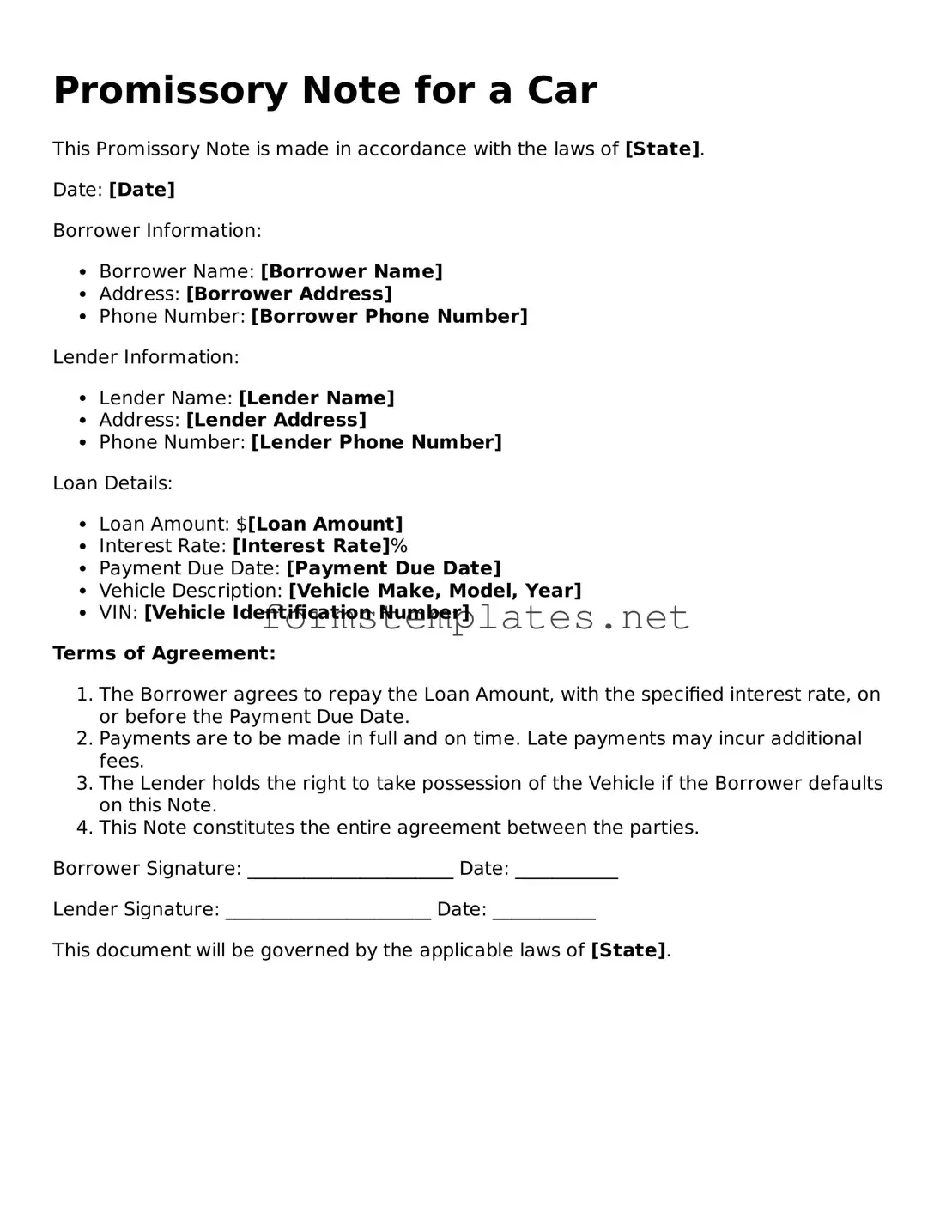

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines a borrower's promise to repay a loan used to purchase a vehicle. This note includes important details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a formal agreement between the lender and the borrower, ensuring both parties understand their rights and obligations.

Who typically uses a Promissory Note for a Car?

Promissory Notes for cars are commonly used by individuals who are financing a vehicle purchase. This includes private sellers, dealerships, or financial institutions. Whether you are buying a car from a friend or a dealership, having a written agreement helps protect both the buyer and the seller.

To ensure clarity and enforceability, a Promissory Note for a Car should include the following information:

-

Names of the parties:

Full names of the borrower and lender.

-

Loan amount:

The total amount borrowed to purchase the vehicle.

-

Interest rate:

The percentage charged on the loan amount.

-

Repayment terms:

The schedule for payments, including due dates and amounts.

-

Collateral:

Details about the vehicle being financed, including make, model, year, and VIN.

-

Default terms:

Conditions that would constitute a default and the consequences.

What happens if I default on the Promissory Note?

If a borrower defaults on the Promissory Note, the lender has the right to take specific actions. These may include:

-

Charging late fees as specified in the agreement.

-

Taking possession of the vehicle if it serves as collateral.

-

Reporting the default to credit bureaus, which can affect the borrower's credit score.

It’s crucial to communicate with the lender if you foresee any difficulties in making payments to explore possible solutions.

Can I modify the terms of the Promissory Note after it is signed?

Yes, it is possible to modify the terms of a Promissory Note after it has been signed, but both parties must agree to the changes. It’s advisable to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It creates an enforceable obligation for the borrower to repay the loan as outlined in the document. However, for the note to be valid, it must meet certain legal requirements, such as being signed by both parties and containing clear terms.

Do I need a lawyer to create a Promissory Note for a Car?

While it is not strictly necessary to have a lawyer draft a Promissory Note, consulting with one can be beneficial, especially if you have concerns about the terms or want to ensure that the document complies with state laws. Many templates are available online, but personalized legal advice can provide peace of mind and help avoid potential issues down the road.