Free Gift Letter Template

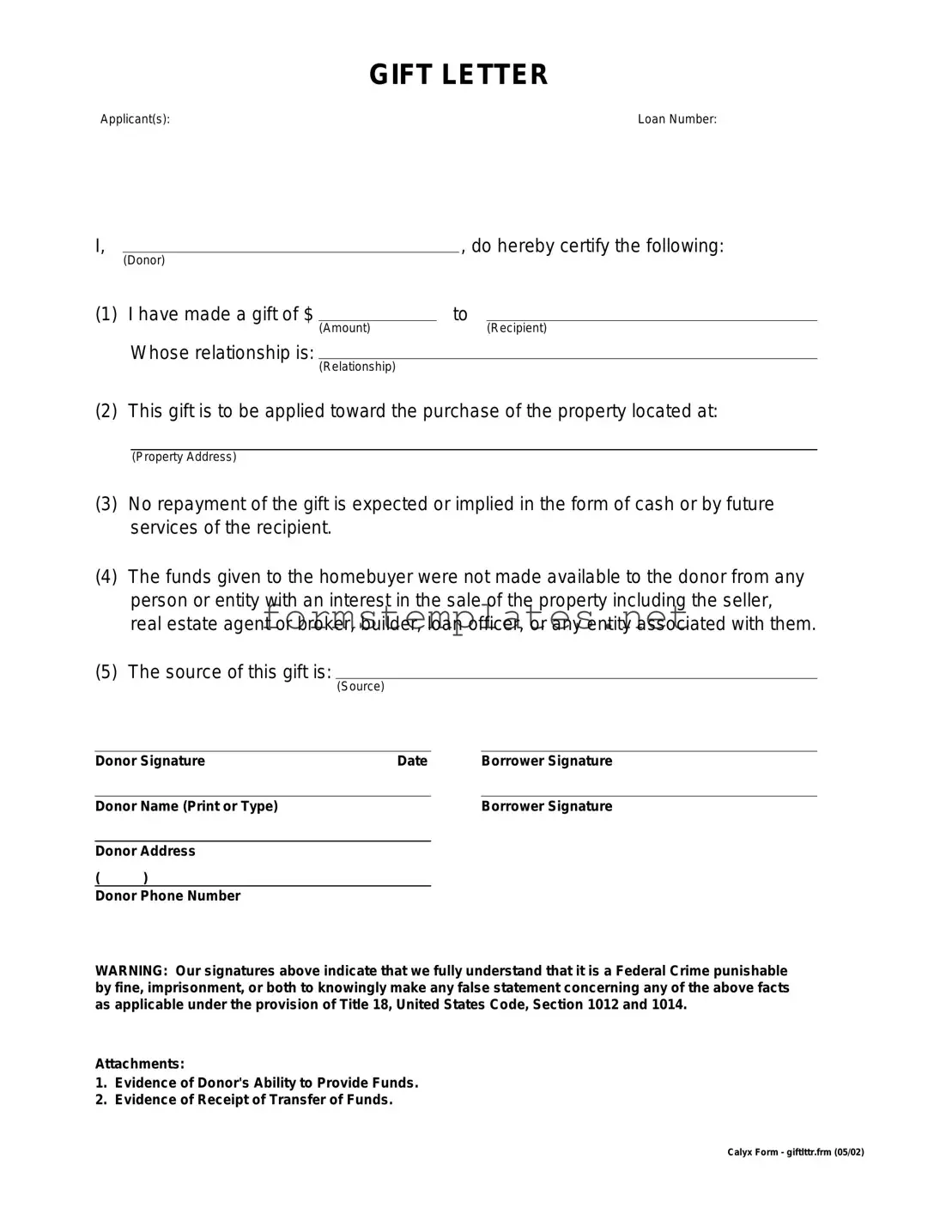

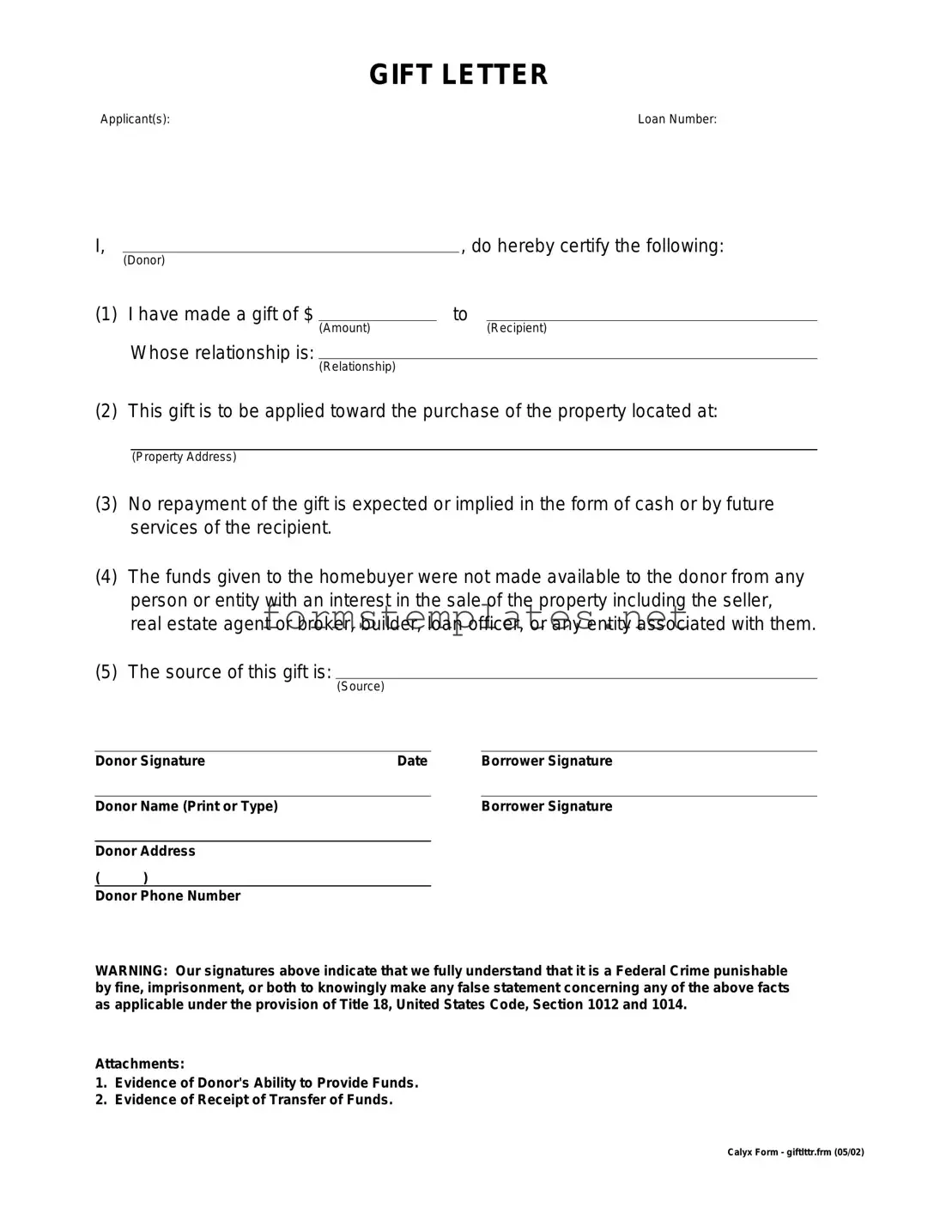

The Gift Letter form is a document used to declare that a monetary gift has been given, often to assist with a home purchase. This form helps clarify the nature of the funds, ensuring that they are not considered a loan. By providing transparency, it protects both the giver and the recipient in financial transactions.

Open Editor Now

Free Gift Letter Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Gift Letter online — simple edits, saving, and download.