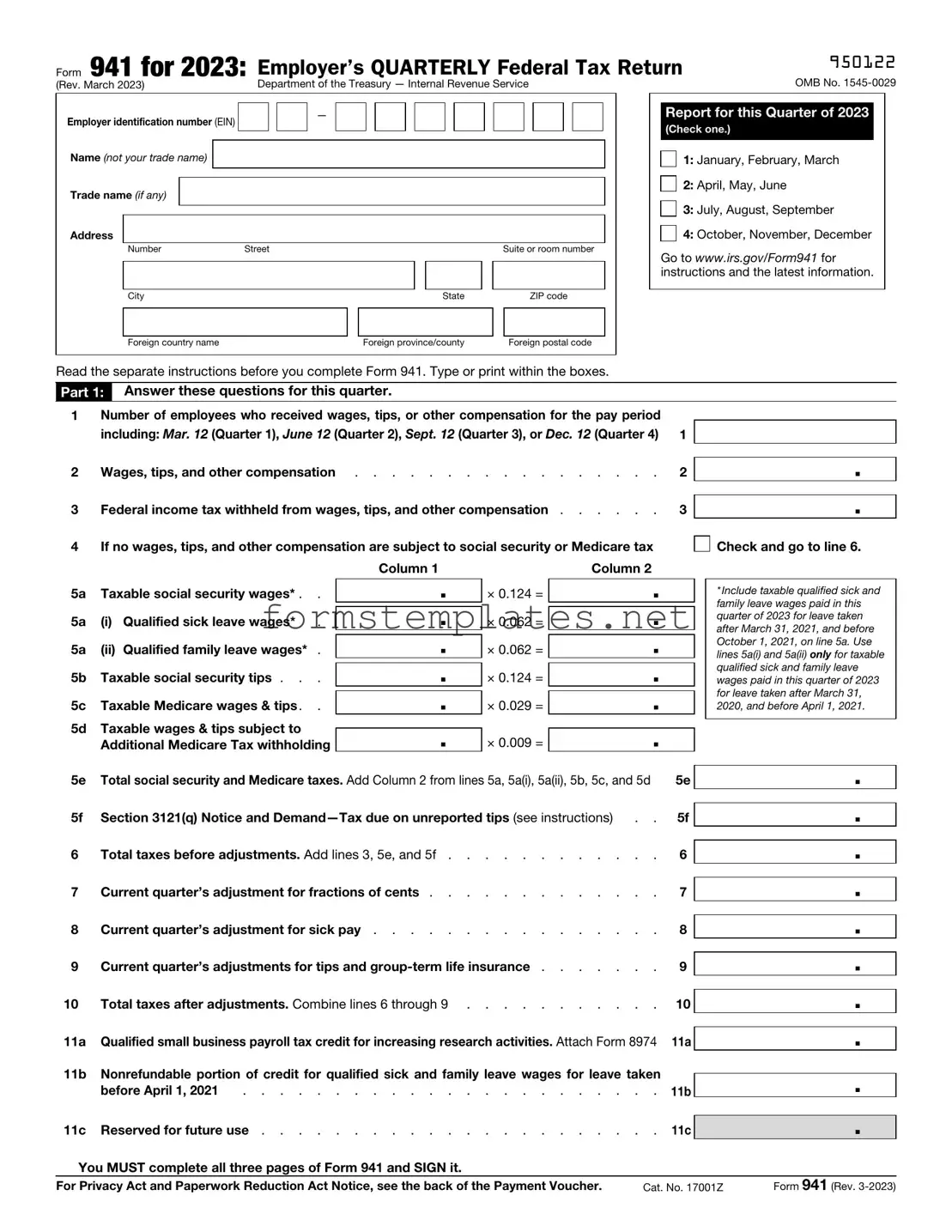

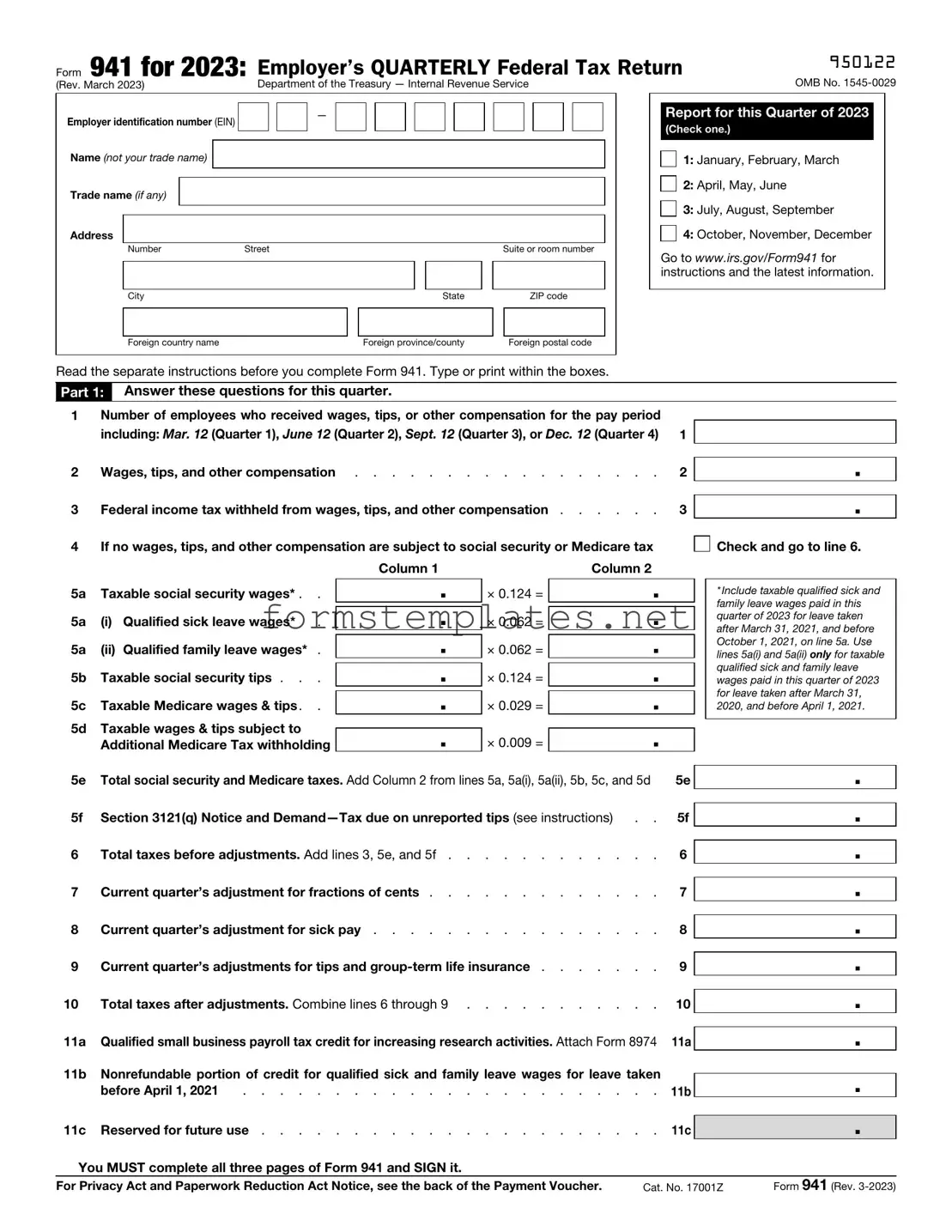

Free IRS 941 Template

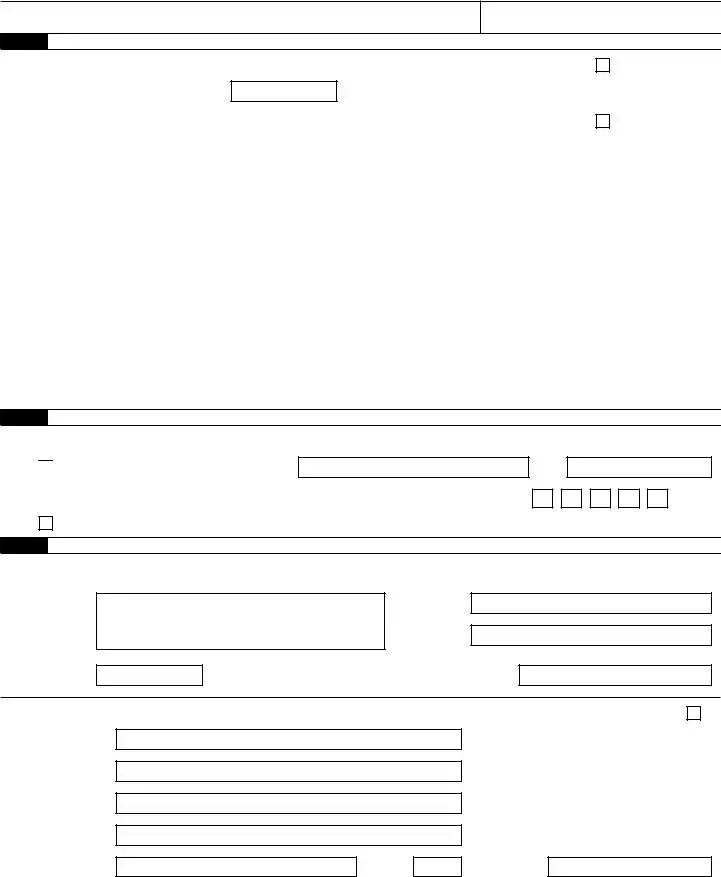

The IRS Form 941 is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring compliance with federal tax regulations and provides the IRS with information about the employer's payroll tax obligations. Understanding the details and requirements of Form 941 is crucial for accurate reporting and timely submissions.

