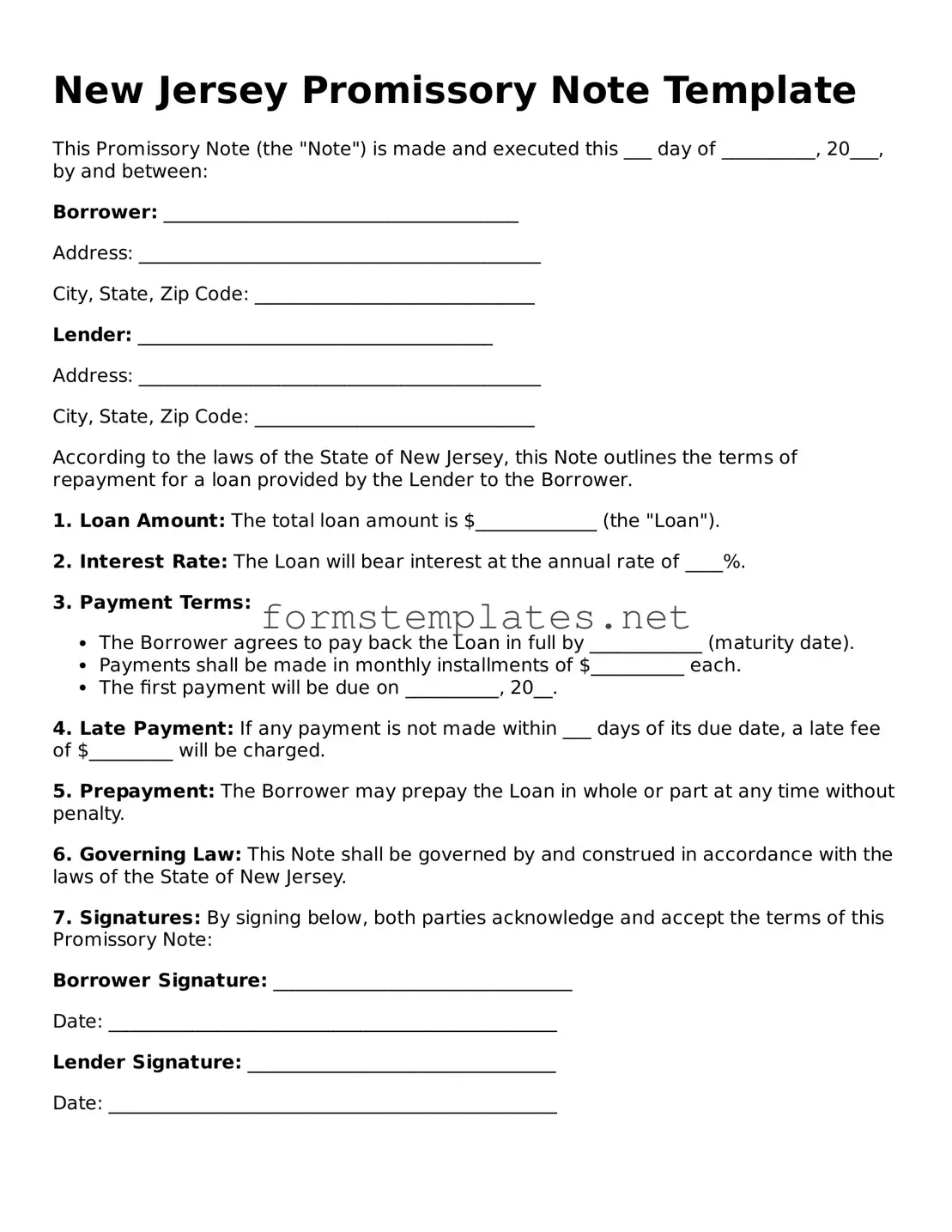

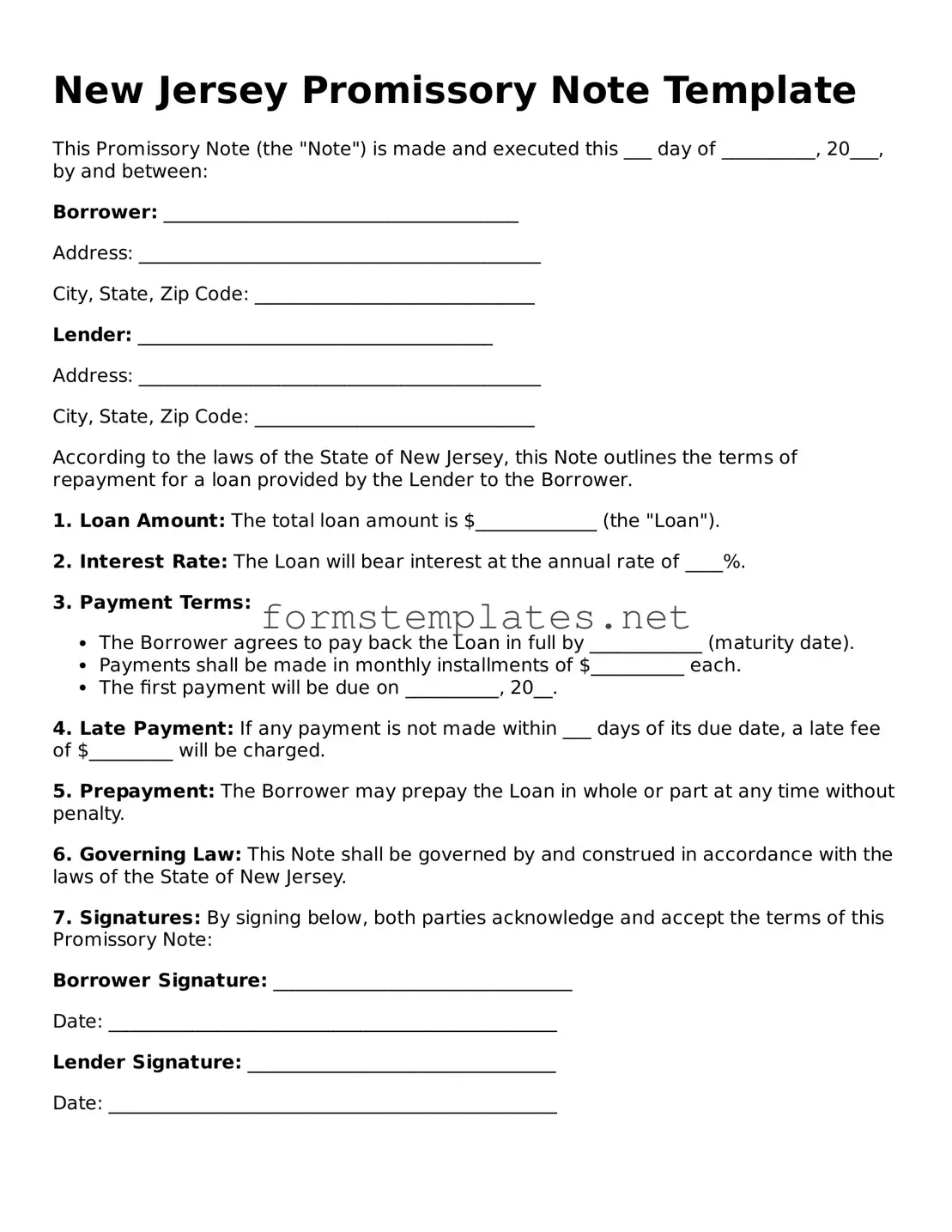

Attorney-Approved New Jersey Promissory Note Template

A New Jersey Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool in financial transactions, providing clarity and security for both parties involved. Understanding its components can help ensure that your rights are protected and obligations are clear.

Open Editor Now

Attorney-Approved New Jersey Promissory Note Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Promissory Note online — simple edits, saving, and download.