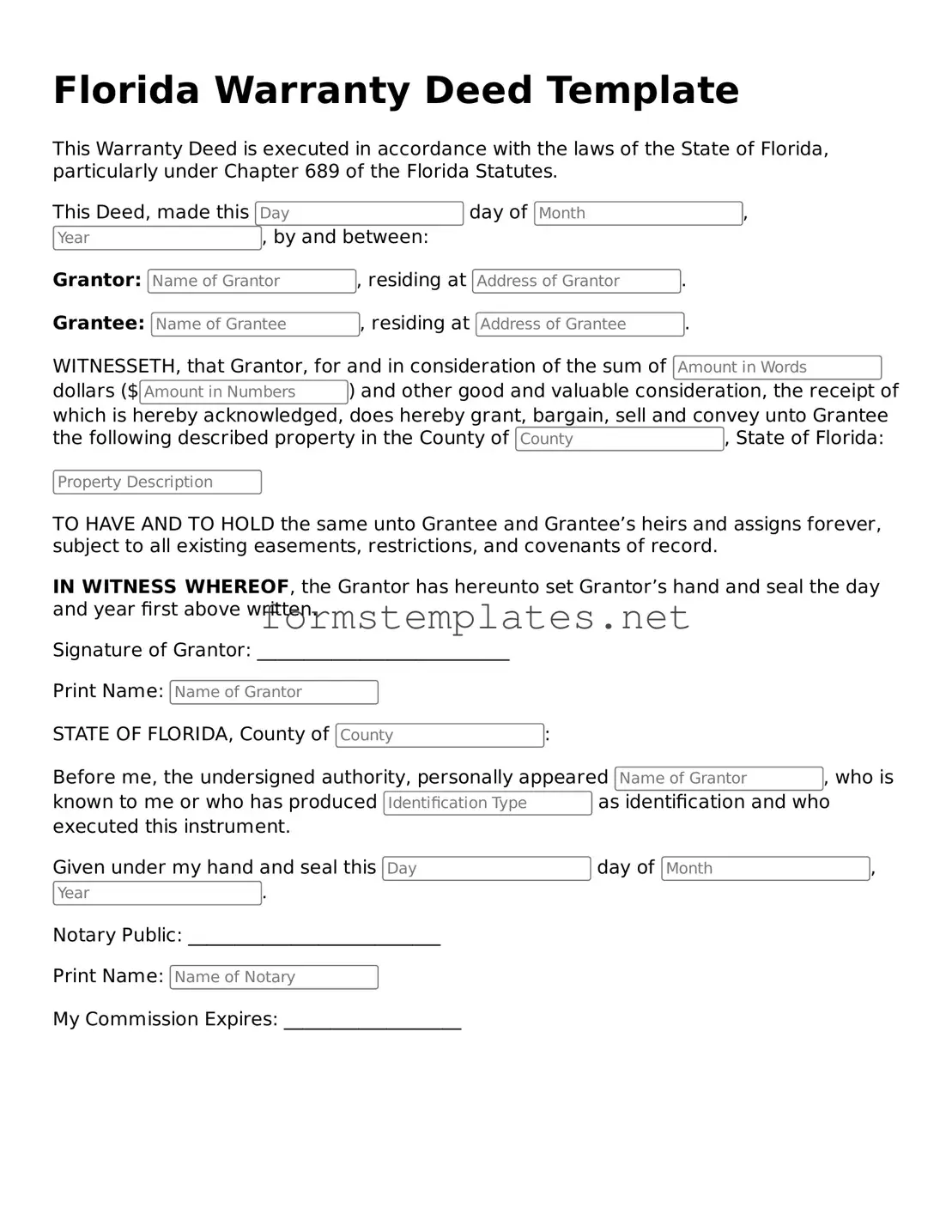

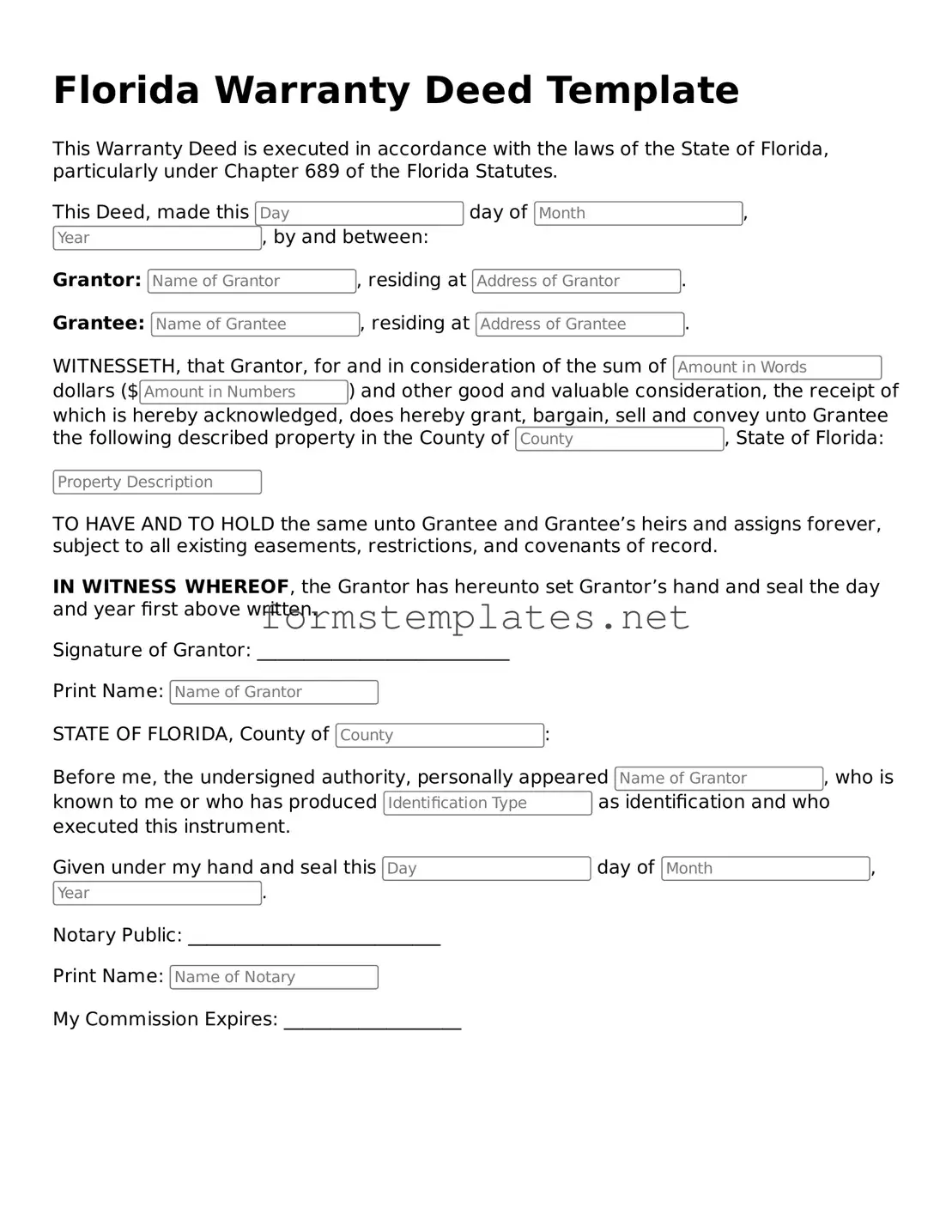

Attorney-Approved Florida Deed Template

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines the specifics of the transaction, including the parties involved and the property being transferred. Understanding this document is essential for anyone looking to buy or sell property in Florida.

Open Editor Now

Attorney-Approved Florida Deed Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Deed online — simple edits, saving, and download.