What is a Florida Loan Agreement?

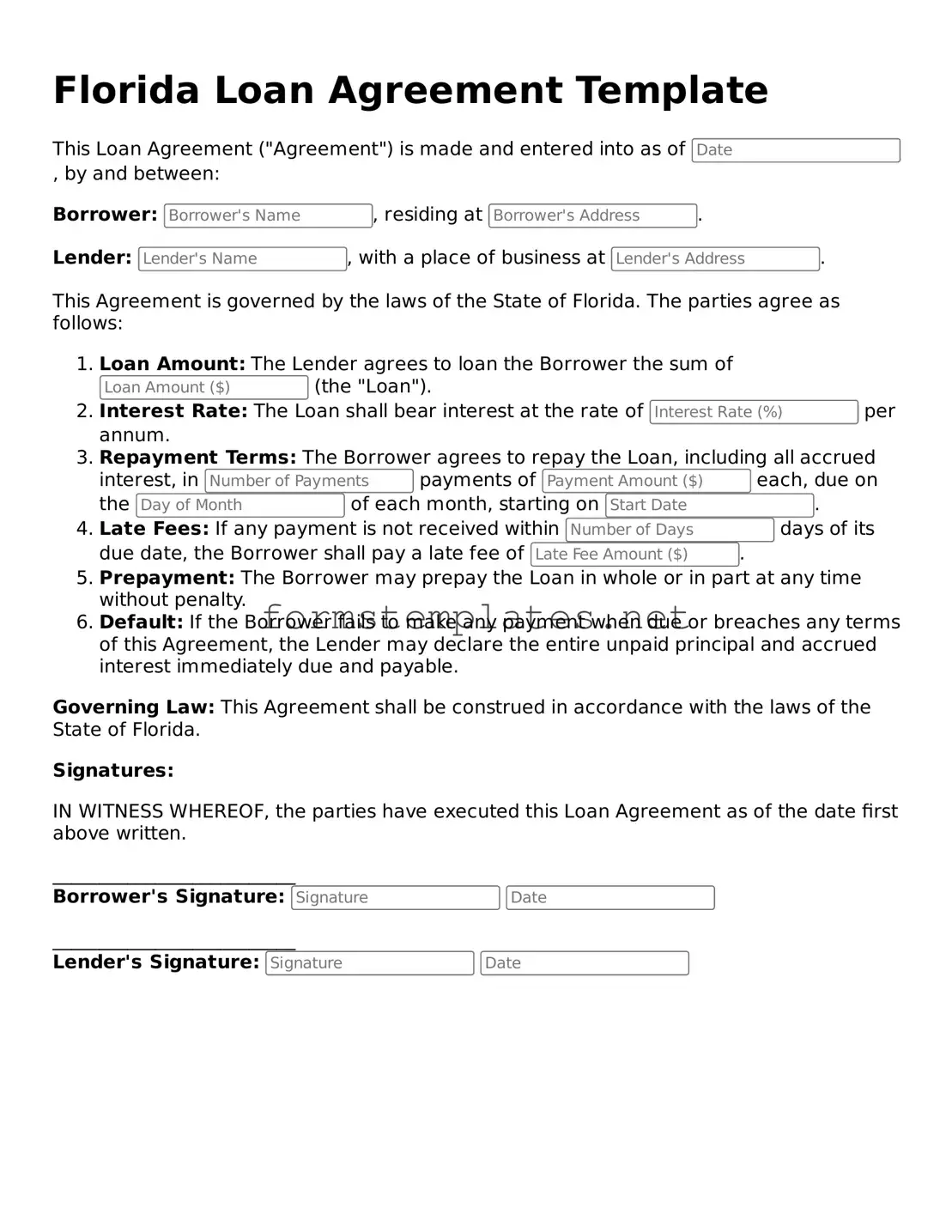

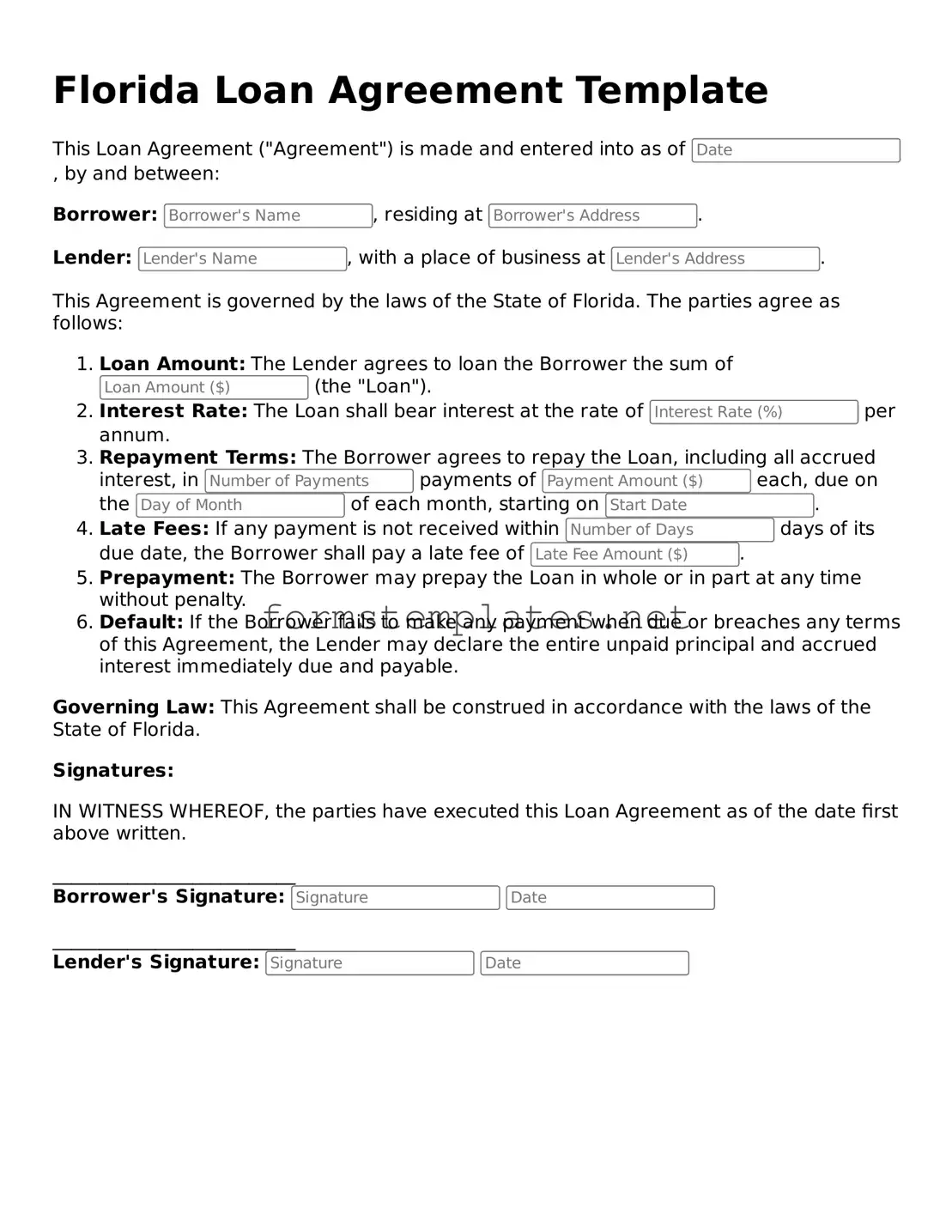

A Florida Loan Agreement is a legal document that outlines the terms and conditions under which one party lends money to another. It specifies details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This agreement protects both the lender and the borrower by clearly defining their rights and obligations.

Who needs a Loan Agreement?

Anyone involved in a lending transaction should consider using a Loan Agreement. This includes:

-

Individuals lending money to friends or family.

-

Businesses extending credit to customers or partners.

-

Investors providing funds for projects.

A formal agreement helps prevent misunderstandings and provides legal recourse if necessary.

What should be included in a Florida Loan Agreement?

A comprehensive Loan Agreement should include the following key elements:

-

Loan amount.

-

Interest rate.

-

Repayment schedule.

-

Terms regarding late payments or defaults.

-

Any collateral securing the loan.

-

Signatures of both parties.

Including these details ensures clarity and reduces the risk of disputes.

Is it necessary to have a Loan Agreement in writing?

While verbal agreements can be legally binding, having a Loan Agreement in writing is highly recommended. A written document provides clear evidence of the terms agreed upon. In case of a dispute, it serves as a crucial reference point for both parties.

Can I customize a Florida Loan Agreement?

Yes, you can customize a Loan Agreement to fit your specific needs. While there are standard templates available, it’s important to tailor the agreement to reflect the unique aspects of your transaction. Just ensure that all essential elements are included and comply with Florida laws.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include:

-

Negotiating a new repayment plan.

-

Taking legal action to recover the owed amount.

-

Seizing collateral if applicable.

The Loan Agreement should outline the steps to take in case of default, providing clarity for both parties.

Do I need a lawyer to create a Loan Agreement?

While it’s not mandatory to hire a lawyer, consulting one can be beneficial, especially for larger loans or complex agreements. A legal professional can ensure that the document complies with state laws and adequately protects your interests.

How do I enforce a Loan Agreement in Florida?

To enforce a Loan Agreement in Florida, you may need to file a lawsuit in civil court if the borrower fails to repay the loan as agreed. Having a written agreement makes it easier to prove your case. Ensure you keep copies of all relevant documents, including the signed agreement and any communication regarding the loan.