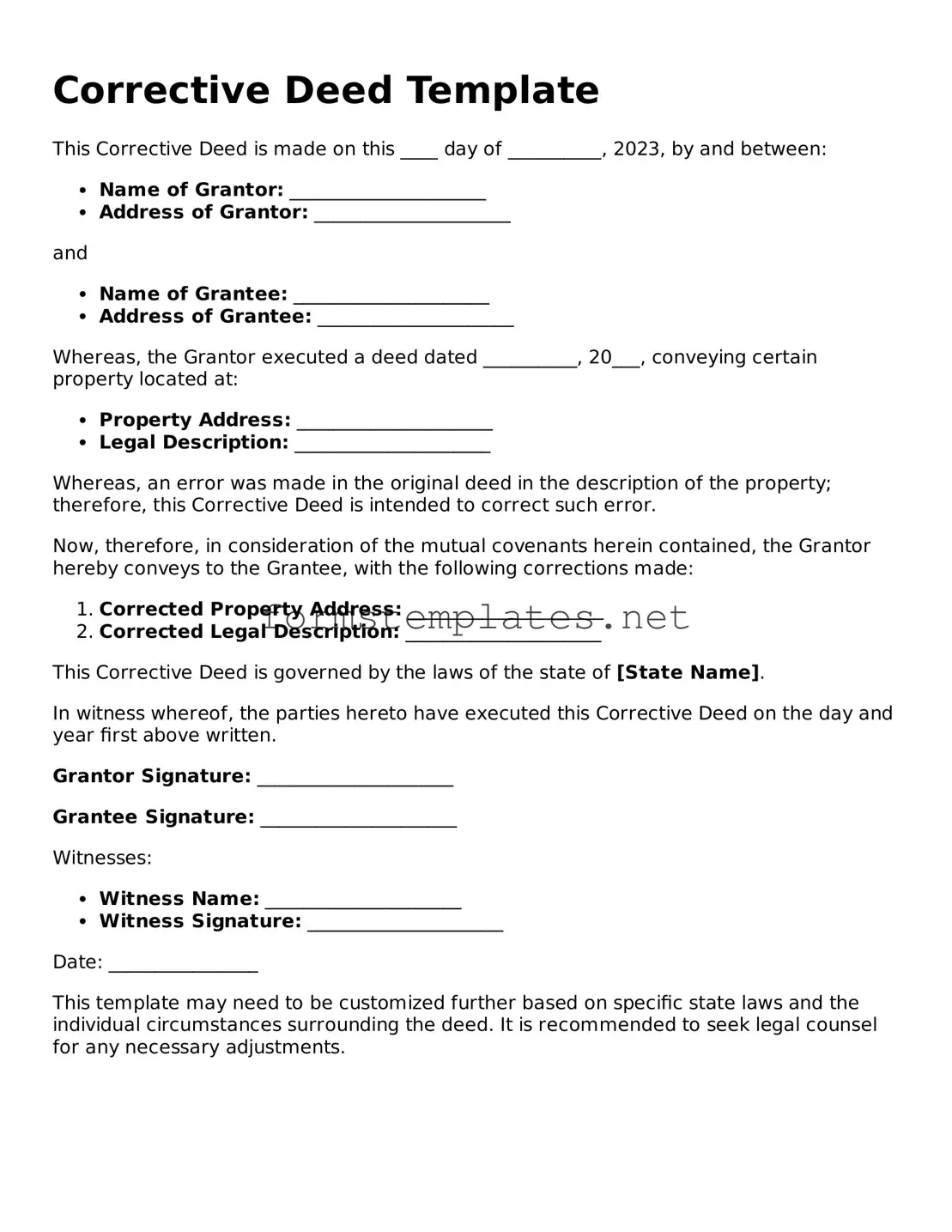

Attorney-Verified Corrective Deed Form

A Corrective Deed is a legal document used to amend or clarify the details of an existing deed. This form serves to rectify errors or omissions that may have occurred in the original deed, ensuring that the property records accurately reflect the intentions of the parties involved. By utilizing a Corrective Deed, individuals can prevent potential disputes and enhance the clarity of property ownership.

Open Editor Now

Attorney-Verified Corrective Deed Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Corrective Deed online — simple edits, saving, and download.