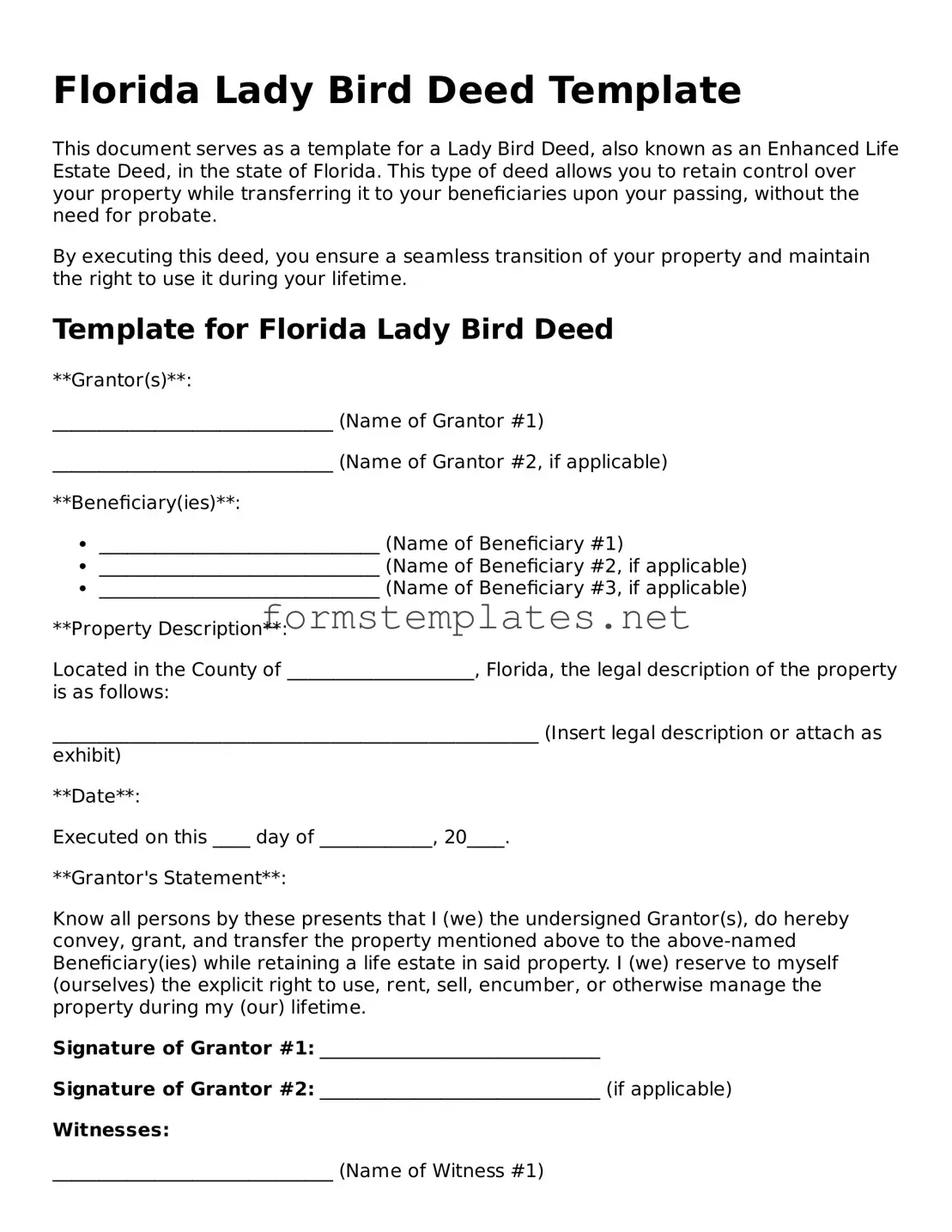

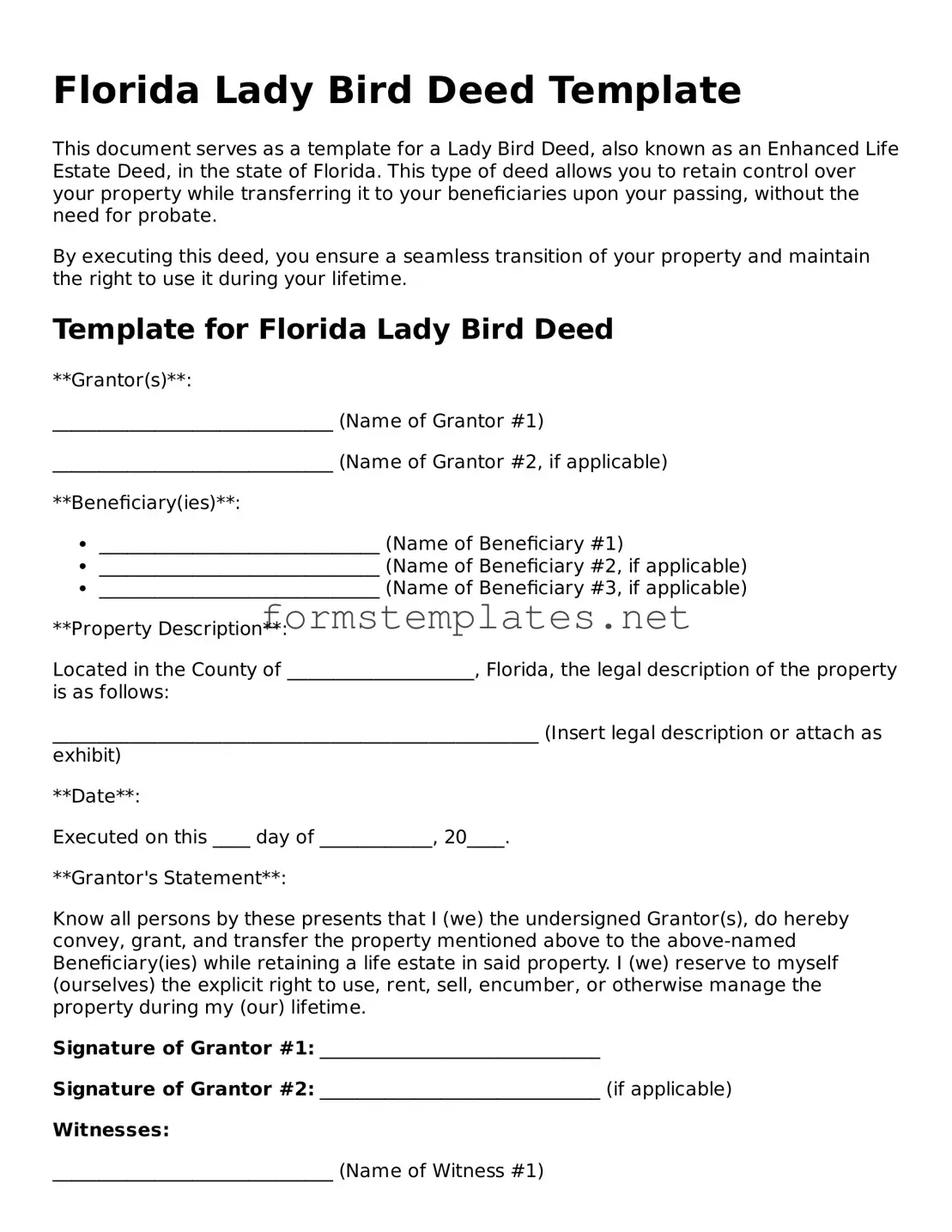

Florida Lady Bird Deed Template

This document serves as a template for a Lady Bird Deed, also known as an Enhanced Life Estate Deed, in the state of Florida. This type of deed allows you to retain control over your property while transferring it to your beneficiaries upon your passing, without the need for probate.

By executing this deed, you ensure a seamless transition of your property and maintain the right to use it during your lifetime.

Template for Florida Lady Bird Deed

**Grantor(s)**:

______________________________ (Name of Grantor #1)

______________________________ (Name of Grantor #2, if applicable)

**Beneficiary(ies)**:

- ______________________________ (Name of Beneficiary #1)

- ______________________________ (Name of Beneficiary #2, if applicable)

- ______________________________ (Name of Beneficiary #3, if applicable)

**Property Description**:

Located in the County of ____________________, Florida, the legal description of the property is as follows:

____________________________________________________ (Insert legal description or attach as exhibit)

**Date**:

Executed on this ____ day of ____________, 20____.

**Grantor's Statement**:

Know all persons by these presents that I (we) the undersigned Grantor(s), do hereby convey, grant, and transfer the property mentioned above to the above-named Beneficiary(ies) while retaining a life estate in said property. I (we) reserve to myself (ourselves) the explicit right to use, rent, sell, encumber, or otherwise manage the property during my (our) lifetime.

Signature of Grantor #1: ______________________________

Signature of Grantor #2: ______________________________ (if applicable)

Witnesses:

______________________________ (Name of Witness #1)

______________________________ (Name of Witness #2)

State of Florida

County of ________________________

On this ____ day of ____________, 20____, before me personally appeared the undersigned Grantor(s), known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

Notary Public: ______________________________

My Commission Expires: _____________________

This template is designed to help facilitate a straightforward transfer of property while still allowing you to retain rights as the owner during your lifetime. It's always wise to consult with an attorney to review any legal documents before signing to ensure they meet your unique needs.