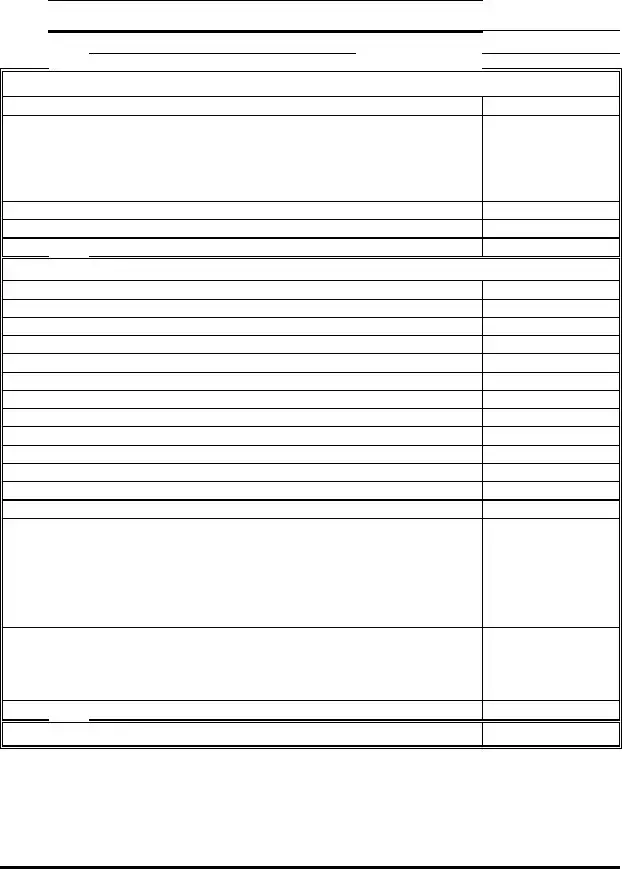

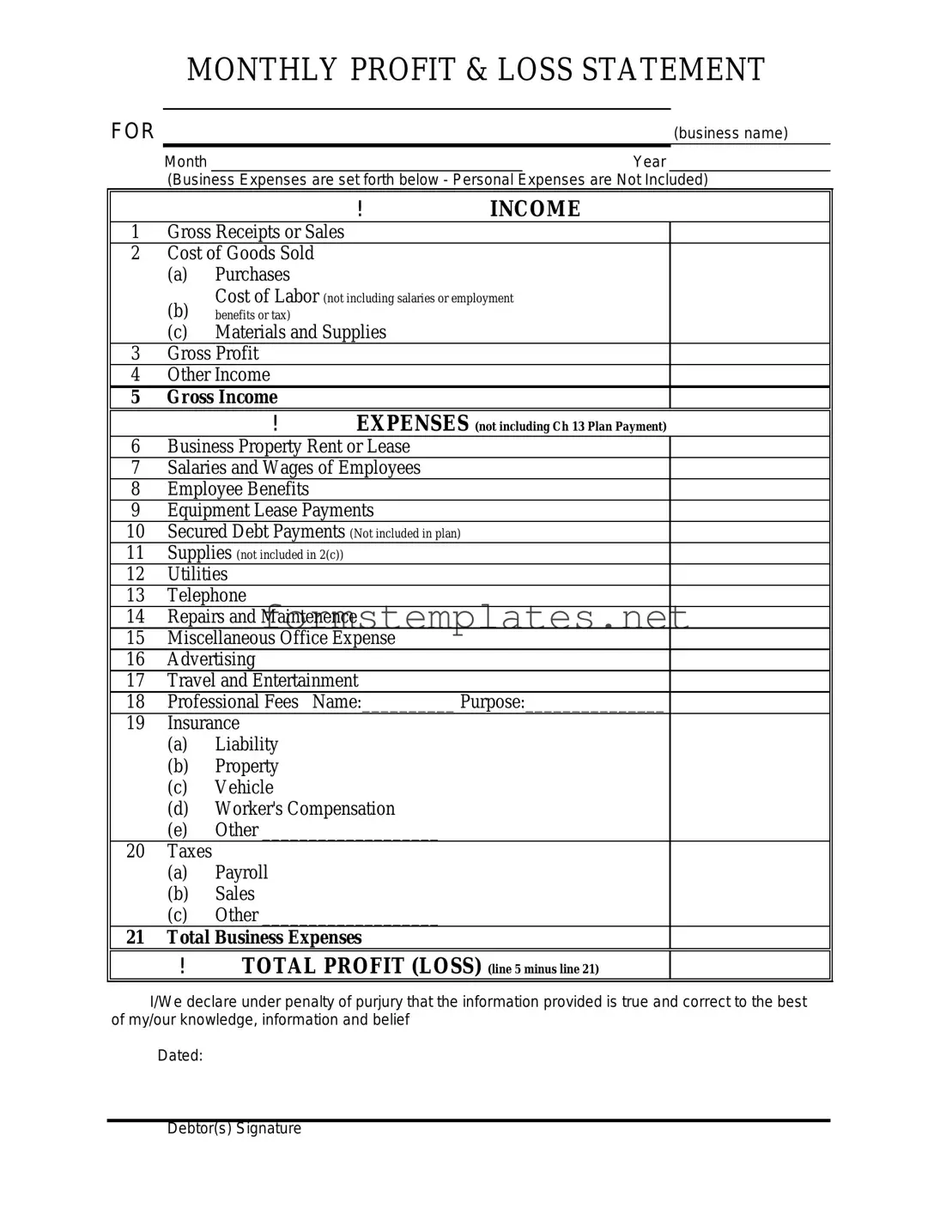

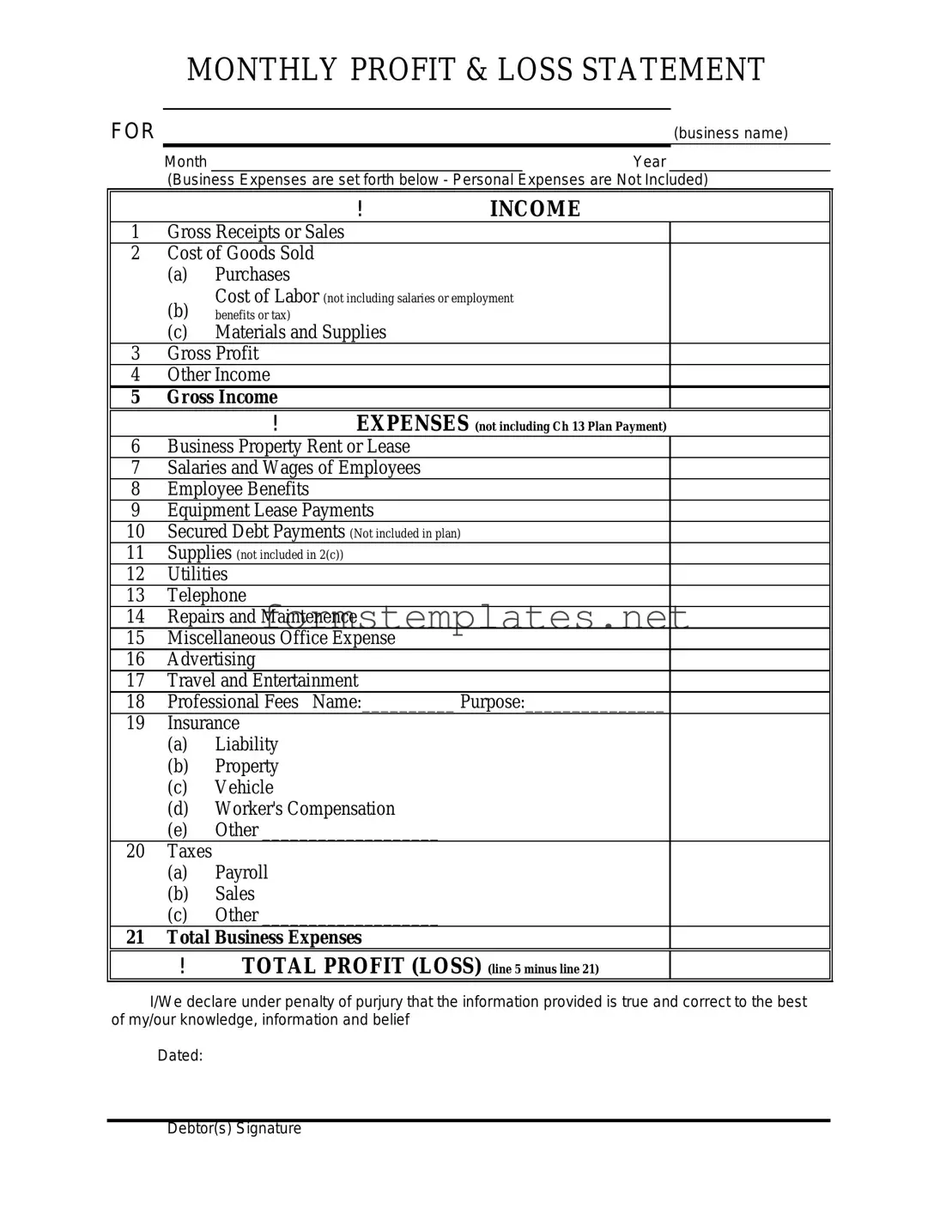

Free Profit And Loss Template

The Profit and Loss form is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period. This essential document helps businesses assess their financial performance, enabling them to make informed decisions. Understanding how to read and utilize this form can significantly impact a company's strategic planning and overall success.

Open Editor Now

Free Profit And Loss Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Profit And Loss online — simple edits, saving, and download.