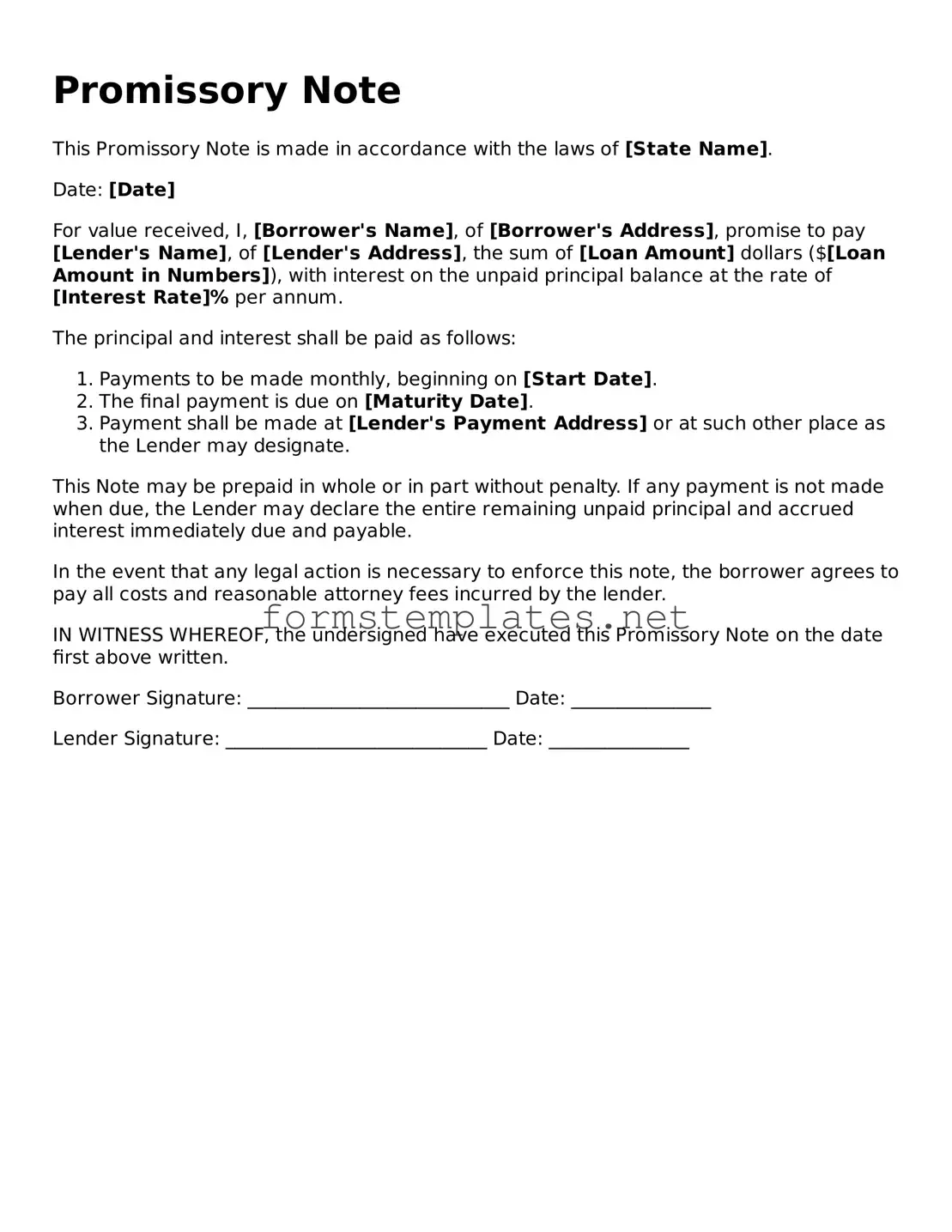

Attorney-Verified Promissory Note Form

A Promissory Note is a legal document that outlines a promise to pay a specific amount of money to a designated person or entity at a defined time. This form serves as a written record of the debt and the terms of repayment. Understanding the components of a Promissory Note is essential for both borrowers and lenders to ensure clarity and enforceability in financial agreements.

Open Editor Now

Attorney-Verified Promissory Note Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Promissory Note online — simple edits, saving, and download.