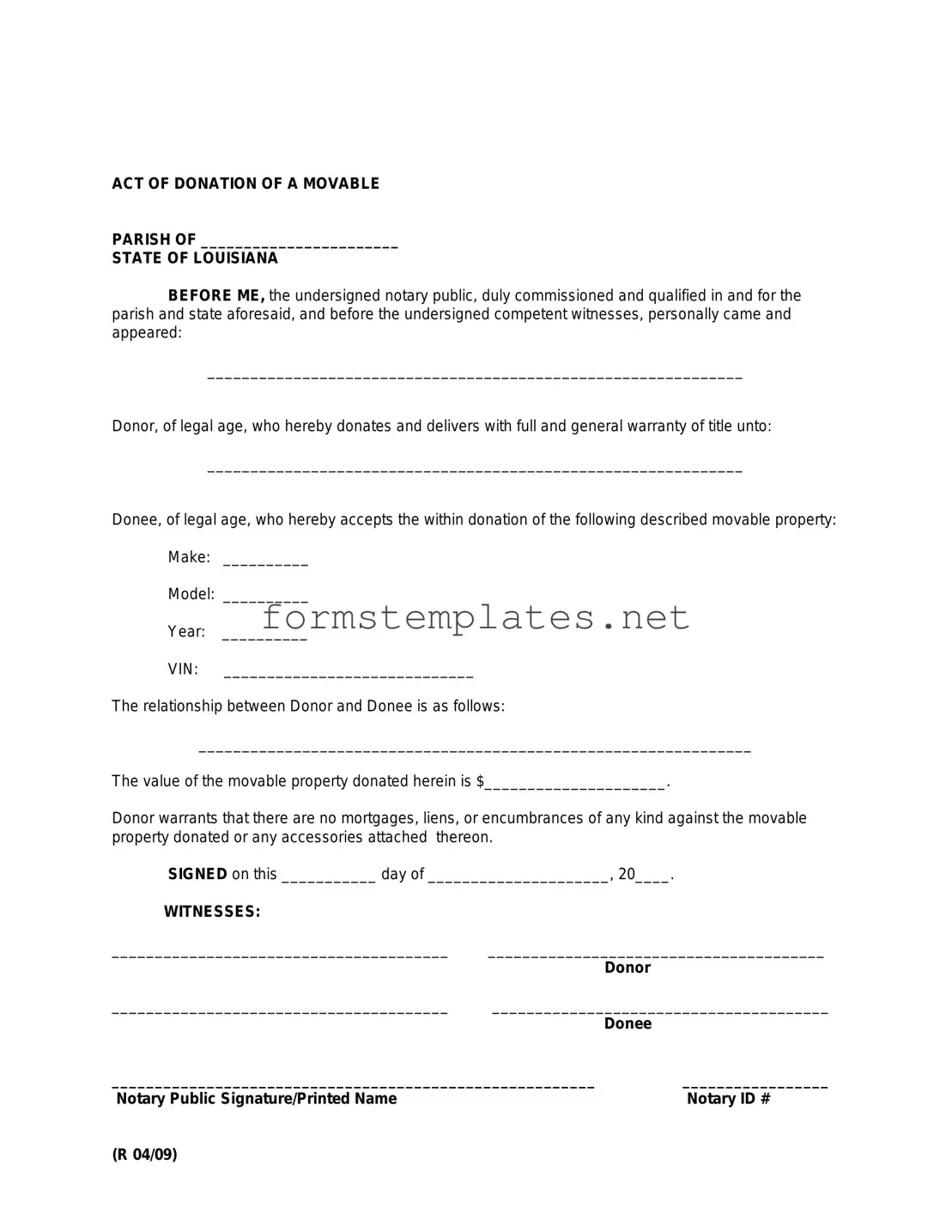

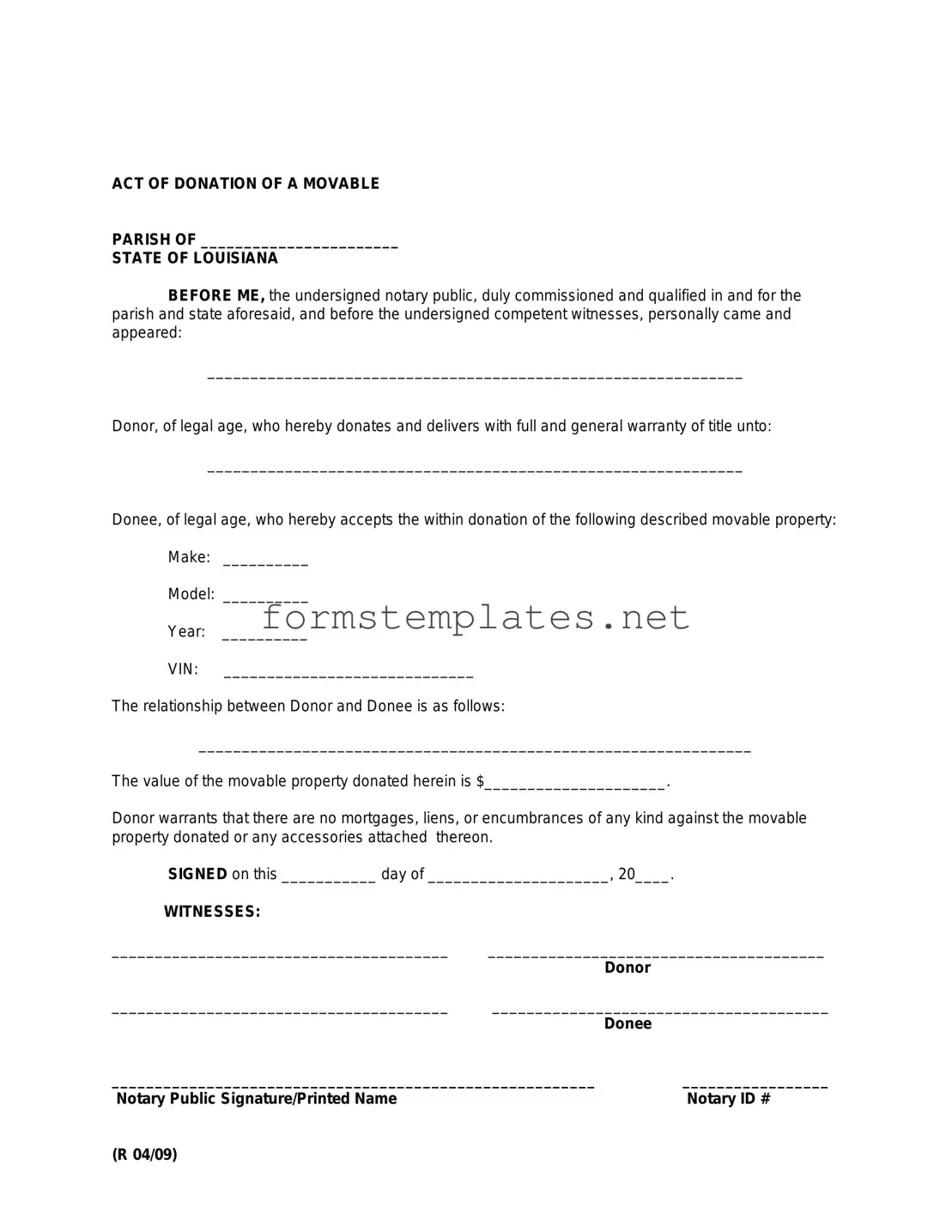

Free Louisiana act of donation Template

The Louisiana act of donation form is a legal document that allows individuals to transfer ownership of property or assets to another person without any exchange of payment. This form serves as a formal declaration of the donor's intent to make a gift, ensuring clarity and legality in the transaction. Understanding the requirements and implications of this form is essential for anyone considering a donation in Louisiana.

Open Editor Now

Free Louisiana act of donation Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Louisiana act of donation online — simple edits, saving, and download.