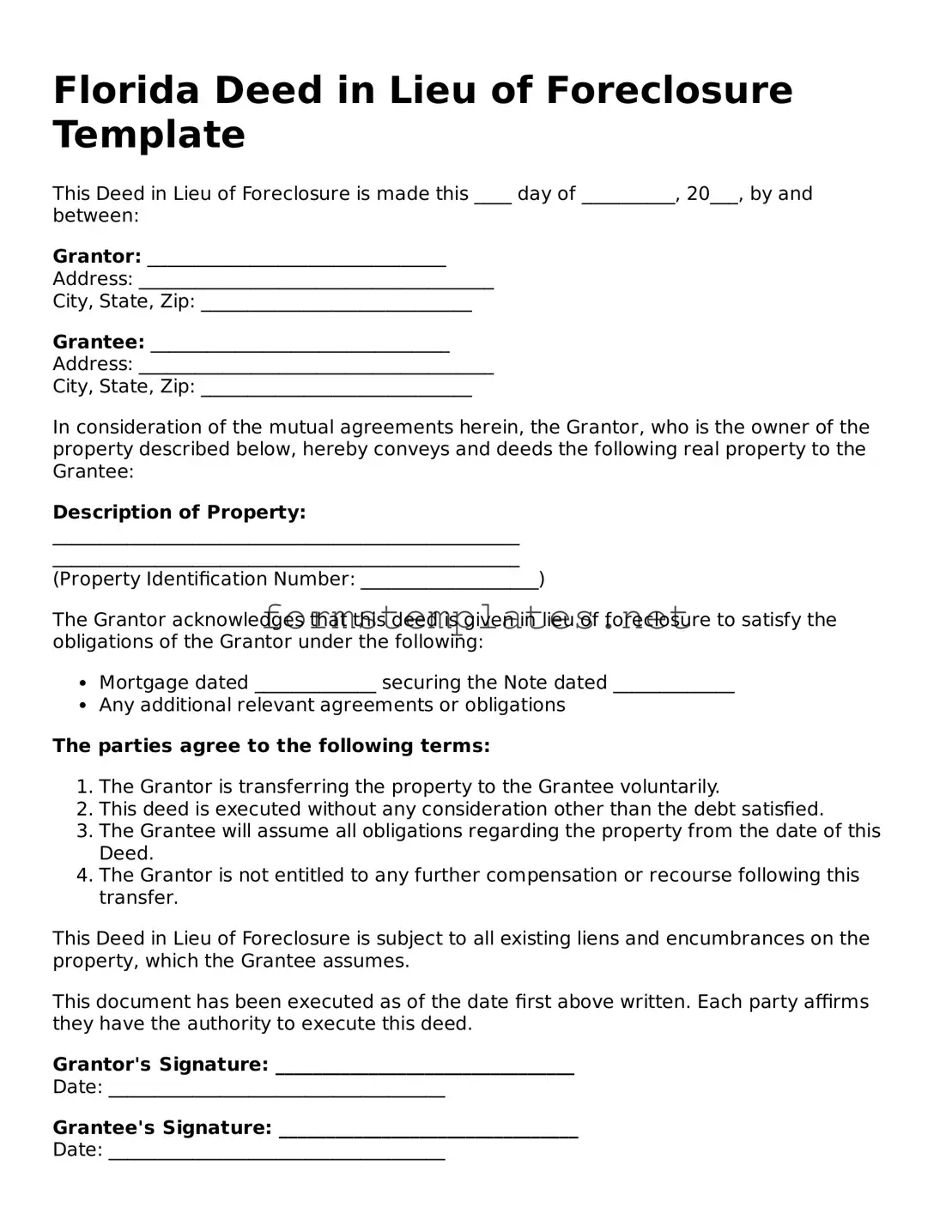

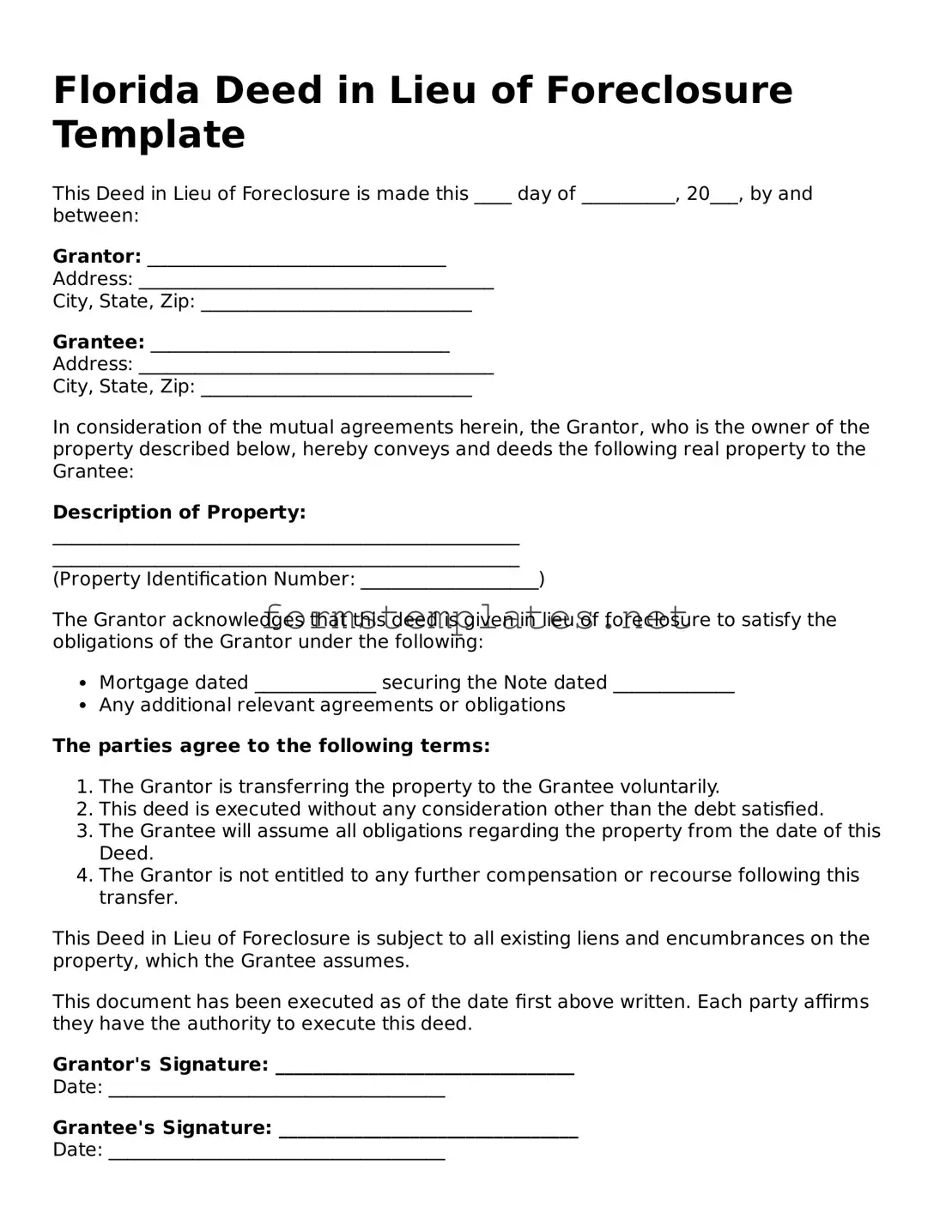

Attorney-Approved Florida Deed in Lieu of Foreclosure Template

A Florida Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid the lengthy foreclosure process. This option can provide a more amicable resolution for both parties, as it often leads to less financial and emotional strain. Understanding the implications and procedures involved in this process is crucial for homeowners facing financial difficulties.

Open Editor Now

Attorney-Approved Florida Deed in Lieu of Foreclosure Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Deed in Lieu of Foreclosure online — simple edits, saving, and download.