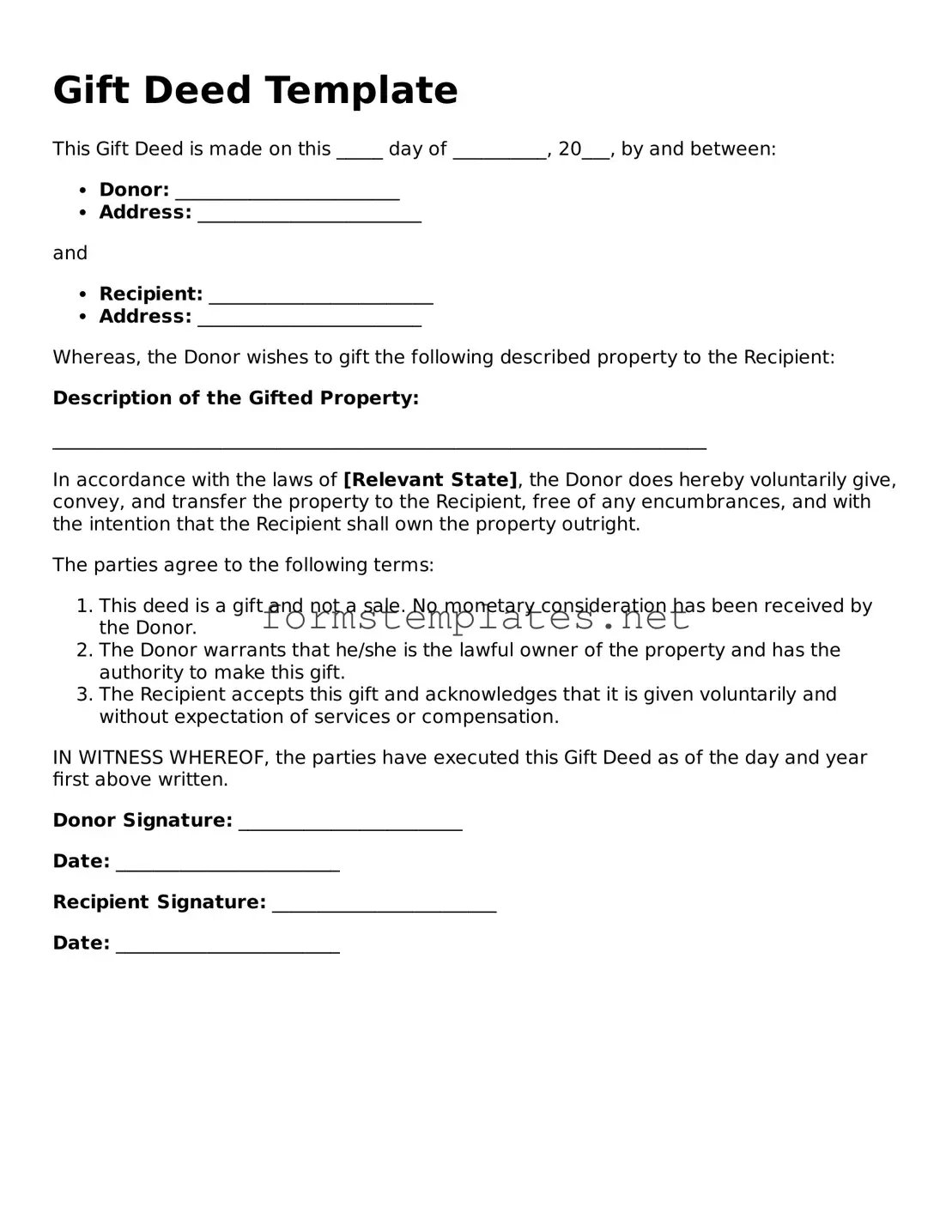

Attorney-Verified Gift Deed Form

A Gift Deed is a legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. This form outlines the terms of the gift, ensuring that the transfer is clear and legally binding. Understanding the nuances of a Gift Deed can help both donors and recipients navigate the process smoothly.

Open Editor Now

Attorney-Verified Gift Deed Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Gift Deed online — simple edits, saving, and download.