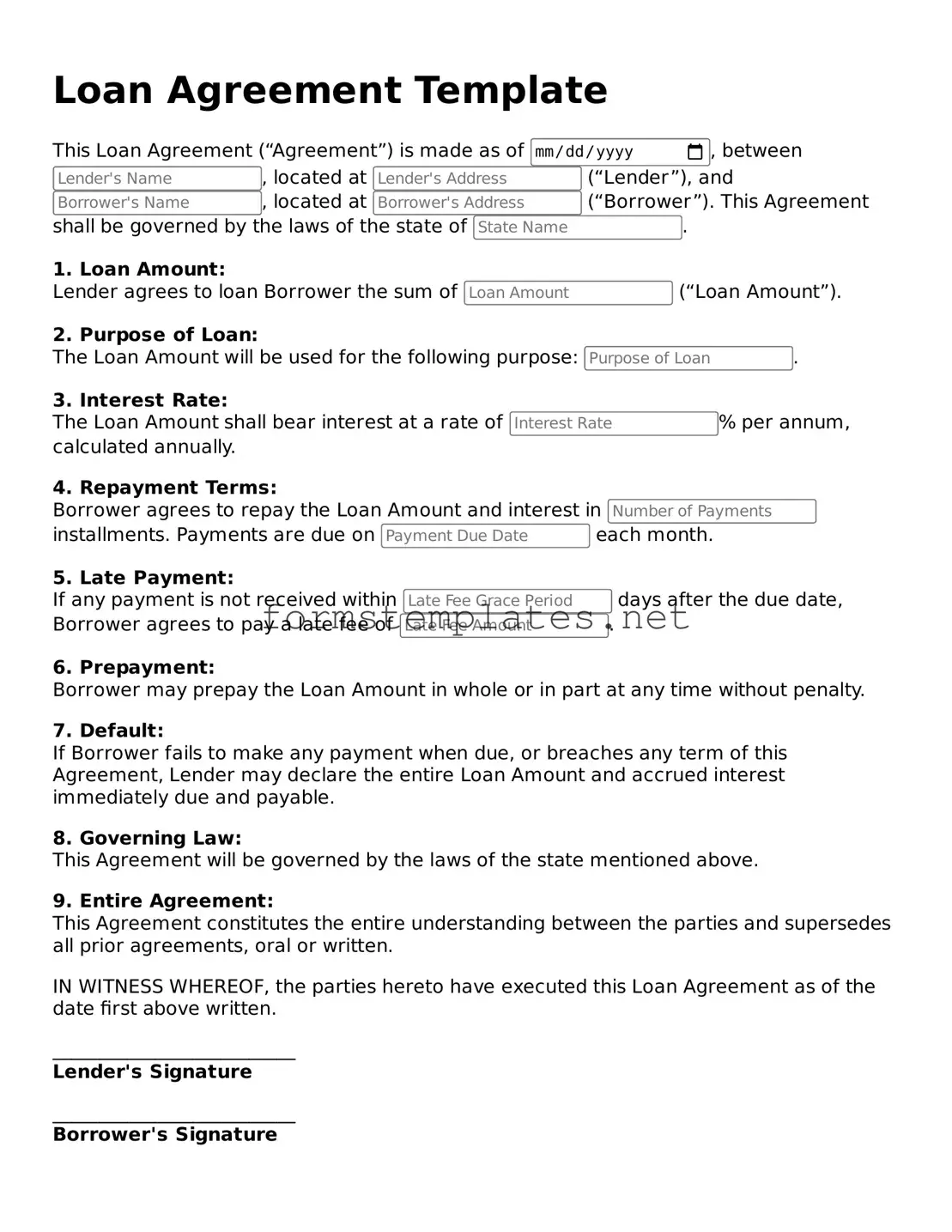

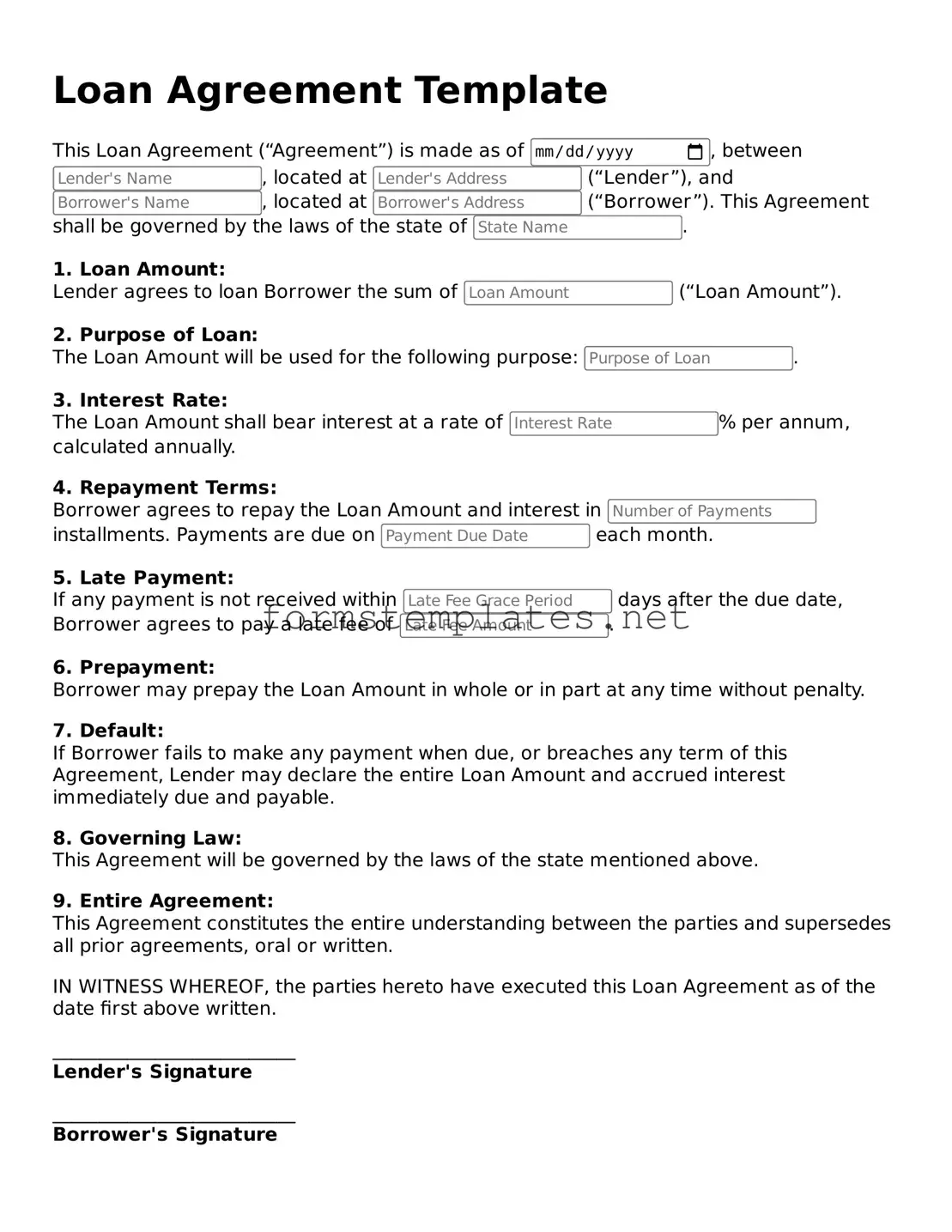

Attorney-Verified Loan Agreement Form

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. This essential agreement serves to protect both parties by clearly defining the repayment schedule, interest rates, and other important details. Understanding the components of a Loan Agreement can help individuals navigate the borrowing process with confidence.

Open Editor Now

Attorney-Verified Loan Agreement Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Loan Agreement online — simple edits, saving, and download.