Open Editor Now

Free IRS 941 Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize IRS 941 online — simple edits, saving, and download.

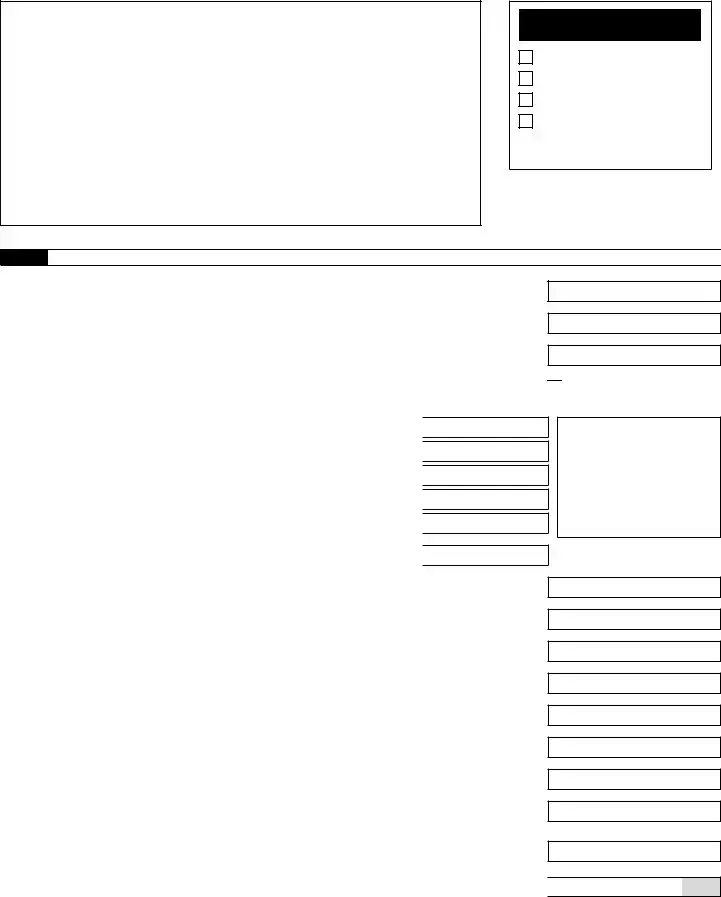

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

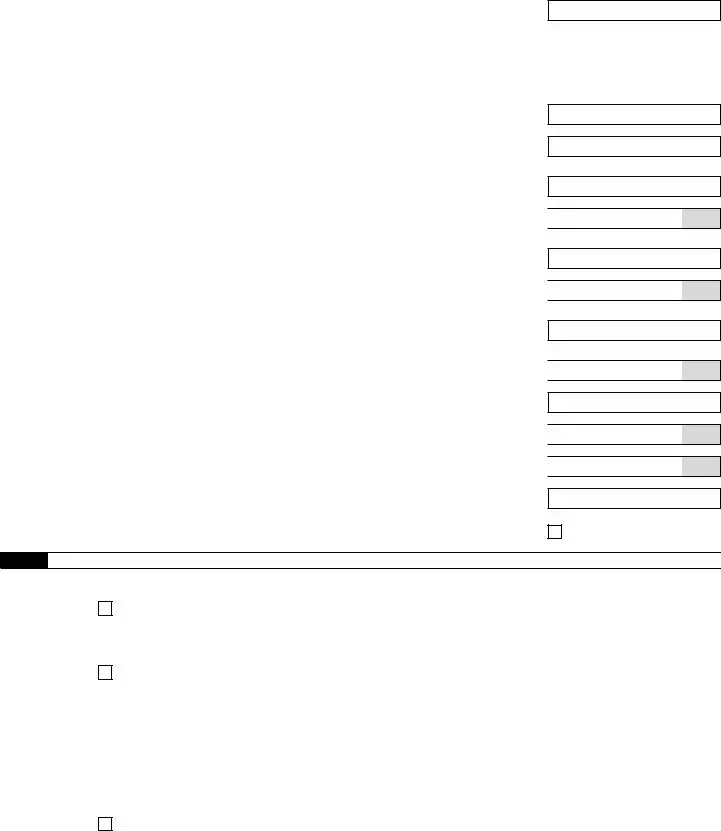

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number