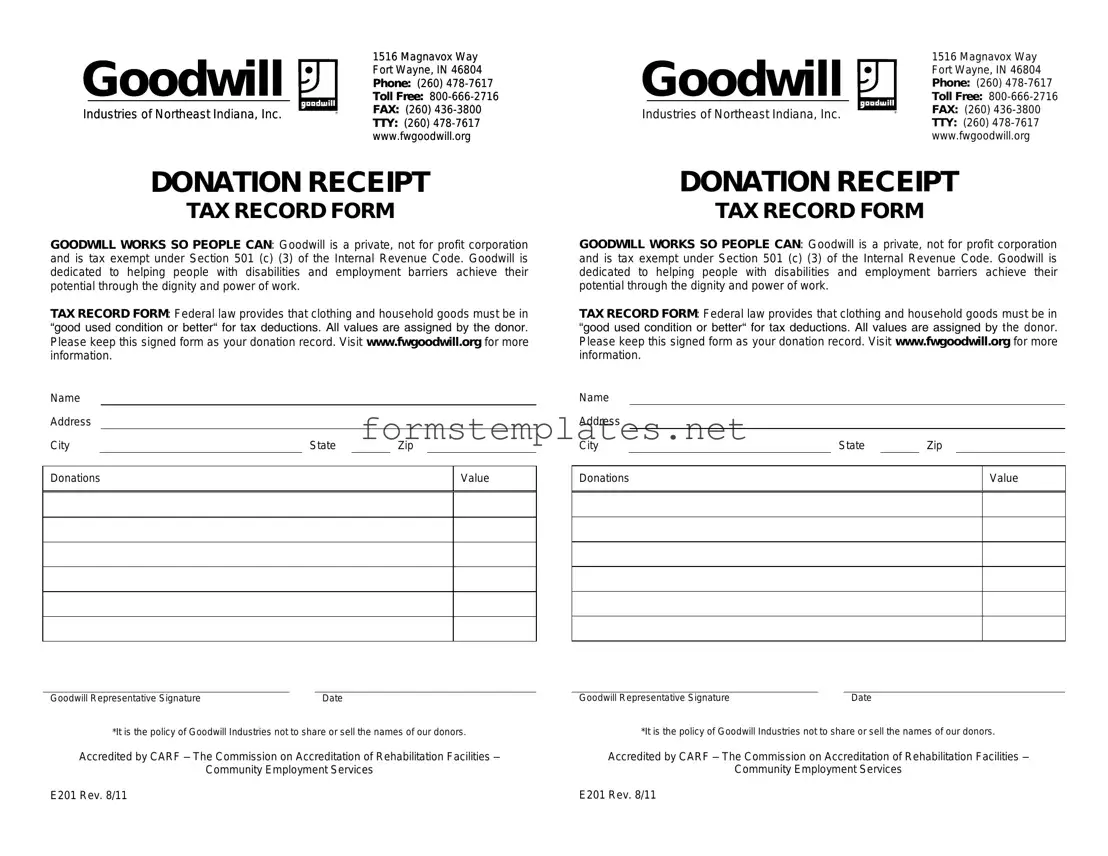

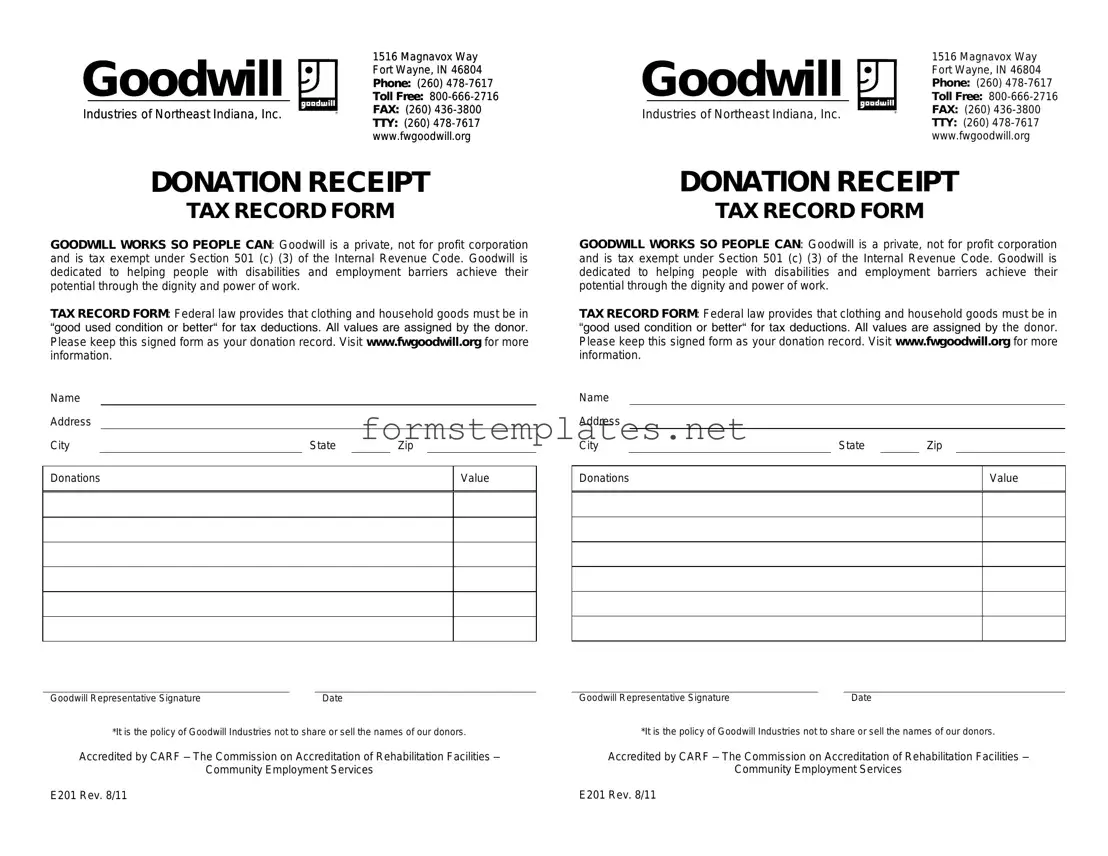

Free Goodwill donation receipt Template

The Goodwill donation receipt form is a document that acknowledges your charitable contribution to Goodwill Industries. This receipt serves as proof of your donation, which can be important for tax purposes. Understanding how to properly fill out and use this form can enhance your charitable giving experience.

Open Editor Now

Free Goodwill donation receipt Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Goodwill donation receipt online — simple edits, saving, and download.