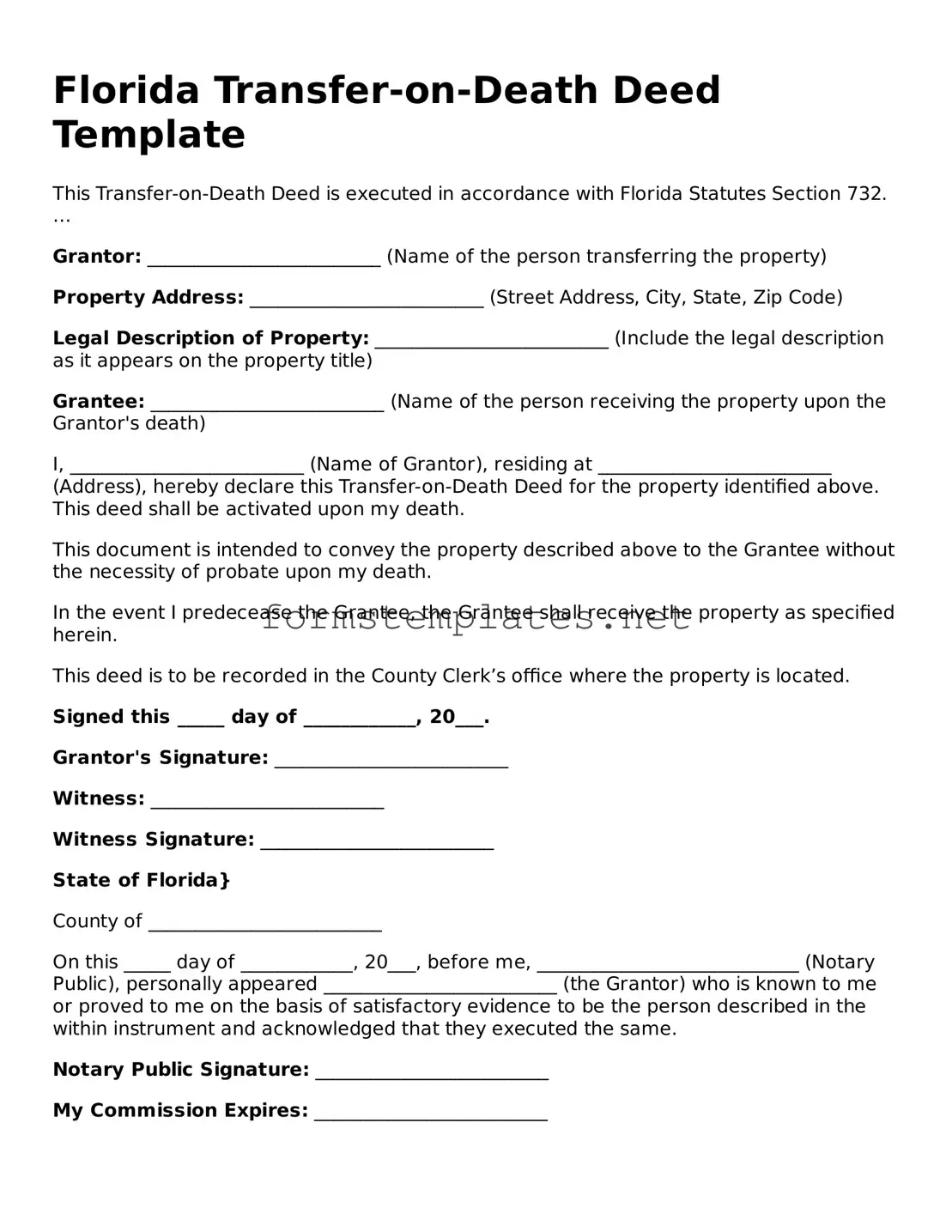

Attorney-Approved Florida Transfer-on-Death Deed Template

The Florida Transfer-on-Death Deed form allows property owners to transfer real estate to designated beneficiaries upon their death, avoiding the probate process. This legal tool provides a straightforward way to ensure that your property is passed on according to your wishes. Understanding the form's requirements and implications is essential for effective estate planning.

Open Editor Now

Attorney-Approved Florida Transfer-on-Death Deed Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Transfer-on-Death Deed online — simple edits, saving, and download.