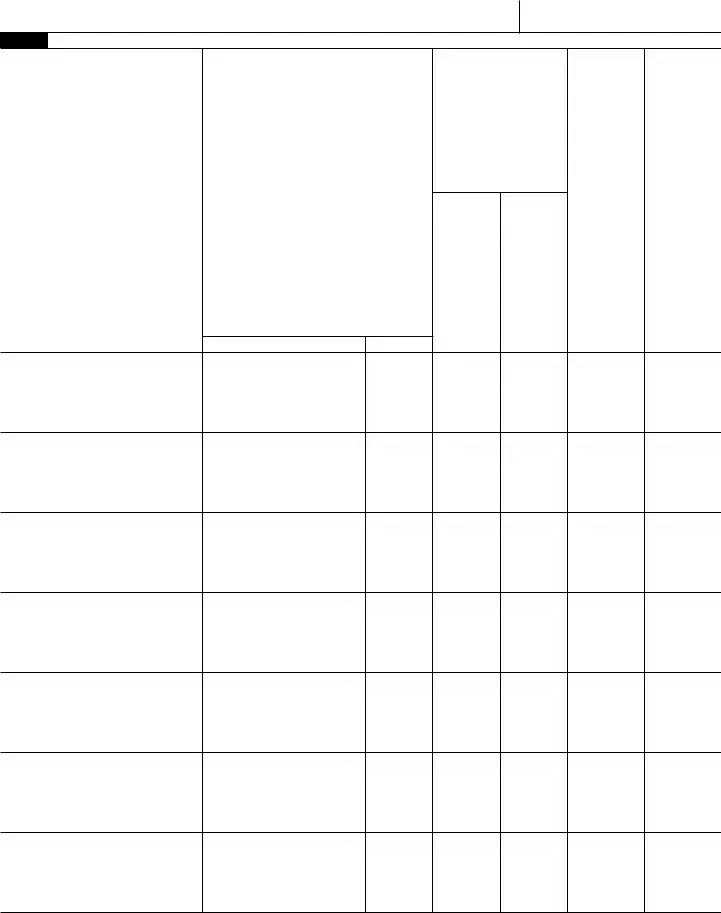

Form 2553 (Rev. 12-2017) |

Page 3 |

Name |

|

Employer identification number |

|

|

Part II |

Selection of Fiscal Tax Year (see instructions) |

|

Note: All corporations using this part must complete item O and item P, Q, or R. |

|

O Check the applicable box to indicate whether the corporation is: |

|

1. |

A new corporation adopting the tax year entered in item F, Part I. |

|

2. |

An existing corporation retaining the tax year entered in item F, Part I. |

|

3. |

An existing corporation changing to the tax year entered in item F, Part I. |

|

PComplete item P if the corporation is using the automatic approval provisions of Rev. Proc. 2006-46, 2006-45 I.R.B. 859, to request (1) a natural business year (as defined in section 5.07 of Rev. Proc. 2006-46) or (2) a year that satisfies the ownership tax year test (as defined in section 5.08 of Rev. Proc. 2006-46). Check the applicable box below to indicate the representation statement the corporation is making.

1. Natural Business Year ▶ |

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies |

as its natural business year (as defined in section 5.07 of Rev. Proc. 2006-46) and has attached a statement showing separately for each month the gross receipts for the most recent 47 months. See instructions. I also represent that the corporation is not precluded by section 4.02 of Rev. Proc. 2006-46 from obtaining automatic approval of such adoption, retention, or change in tax year.

2. Ownership Tax Year ▶ |

I represent that shareholders (as described in section 5.08 of Rev. Proc. 2006-46) holding more |

than half of the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies the requirement of section 4.01(3) of Rev. Proc. 2006-46. I also represent that the corporation is not precluded by section 4.02 of Rev. Proc. 2006-46 from obtaining automatic approval of such adoption, retention, or change in tax year.

Note: If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal tax year based on a business purpose and to make a back-up section 444 election. Item R is used to make a regular section 444 election.

QBusiness Purpose—To request a fiscal tax year based on a business purpose, check box Q1. See instructions for details including payment of a user fee. You may also check box Q2 and/or box Q3.

1. Check here ▶  if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc. 2002-39, 2002-22 I.R.B. 1046. Attach to Form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. See the instructions for details regarding the gross receipts from sales and services. If the IRS proposes to disapprove the requested fiscal year, do you want a conference with the IRS National Office?

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc. 2002-39, 2002-22 I.R.B. 1046. Attach to Form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. See the instructions for details regarding the gross receipts from sales and services. If the IRS proposes to disapprove the requested fiscal year, do you want a conference with the IRS National Office?

2.Check here ▶

to show that the corporation intends to make a back-up section 444 election in the event the corporation’s business purpose request is not approved by the IRS. See instructions for more information.

to show that the corporation intends to make a back-up section 444 election in the event the corporation’s business purpose request is not approved by the IRS. See instructions for more information.

3.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a back-up section 444 election, but is ultimately not qualified to make a section 444 election, or (2) the corporation’s business purpose request is not approved and the corporation did not make a back-up section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a back-up section 444 election, but is ultimately not qualified to make a section 444 election, or (2) the corporation’s business purpose request is not approved and the corporation did not make a back-up section 444 election.

RSection 444 Election—To make a section 444 election, check box R1. You may also check box R2.

1.Check here ▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

2.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

Calendar year

Calendar year Fiscal year ending (month and day)

Fiscal year ending (month and day)

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

to show that the corporation intends to make a

to show that the corporation intends to make a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.