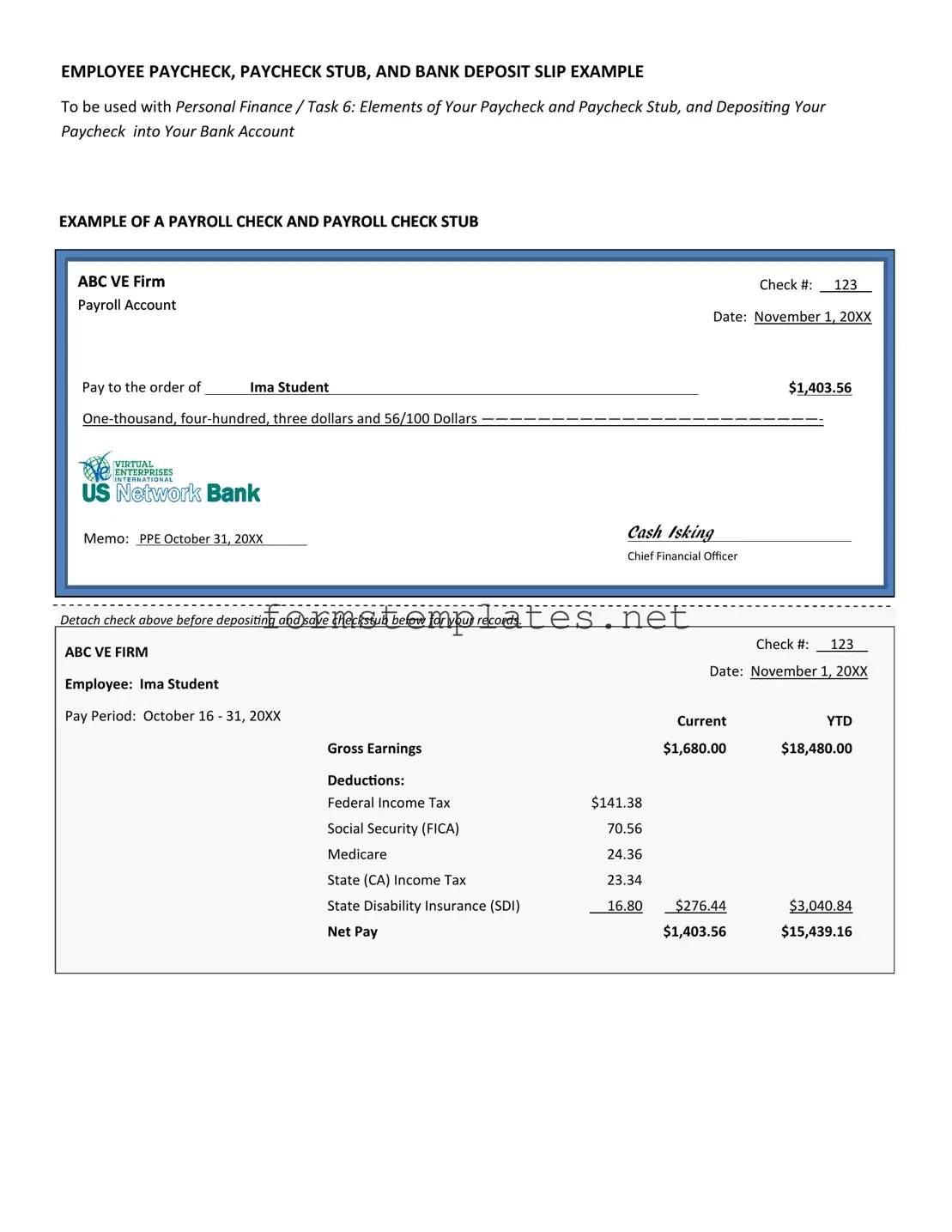

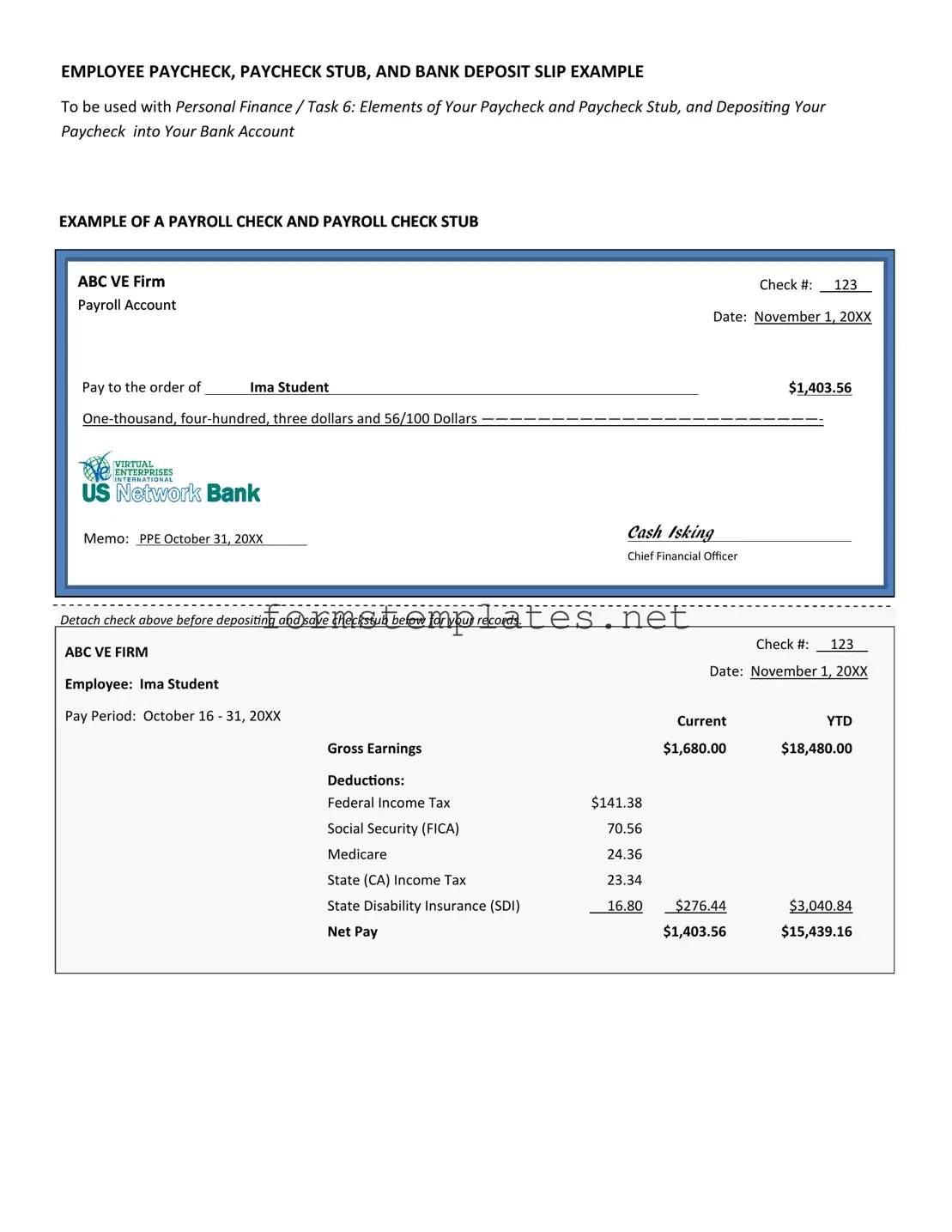

A Payroll Check form is a document used by employers to authorize the payment of wages to employees. It typically includes essential details such as the employee's name, the amount to be paid, the pay period, and the employer's signature. This form serves as a record of the payment and ensures that employees are compensated for their work in a timely manner.

Generally, the Payroll Check form needs to be filled out by the employer or payroll administrator. However, employees may need to provide certain information, such as their name, Social Security number, and hours worked, to ensure accurate payment. In some cases, employees may also be required to sign the form to confirm receipt of payment.

The Payroll Check form typically requires the following information:

-

Employee's full name

-

Employee's Social Security number

-

Pay period dates

-

Gross wages

-

Deductions (taxes, benefits, etc.)

-

Net pay amount

-

Employer's signature

Including accurate details ensures that employees receive the correct payment and that the employer maintains proper records for tax purposes.

The frequency of issuing Payroll Check forms depends on the employer's payroll schedule. Common payroll cycles include weekly, bi-weekly, and monthly. Employers should adhere to their established schedule to ensure employees receive their wages consistently and on time.

If you notice an error on your Payroll Check form, it is important to address it promptly. Start by notifying your employer or payroll department about the mistake. They will likely require you to provide details about the error, and they may need to issue a corrected check or make adjustments in the payroll system. Always keep records of your communications regarding the issue for your own reference.

While Payroll Check forms are primarily associated with paper checks, they can also be adapted for use with direct deposit. Employers may provide a similar form that includes the necessary information for electronic payments, such as the employee's bank account details. However, it is crucial to ensure that all information is accurate to avoid any issues with direct deposits.

If you lose your Payroll Check form, you should inform your employer immediately. They can provide a replacement or issue a new check if necessary. It's advisable to keep a record of all paychecks and forms received, as this can help in resolving any discrepancies or issues that may arise in the future.

Payroll Check forms are generally required for all employees who receive wages through the payroll system. However, specific requirements may vary based on the employer's policies, the nature of employment, and applicable state or federal laws. It's best to consult with your employer or human resources department to understand the requirements that apply to your situation.

Employers should retain Payroll Check forms for a minimum of three years, as this is often the standard for tax purposes. However, some states may have different regulations regarding record retention. Keeping these records helps ensure compliance with labor laws and provides a reference in case of disputes or audits.