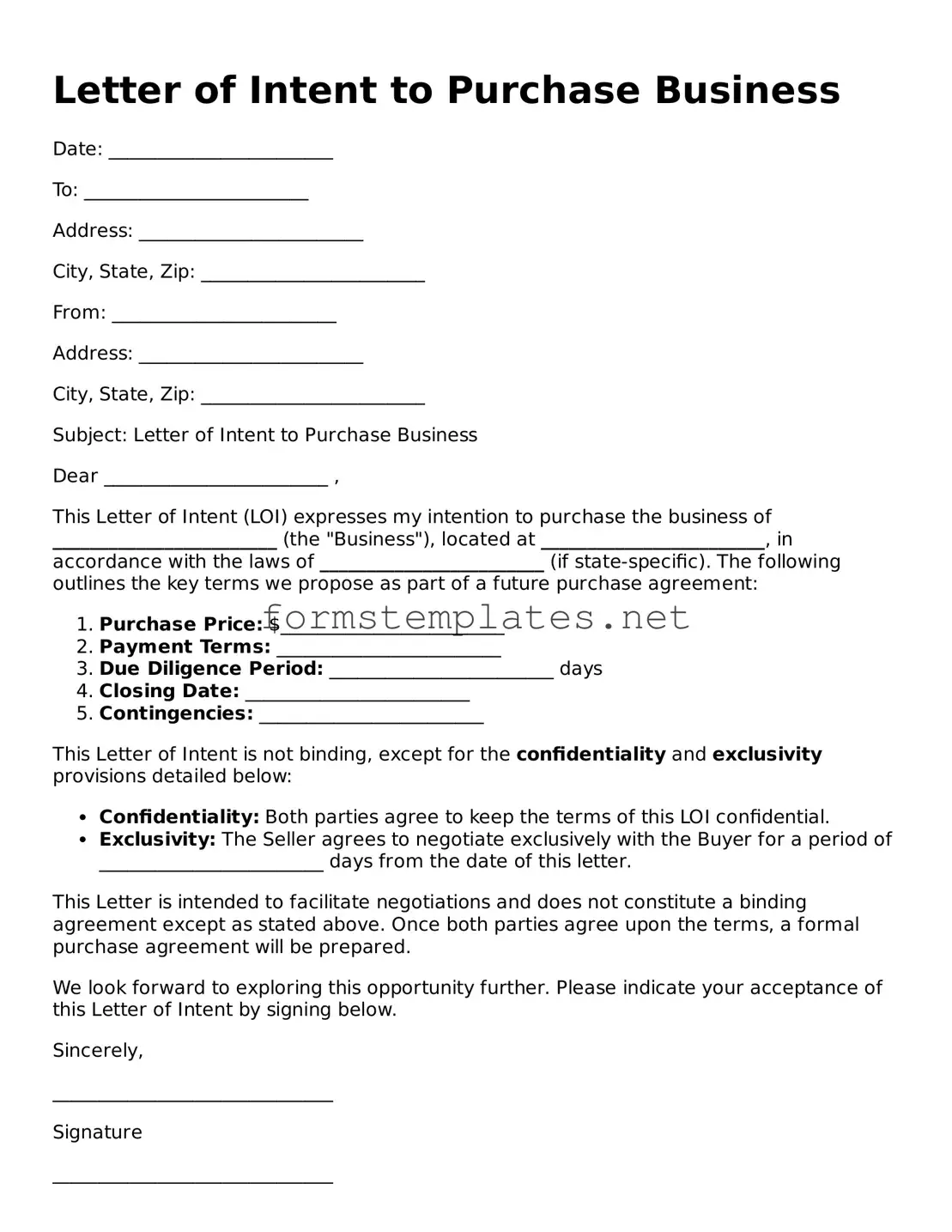

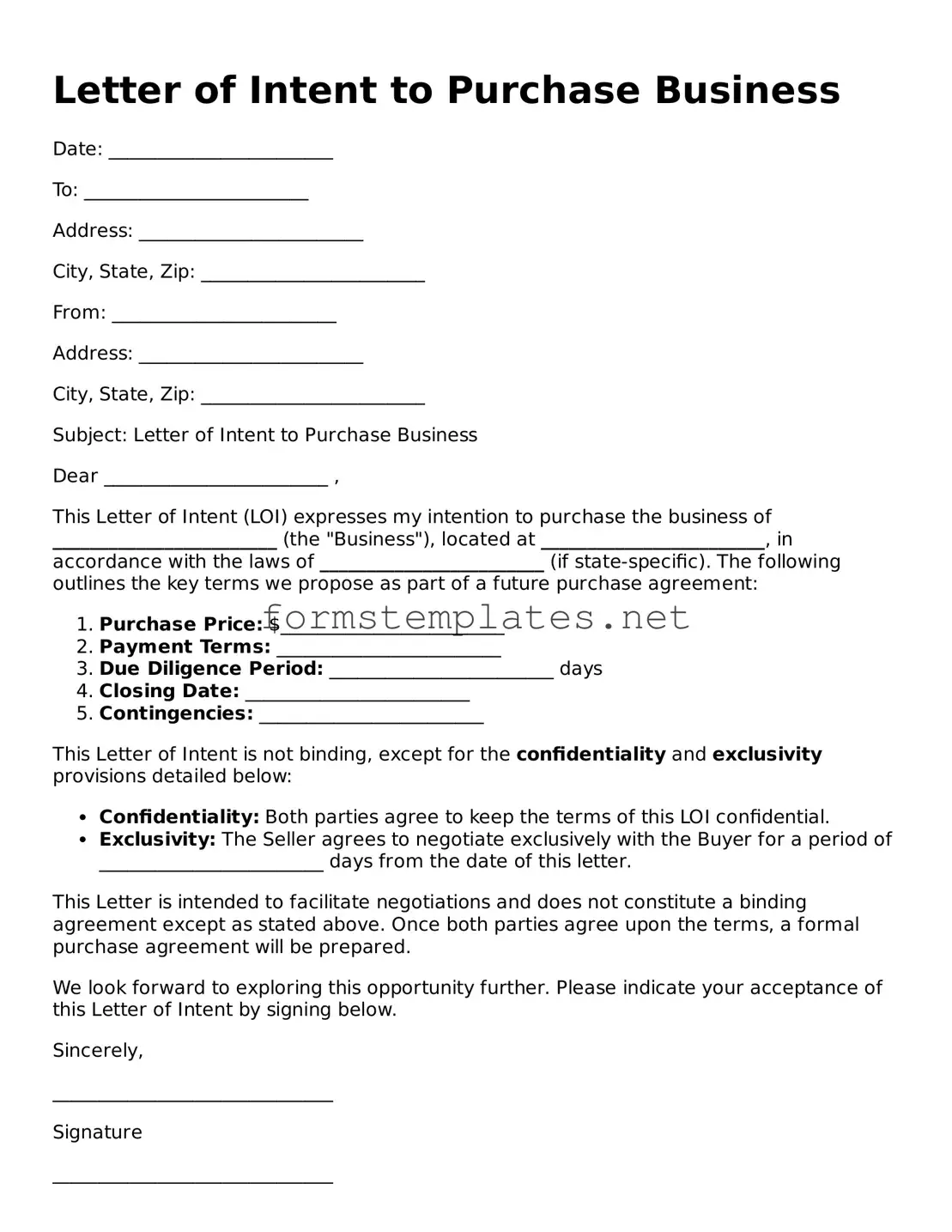

Attorney-Verified Letter of Intent to Purchase Business Form

A Letter of Intent to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. This form serves as a roadmap for negotiations and sets the stage for the final purchase agreement. It typically includes key terms, such as price and conditions, that both parties will need to agree upon.

Open Editor Now

Attorney-Verified Letter of Intent to Purchase Business Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Letter of Intent to Purchase Business online — simple edits, saving, and download.