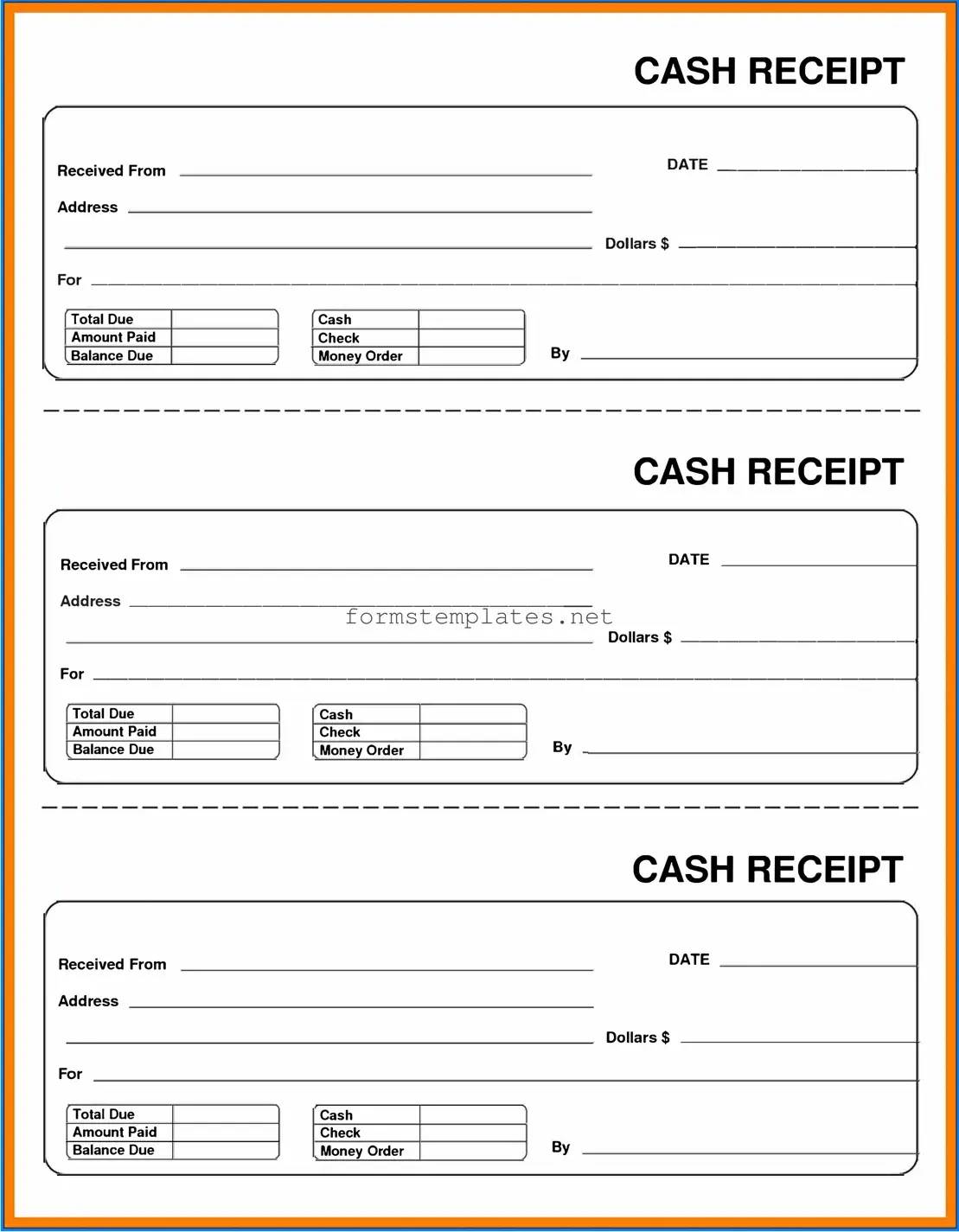

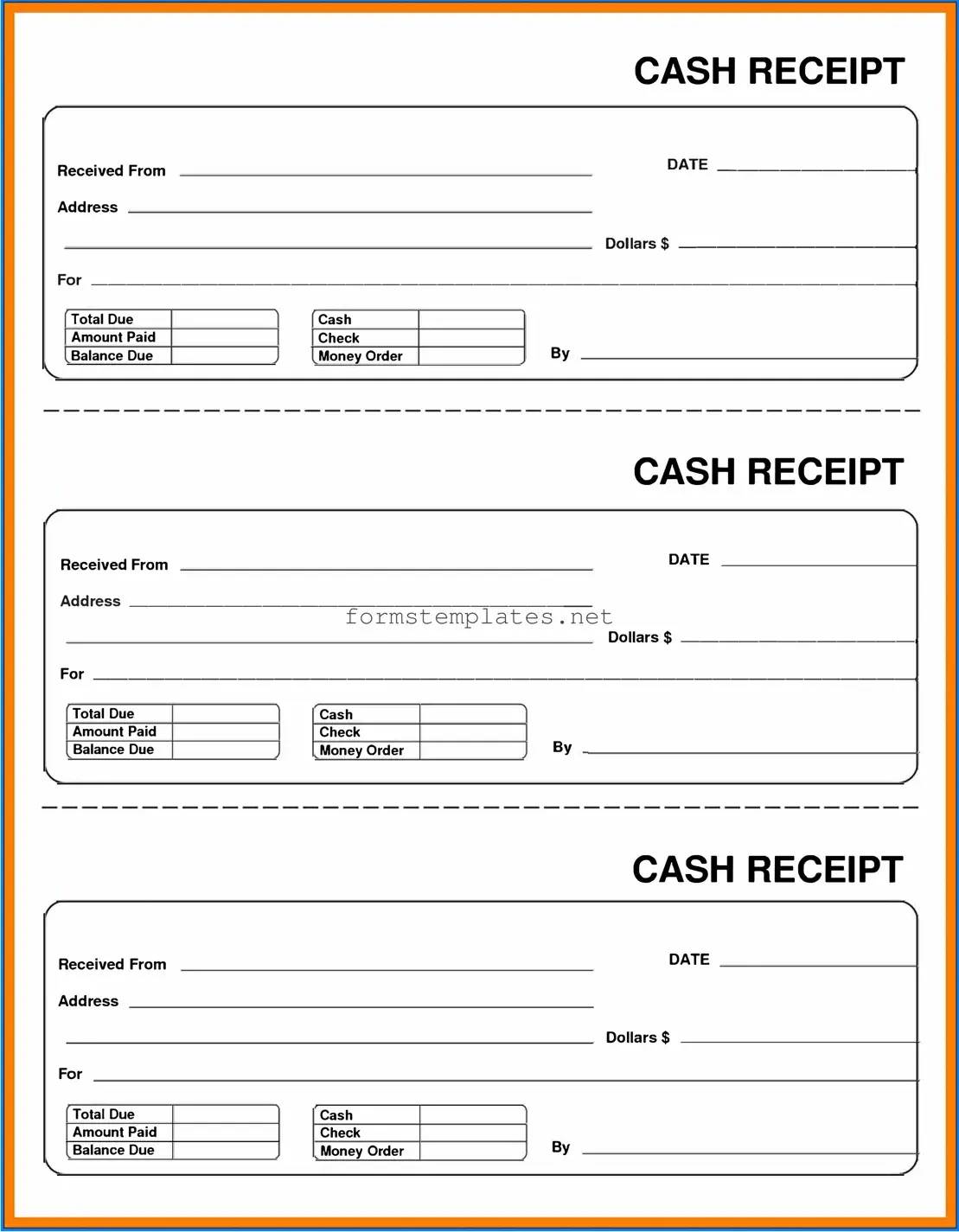

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment and helps maintain accurate financial records. This form is essential for tracking transactions and ensuring accountability in cash handling.

Using a Cash Receipt form is crucial for several reasons:

-

It provides a clear record of cash transactions.

-

It helps prevent errors and fraud by documenting each payment.

-

It assists in reconciling cash balances during audits.

-

It can be used for tax purposes to demonstrate income received.

The Cash Receipt form should be completed by anyone who receives cash on behalf of an organization. This includes cashiers, sales personnel, or anyone authorized to handle cash transactions. It’s essential that the individual filling out the form is trained in proper cash handling procedures.

A typical Cash Receipt form should include the following information:

-

Date of the transaction.

-

Amount of cash received.

-

Name of the person or entity making the payment.

-

Purpose of the payment (e.g., invoice number, service provided).

-

Signature of the person receiving the cash.

After completing the Cash Receipt form, it should be stored securely. Keep both digital and physical copies organized. Digital copies should be backed up regularly, while physical copies should be kept in a locked filing cabinet. This ensures easy access for future reference and protects sensitive information.

Modifications to the Cash Receipt form should be avoided unless absolutely necessary. If changes are needed, they should be documented clearly. This includes adding notes or corrections and initialing them. Consistency in the form is vital for maintaining reliable records.

If an error is found on the Cash Receipt form, follow these steps:

-

Do not erase or white-out the mistake.

-

Draw a line through the incorrect entry.

-

Write the correct information above or next to the error.

-

Initial and date the correction.

This process maintains transparency and accuracy in record-keeping.

While it's best practice to use a Cash Receipt form for all cash transactions, certain small transactions may not require it. However, for larger amounts or transactions that need to be tracked for accountability, a Cash Receipt form is highly recommended. Always consult your organization's policy regarding cash handling.

The Cash Receipt form plays a critical role in accounting by providing a clear record of cash inflows. It helps accountants track revenue, manage cash flow, and prepare financial statements. Accurate completion of this form ensures that all cash transactions are recorded in the accounting system, which is vital for financial reporting and analysis.

If a Cash Receipt form is lost, report the loss to your supervisor immediately. Document the details of the transaction, including the date, amount, and purpose. Depending on your organization’s policy, you may need to recreate the form or provide an alternative proof of payment to maintain accurate records.