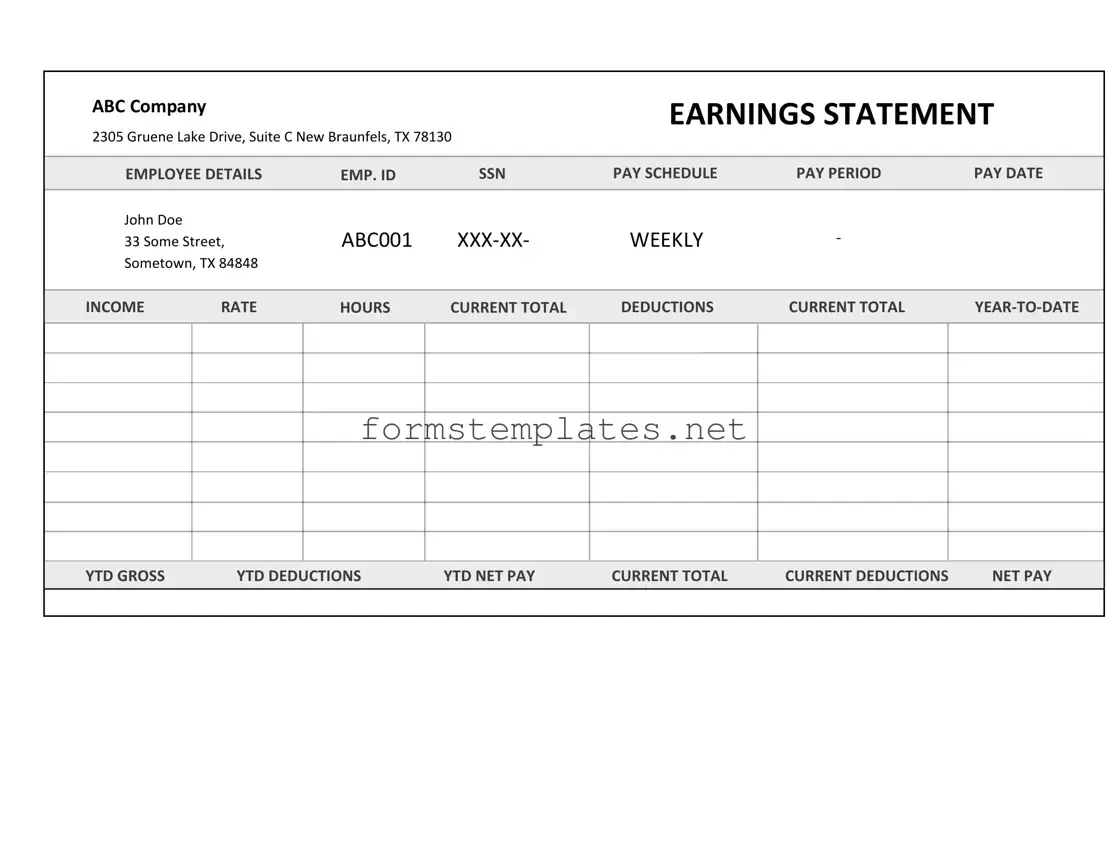

Free Independent Contractor Pay Stub Template

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form serves as a record of payment, helping contractors keep track of their income and ensuring transparency in financial transactions. Understanding how to use this form can simplify tax reporting and improve financial management for freelancers and contractors alike.

Open Editor Now

Free Independent Contractor Pay Stub Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Independent Contractor Pay Stub online — simple edits, saving, and download.