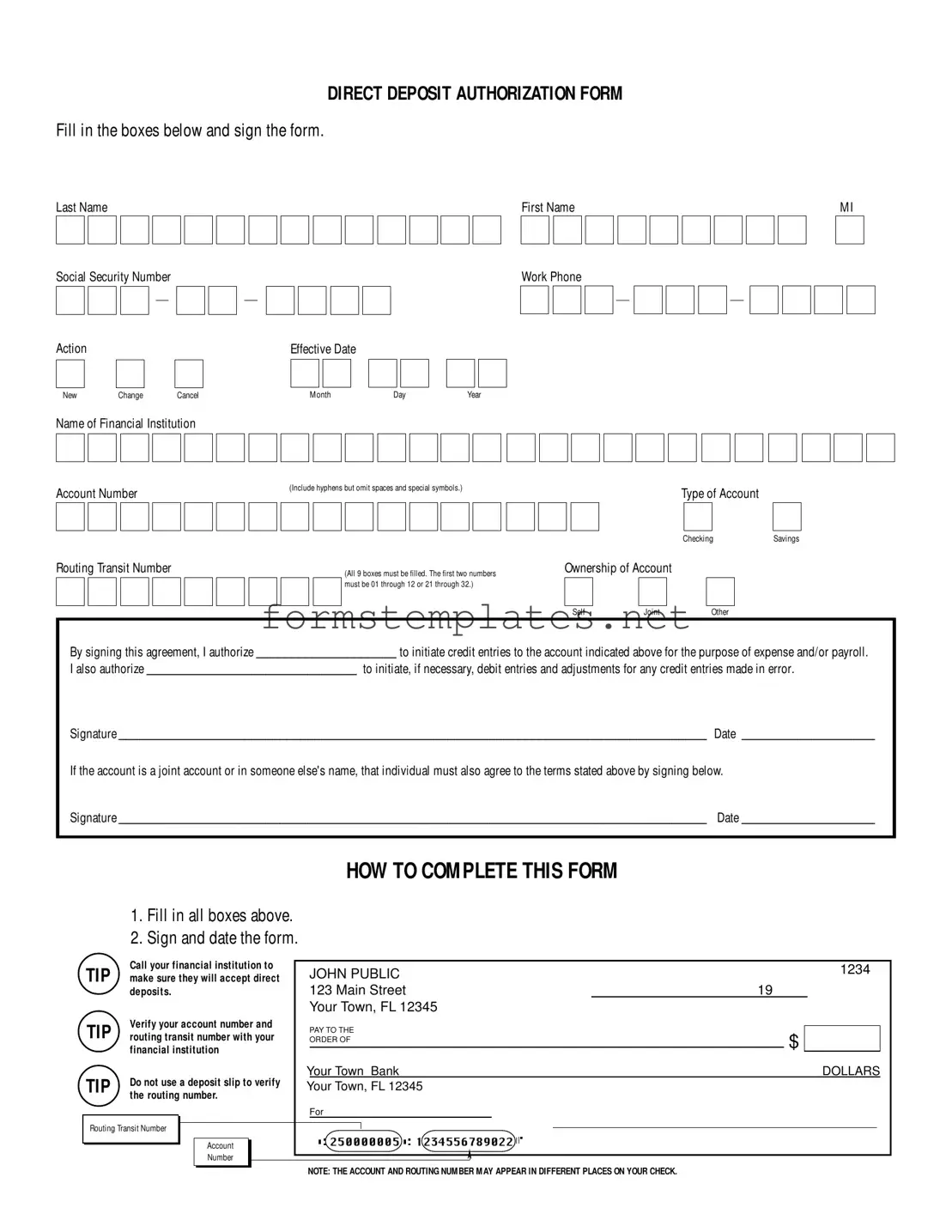

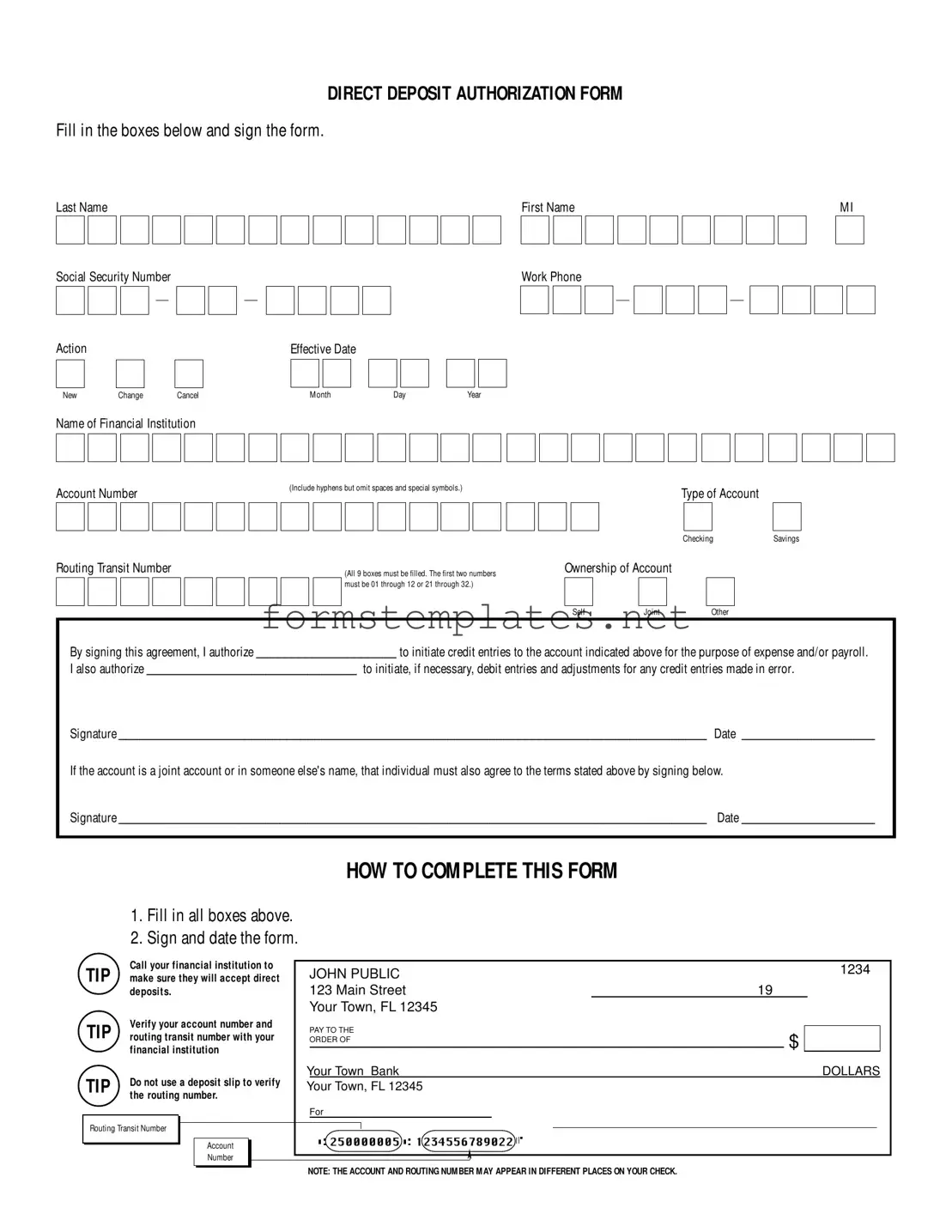

Free Generic Direct Deposit Template

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their bank accounts. This form requires personal information, such as the account holder's name, Social Security number, and bank details, ensuring that payments are securely processed. Completing the form accurately is essential for smooth transactions and to avoid any delays in receiving funds.

Open Editor Now

Free Generic Direct Deposit Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Generic Direct Deposit online — simple edits, saving, and download.

□

□