What is an Investment Letter of Intent?

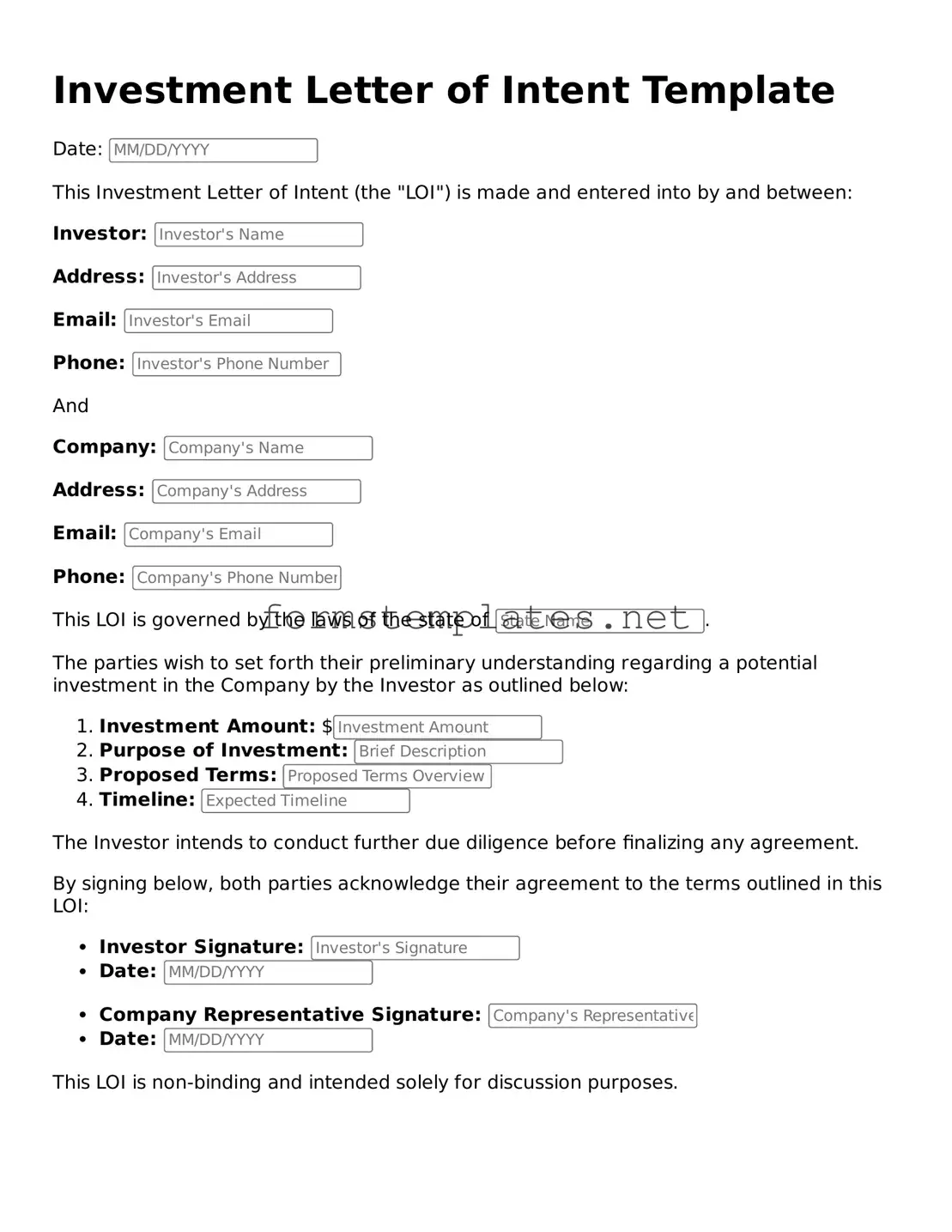

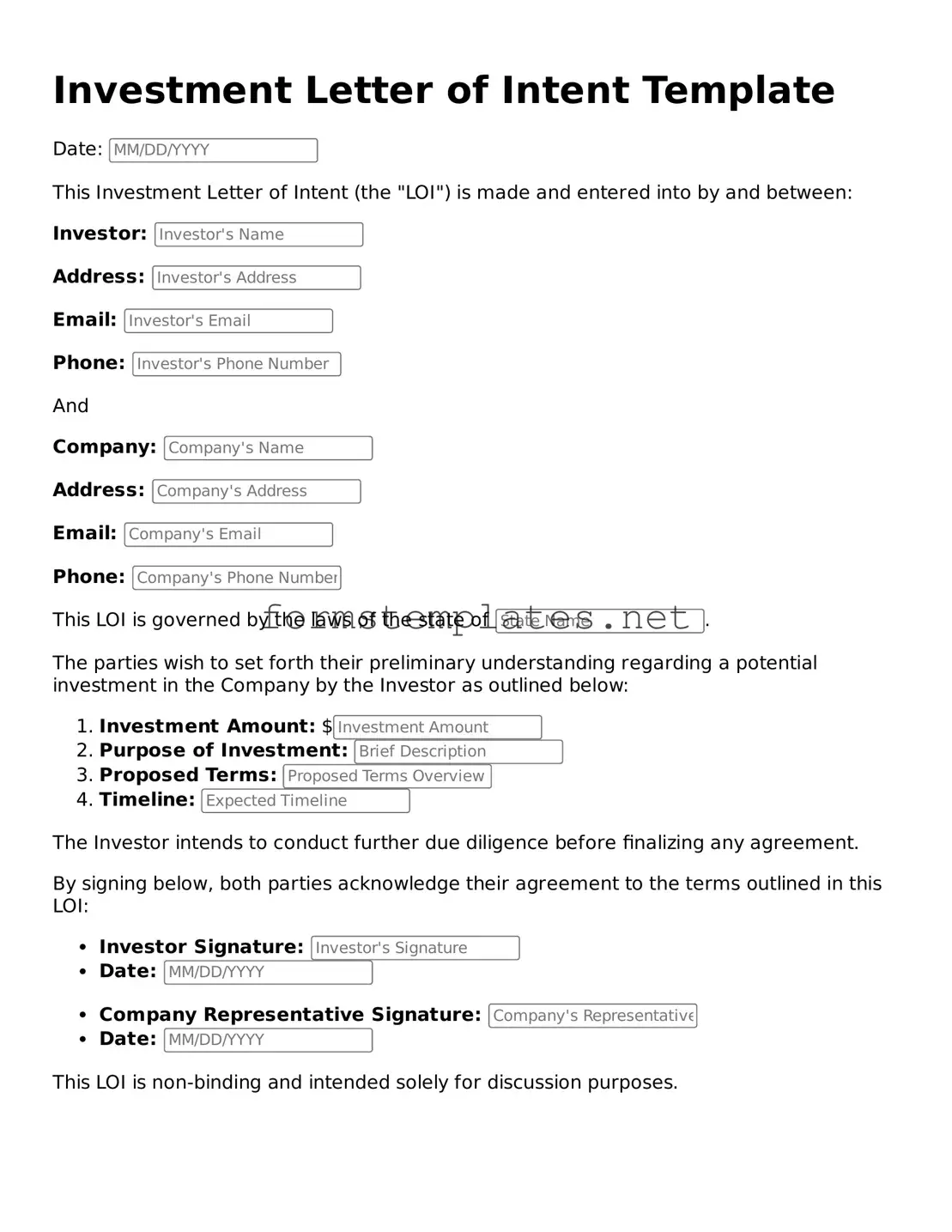

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties who intend to enter into a formal investment agreement. It serves as a roadmap for the negotiation process, highlighting key terms and conditions that will be discussed in more detail later.

Why do I need an Investment Letter of Intent?

An LOI helps clarify the intentions of both parties before formalizing an agreement. It can streamline negotiations and ensure that everyone is on the same page regarding critical aspects of the investment. By outlining expectations early on, it can help prevent misunderstandings later in the process.

What should be included in an Investment Letter of Intent?

Typically, an Investment LOI should include:

-

The names and contact information of the parties involved

-

A description of the investment opportunity

-

Key financial terms, such as the amount of investment and valuation

-

Proposed timelines for closing the deal

-

Any contingencies or conditions that must be met

-

Confidentiality clauses, if applicable

Is an Investment Letter of Intent legally binding?

Generally, an LOI is not legally binding, meaning it does not create enforceable obligations for either party. However, certain sections, like confidentiality agreements, may be binding. It’s crucial to clearly state which parts of the LOI are intended to be binding and which are not.

To fill out the form, start by entering the names of the parties involved. Next, provide a brief description of the investment opportunity. Include financial terms and any specific conditions you wish to outline. Review the form carefully to ensure all information is accurate and complete before submitting it.

What happens after I submit the Investment Letter of Intent?

After submission, the parties will typically review the LOI and may engage in discussions to negotiate the terms further. This may involve additional meetings or exchanges of information. If both parties agree on the terms, they can then move forward to draft a formal investment agreement.

Can I modify the Investment Letter of Intent after submission?

Yes, you can modify the LOI after submission. If changes are necessary, communicate them clearly to the other party. Both parties should agree to any modifications in writing to ensure clarity and mutual understanding.

What should I do if I have concerns about the Investment Letter of Intent?

If you have concerns, it’s important to address them before moving forward. Consider discussing your worries with the other party or seeking advice from a legal professional. Open communication can help resolve issues and ensure that both parties are comfortable with the terms outlined in the LOI.

How long is the Investment Letter of Intent valid?

The validity of an LOI depends on the terms agreed upon by both parties. Some LOIs may have a specific expiration date, while others remain valid until a formal agreement is executed. It’s essential to clarify this timeframe in the document to avoid confusion later.