Attorney-Verified Deed Form

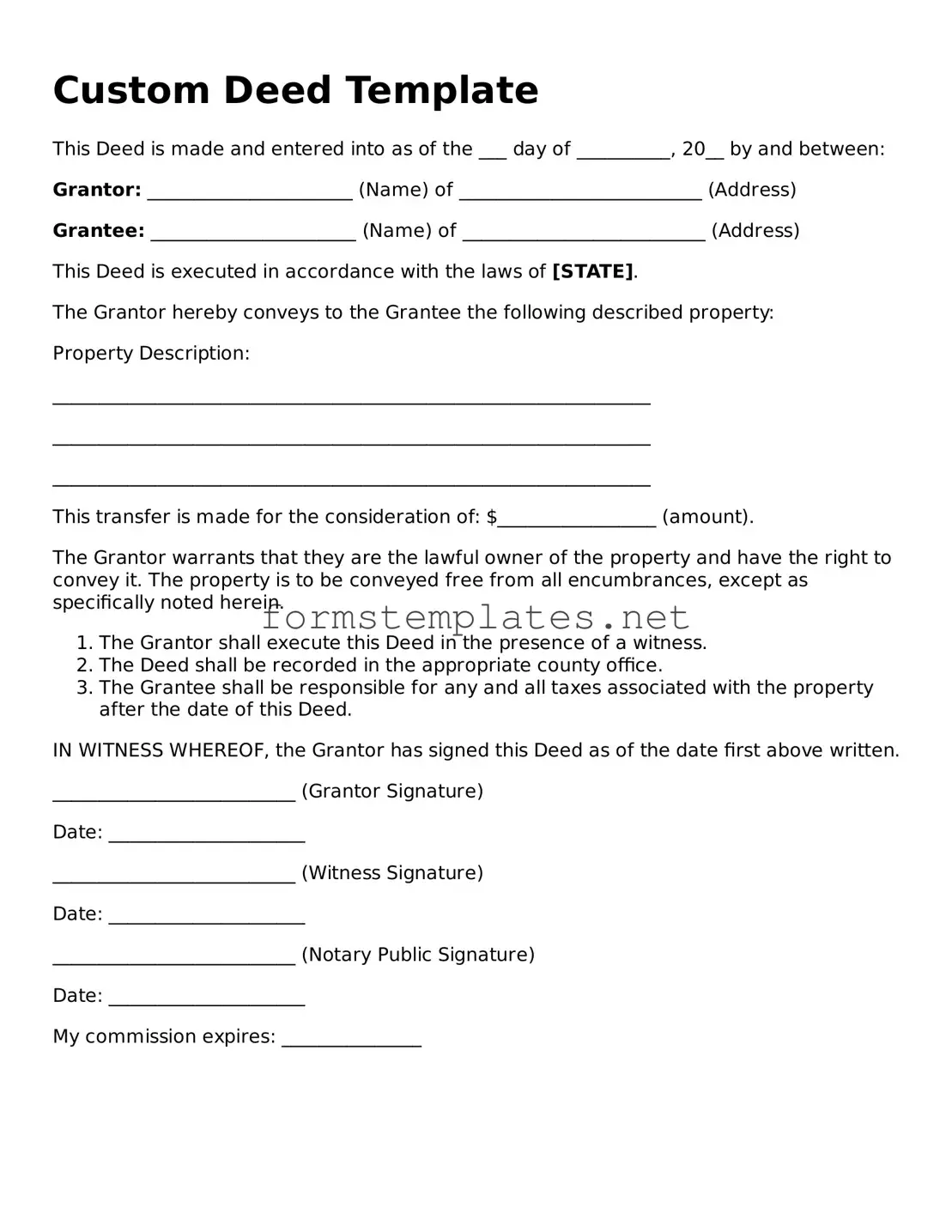

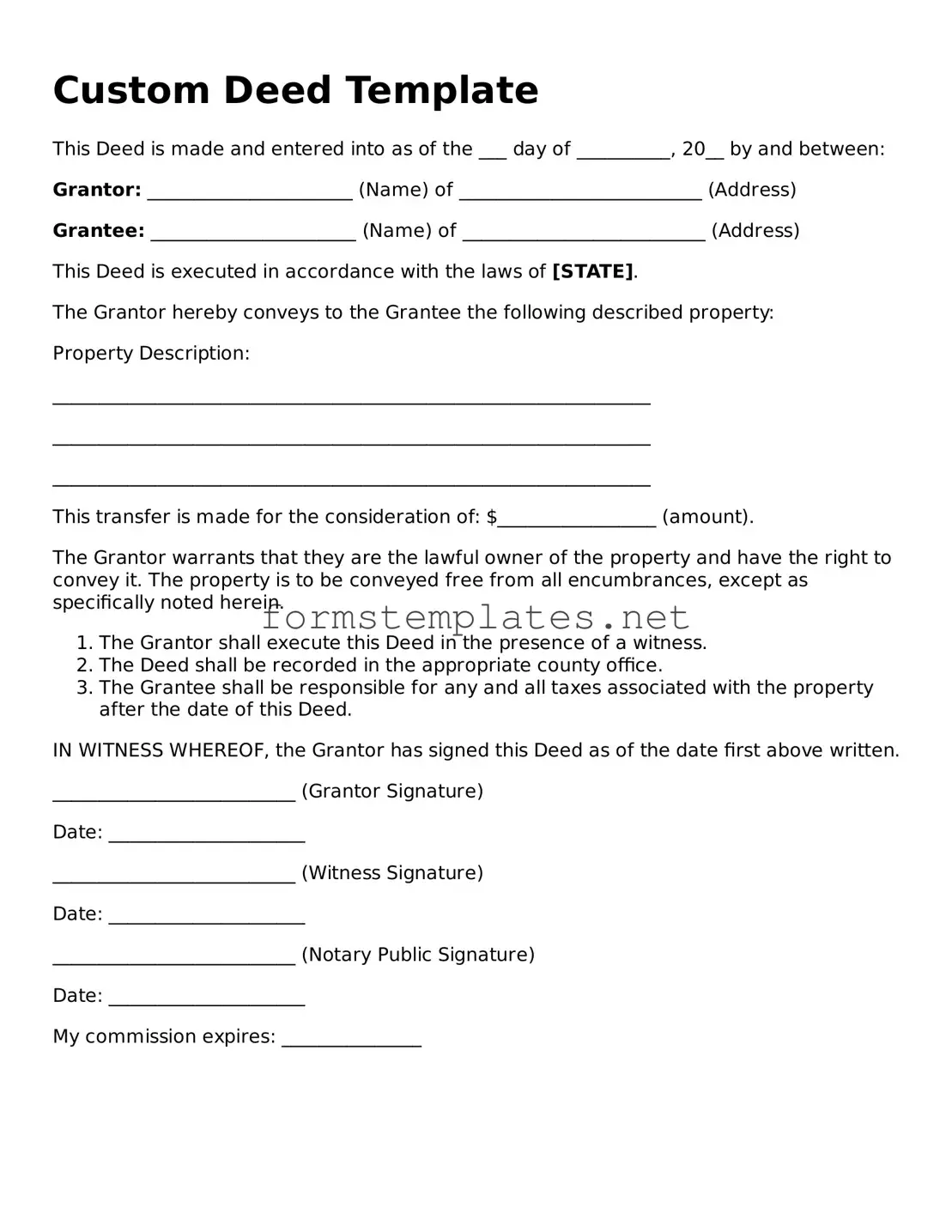

A deed form is a legal document that conveys ownership of property from one party to another. It serves as a formal record of the transfer and is essential for establishing rights in real estate transactions. Understanding the components and implications of a deed form is crucial for anyone involved in buying or selling property.

Open Editor Now

Attorney-Verified Deed Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Deed online — simple edits, saving, and download.