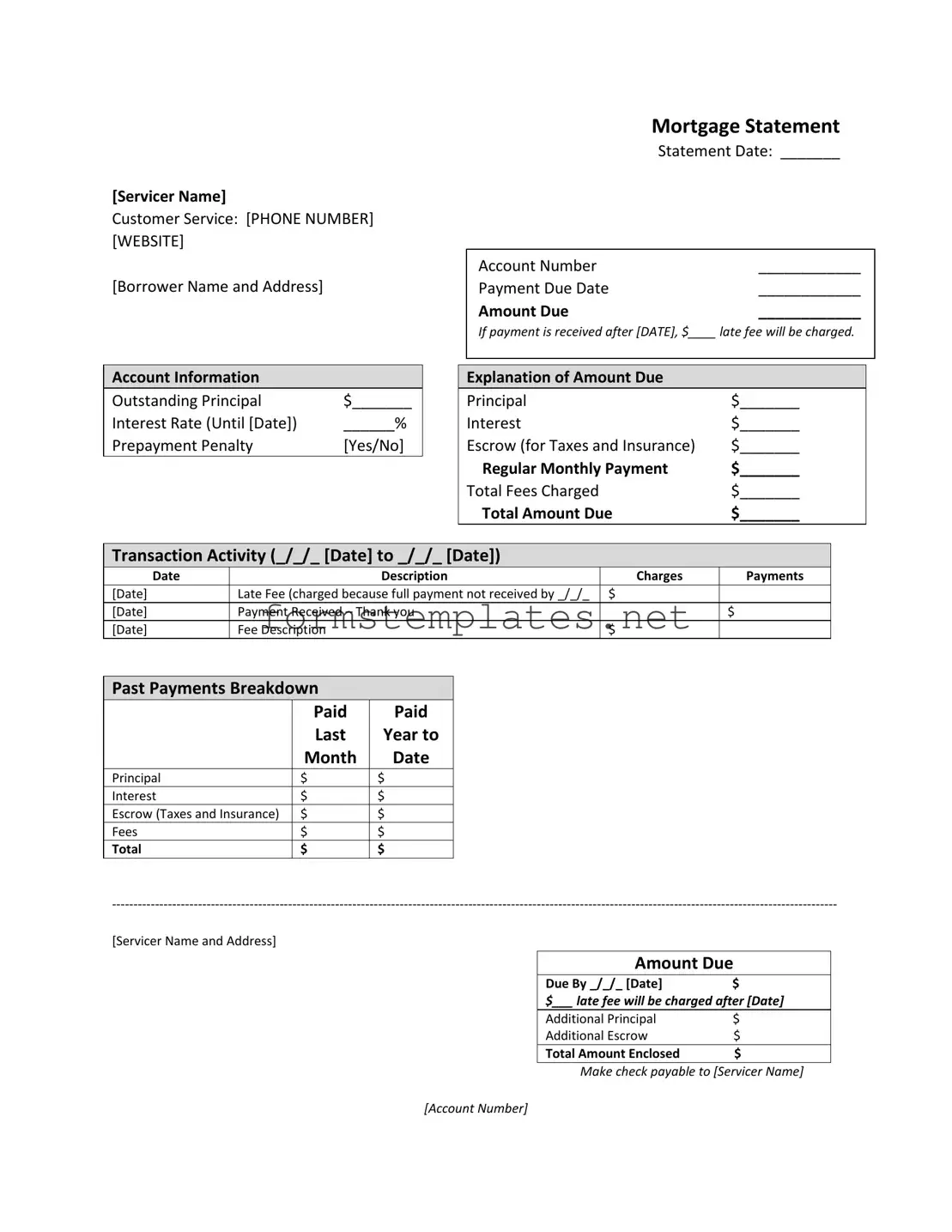

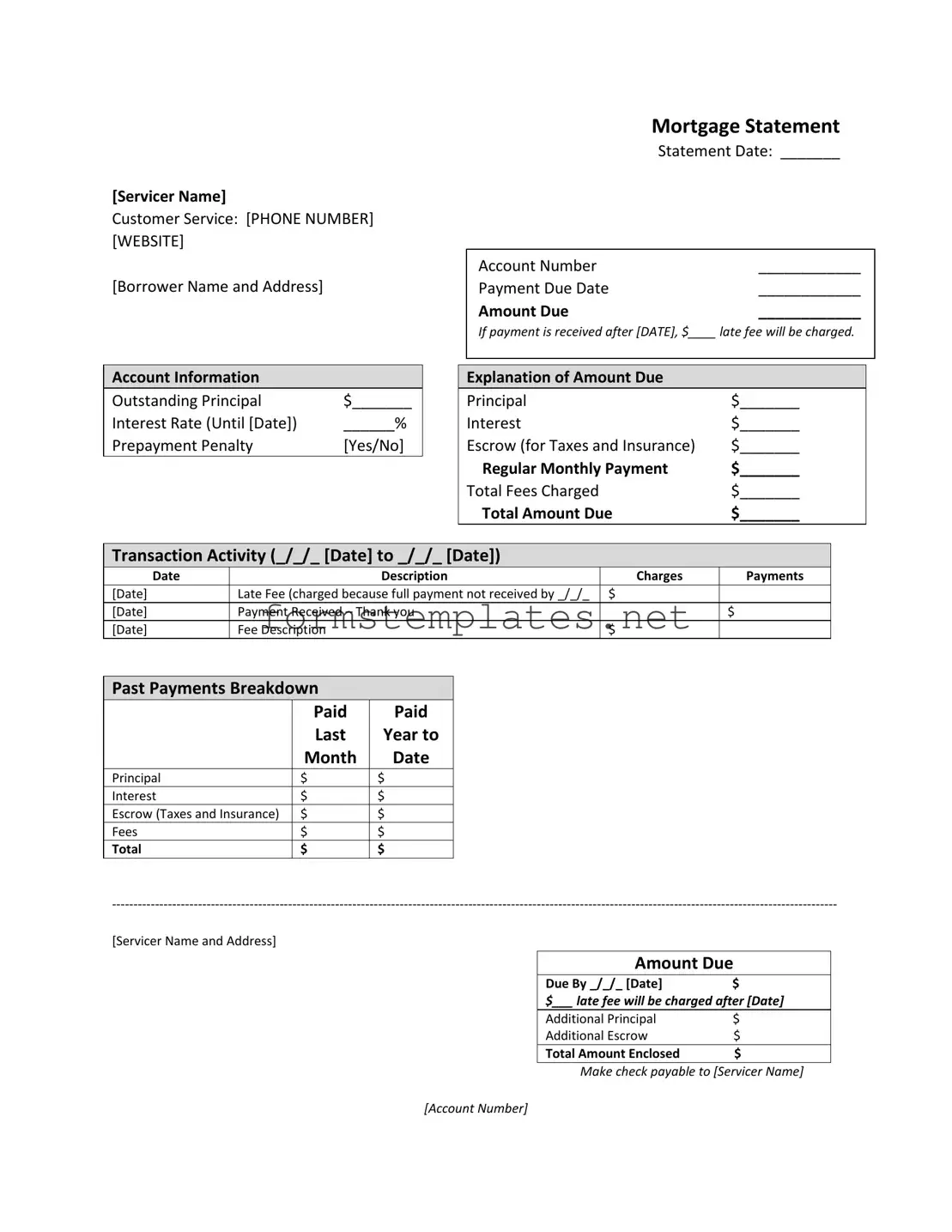

Free Mortgage Statement Template

A Mortgage Statement is a document that outlines the details of your mortgage loan, including the amount due and payment history. It serves as an important tool for homeowners to track their payments and understand their loan status. This article will break down the key components of a Mortgage Statement, helping you navigate your financial responsibilities with confidence.

Open Editor Now

Free Mortgage Statement Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Mortgage Statement online — simple edits, saving, and download.