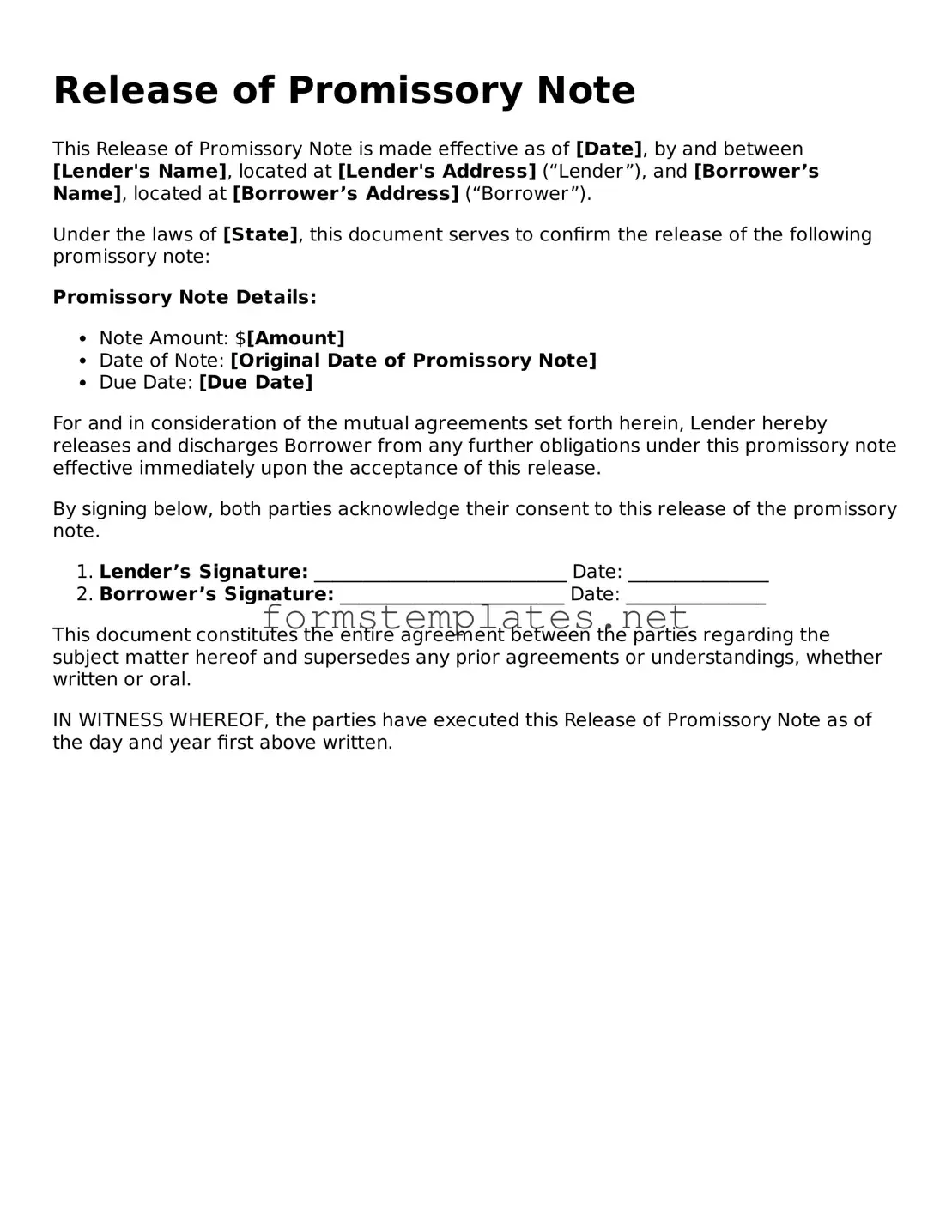

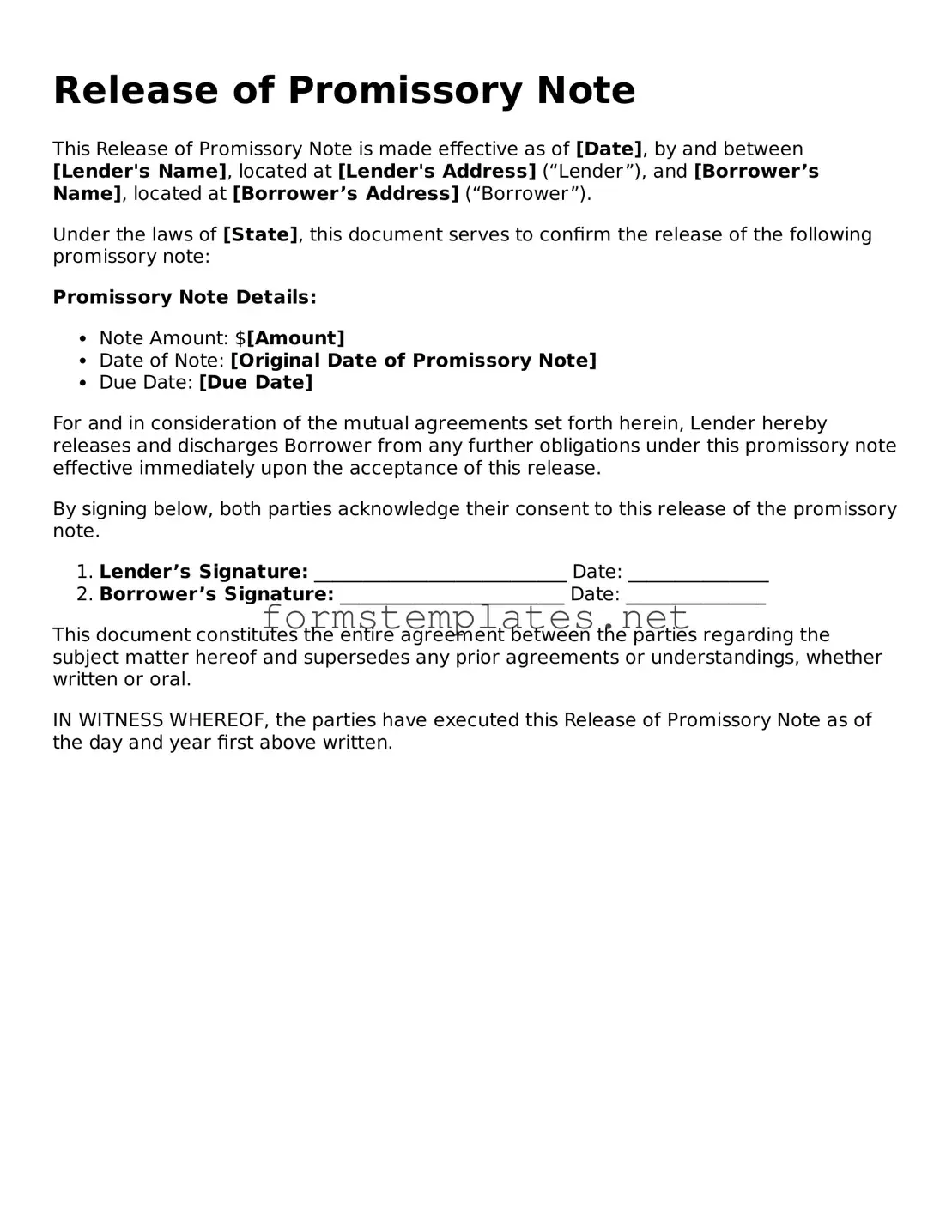

What is a Release of Promissory Note?

A Release of Promissory Note is a legal document that formally acknowledges the repayment of a loan or debt. It signifies that the borrower has fulfilled their obligation to the lender, and the lender releases any claim to the debt. This document is important for both parties as it provides proof that the debt has been settled.

Why is a Release of Promissory Note important?

This document protects both the borrower and the lender. For the borrower, it serves as evidence that the debt has been paid off, preventing any future claims for payment. For the lender, it officially closes the transaction and removes any liability associated with the promissory note.

Who should sign the Release of Promissory Note?

Both the borrower and the lender must sign the Release of Promissory Note. Their signatures confirm that both parties agree the debt has been settled. If there are multiple borrowers or lenders, all parties involved should sign the document.

When should I use a Release of Promissory Note?

A Release of Promissory Note should be used once the borrower has fully repaid the loan. It is essential to complete this document promptly to avoid any confusion or disputes in the future regarding the status of the debt.

The document typically includes:

-

The names and addresses of the borrower and lender.

-

The date of the original promissory note.

-

The amount of the loan.

-

A statement confirming that the loan has been paid in full.

-

Signatures of both parties.

Can I create my own Release of Promissory Note?

Yes, you can create your own Release of Promissory Note. However, it is advisable to ensure that all necessary information is included and that the document complies with local laws. Using a template or seeking assistance from a legal professional may help avoid potential issues.

What happens if I don’t obtain a Release of Promissory Note?

If you do not obtain a Release of Promissory Note after repaying a debt, the lender may still claim that the debt is outstanding. This could lead to disputes or even legal action. It is crucial to secure this document to protect your financial interests.

Is there a fee associated with obtaining a Release of Promissory Note?

Typically, there is no fee for the document itself if both parties agree to create one. However, if you choose to have a legal professional prepare it, there may be associated costs. Always clarify any fees before proceeding.

How should I store the Release of Promissory Note?

Once signed, the Release of Promissory Note should be stored in a safe place. Both parties should keep a copy for their records. Digital copies can also be useful, but ensure they are backed up securely.

What if the lender refuses to sign the Release of Promissory Note?

If the lender refuses to sign the Release of Promissory Note despite full repayment, you may need to gather evidence of payment, such as bank statements or receipts. Legal advice may be necessary to resolve the situation and ensure your rights are protected.