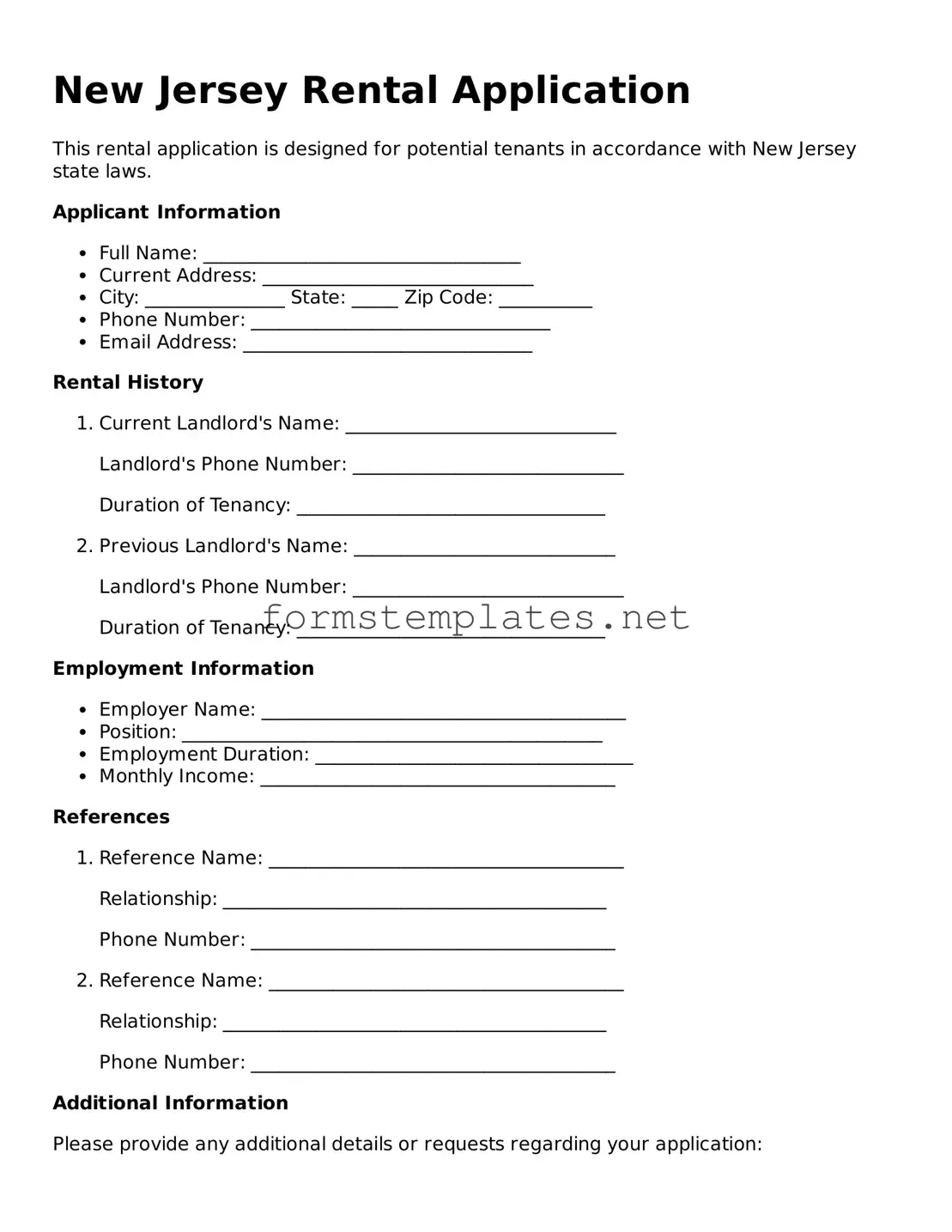

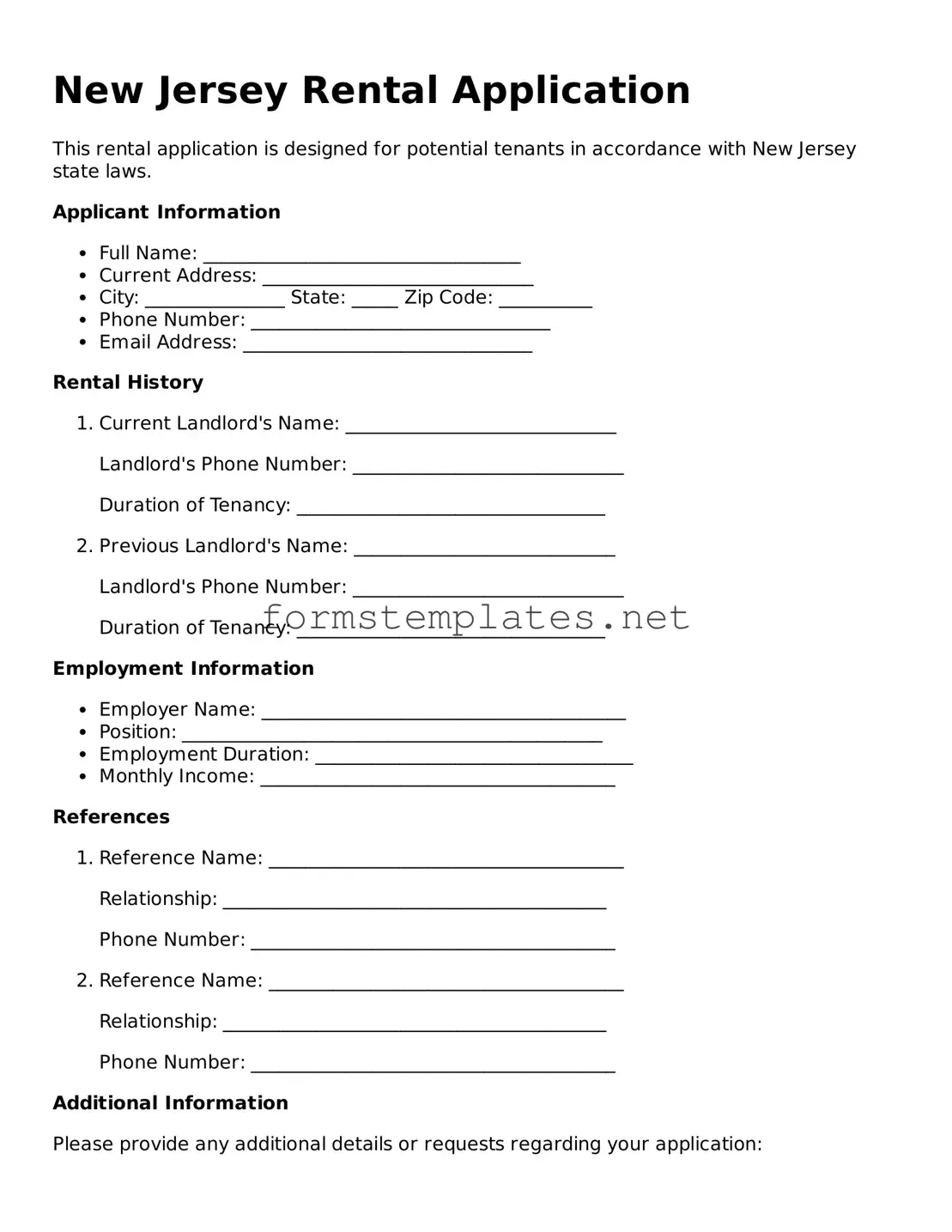

The New Jersey Rental Application form serves as a tool for landlords to screen potential tenants. By collecting essential information, landlords can assess the suitability of applicants based on their financial history, rental history, and personal references. This helps ensure that the selected tenant is responsible and reliable, ultimately protecting the landlord's investment.

When filling out the New Jersey Rental Application, applicants can expect to provide a variety of personal and financial details. Commonly required information includes:

-

Full name and contact information

-

Social Security number

-

Employment history, including current employer and income

-

Rental history, including previous addresses and landlord contact information

-

References, both personal and professional

Additionally, applicants may be asked to consent to a background and credit check, which helps landlords evaluate financial responsibility.

How does the application process work?

The application process typically unfolds in several steps. First, an interested tenant completes the rental application form and submits it to the landlord or property management company. After submission, the landlord reviews the application, which may include verifying the provided information through background checks and contacting references. Once the review is complete, the landlord will inform the applicant of their decision, which could result in approval, denial, or a request for additional information.

What are the fees associated with the rental application?

Many landlords charge an application fee to cover the costs of processing the application and conducting background checks. In New Jersey, the maximum fee cannot exceed $50. This fee is typically non-refundable, even if the application is denied. It is important for applicants to confirm the exact fee with the landlord before submitting their application.

Can an applicant be denied based on their rental application?

Yes, an applicant can be denied for various reasons. Common grounds for denial include:

-

Poor credit history

-

Insufficient income to meet rent obligations

-

Negative rental history, such as evictions or late payments

-

False information provided on the application

Landlords are required to follow fair housing laws and cannot deny an application based on discriminatory reasons, such as race, gender, or familial status. If an application is denied, landlords must provide a reason, and applicants have the right to request a copy of their credit report if it was a factor in the decision.