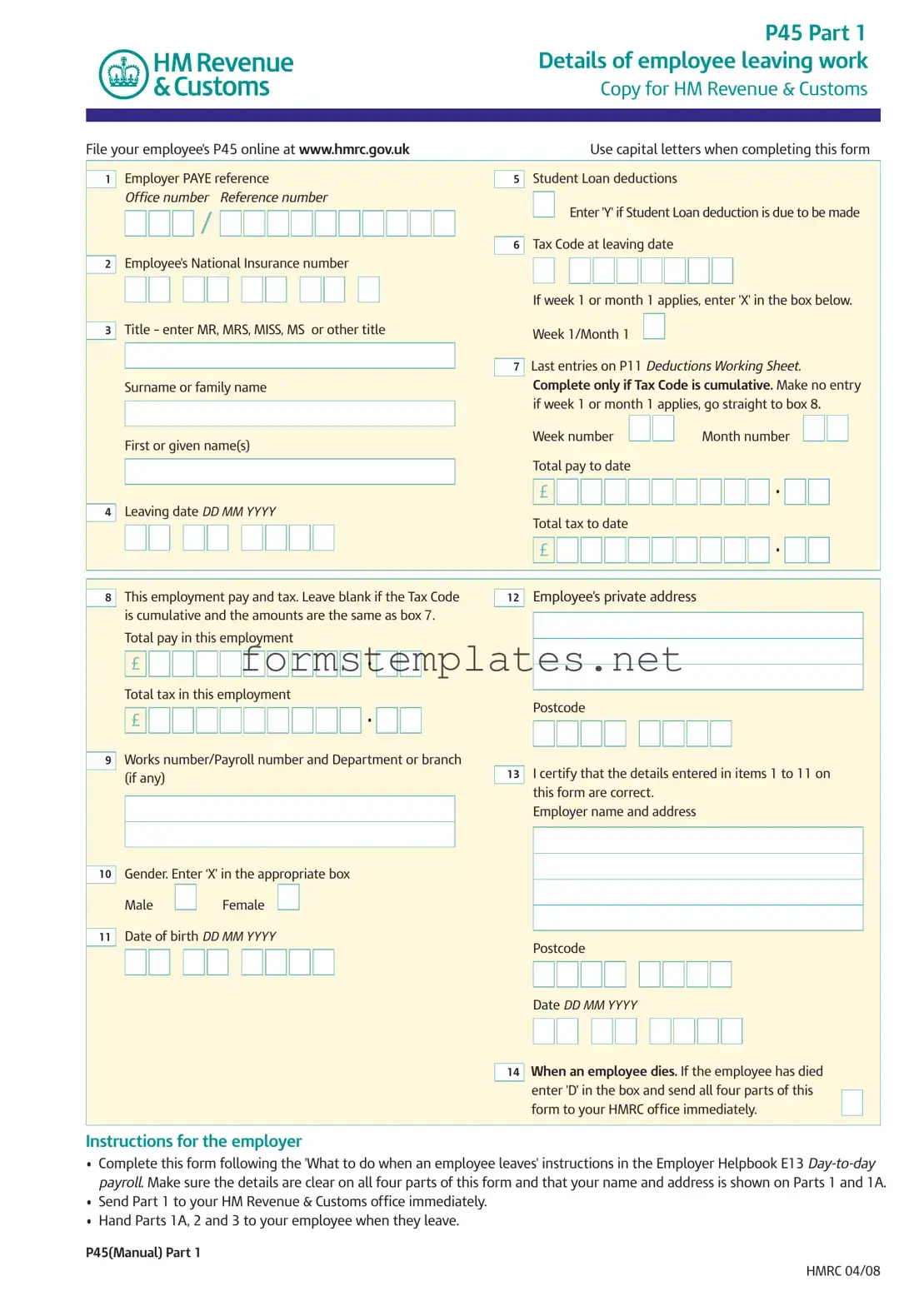

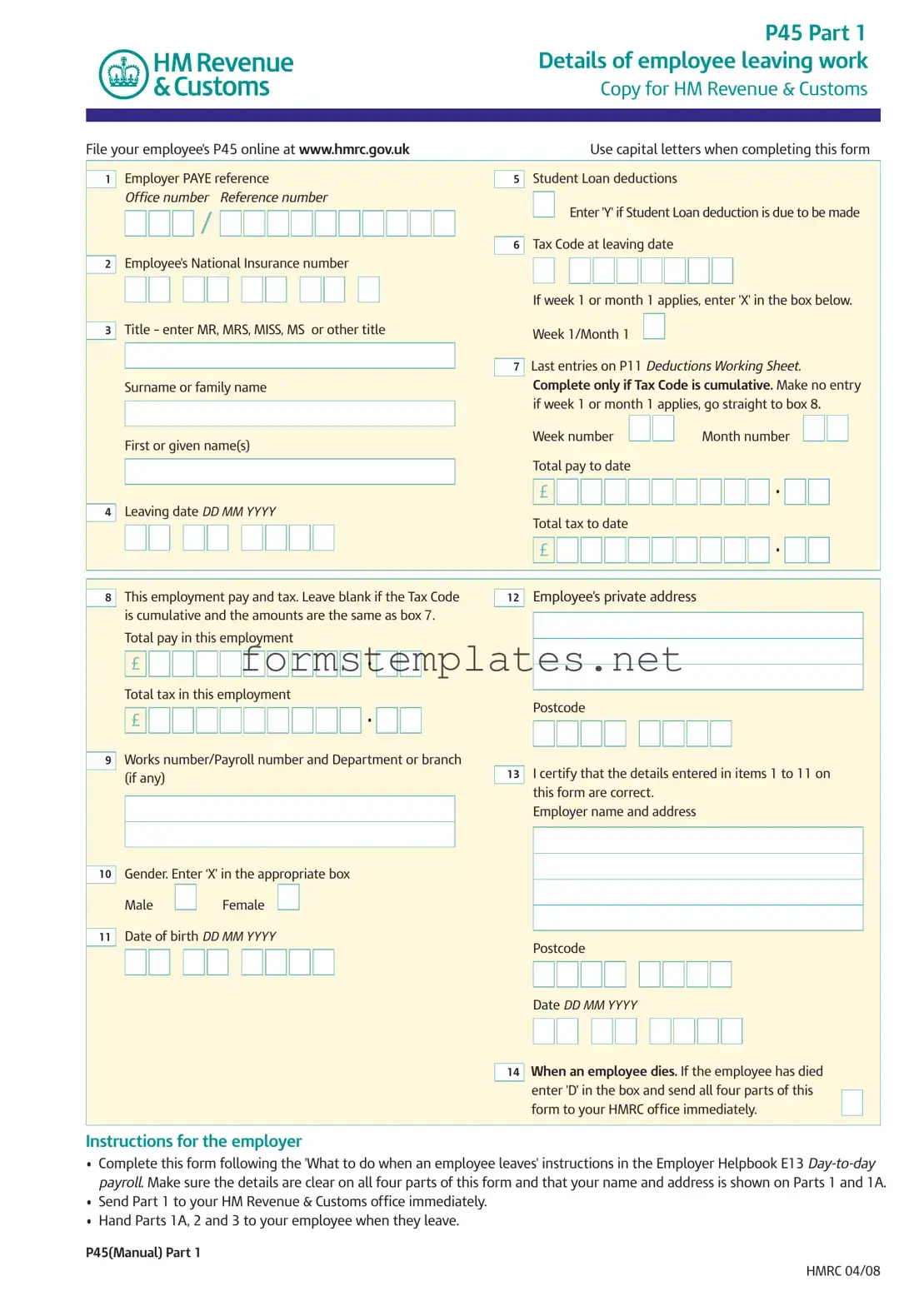

Free P 45 It Template

The P45 IT form is an essential document that an employer provides to an employee when they leave a job. This form outlines important information regarding the employee's tax and pay details, which is crucial for both the employee's future employment and tax obligations. Understanding how to correctly complete and utilize the P45 can help ensure a smooth transition to new employment or benefits.

Open Editor Now

Free P 45 It Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize P 45 It online — simple edits, saving, and download.

/

/

•

•

•

•

/

/

•

•