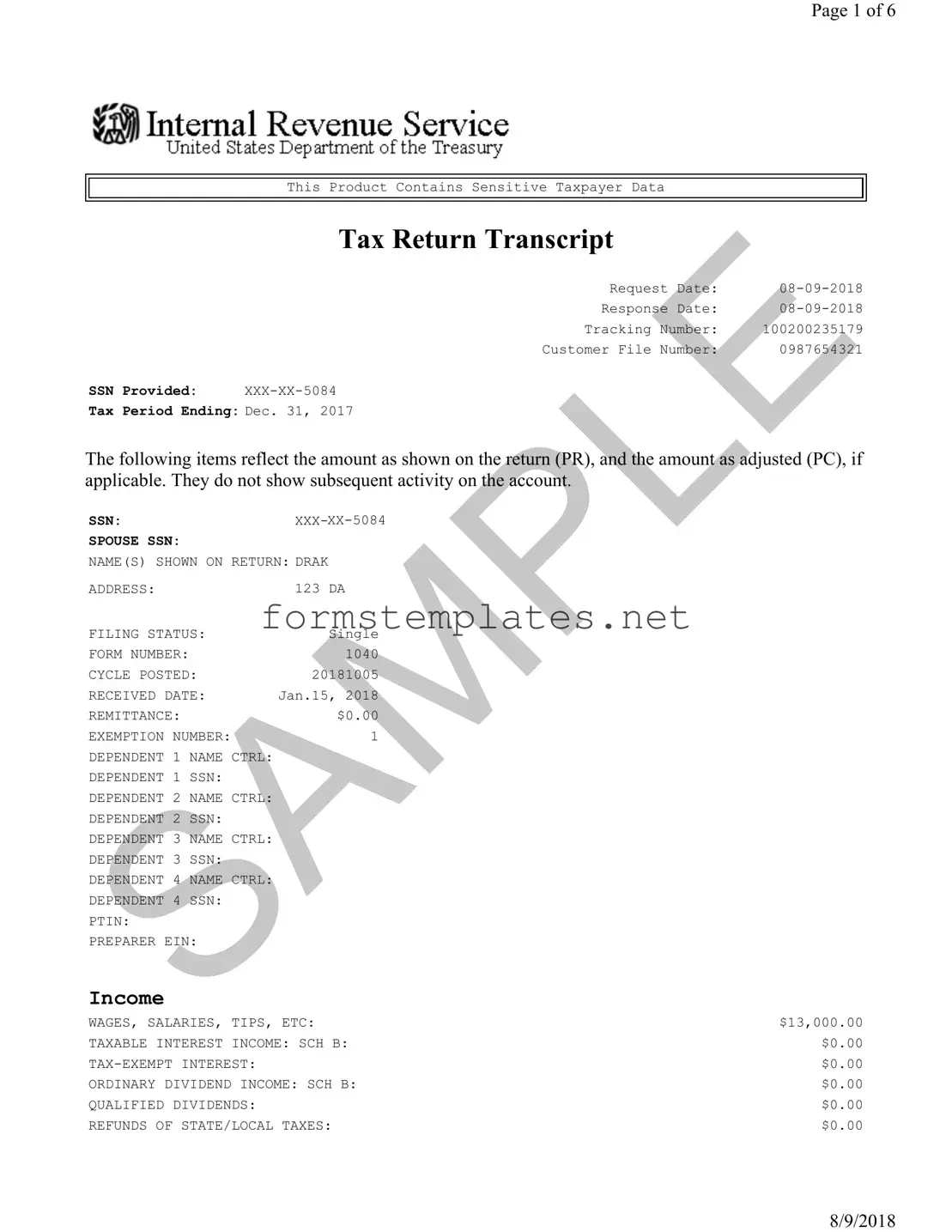

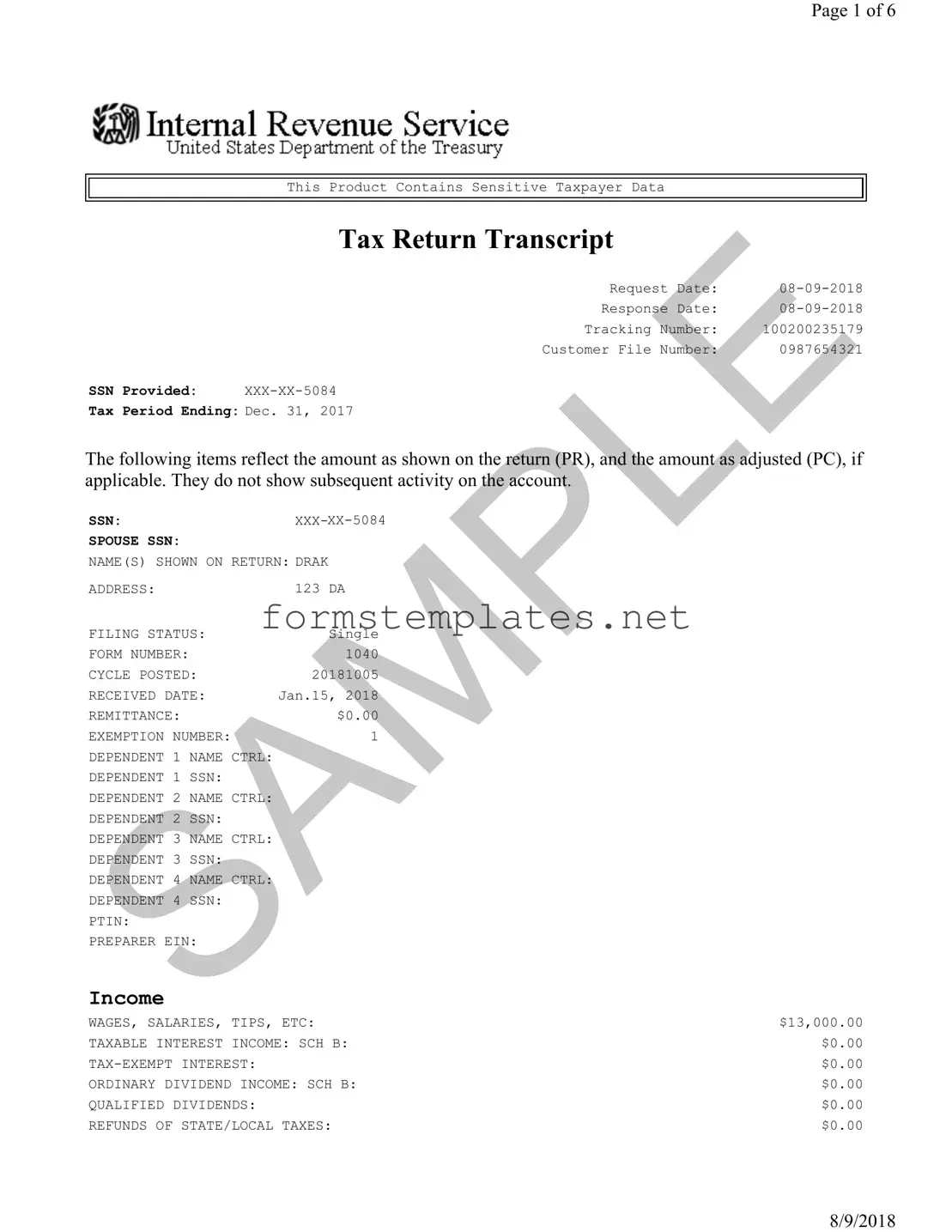

What is a Sample Tax Return Transcript?

A Sample Tax Return Transcript is a document that provides a summary of your tax return information as filed with the IRS. It includes key details such as income, tax liabilities, and credits. This document is often used for verifying income when applying for loans or financial aid.

How can I obtain a Sample Tax Return Transcript?

You can request a Sample Tax Return Transcript from the IRS through several methods. The easiest way is to use the IRS online tool, "Get Transcript." Alternatively, you can request a transcript by mail or by calling the IRS directly. Be prepared to provide your Social Security number, date of birth, and other identifying information.

The transcript includes various details such as:

-

Your name and Social Security number

-

Your filing status

-

Income details, including wages and business income

-

Adjustments to income

-

Tax deductions and credits

-

Total tax liability

-

Payments made and any refund or amount owed

This information reflects what was reported on your tax return, as well as any adjustments made by the IRS.

What is the difference between a Tax Return Transcript and a Tax Account Transcript?

A Tax Return Transcript provides a summary of your tax return as filed, while a Tax Account Transcript contains more detailed information about your account, including any changes made after the return was filed. The Account Transcript includes payment history, adjustments, and other account-related information.

Is the Sample Tax Return Transcript considered an official document?

Yes, the Sample Tax Return Transcript is considered an official document issued by the IRS. It can be used to verify income and tax information for various purposes, such as applying for loans, financial aid, or government assistance programs.

How long does it take to receive a Sample Tax Return Transcript?

If you request your transcript online, you can typically access it immediately. For requests made by mail, it usually takes about 5 to 10 business days for the IRS to process and send the transcript. Delays may occur during peak tax season.

Can I use the Sample Tax Return Transcript for tax filing purposes?

No, the Sample Tax Return Transcript is not suitable for filing your taxes. It is a summary of your past tax returns and does not contain all the necessary forms or detailed information required for tax filing. For filing, you should use your complete tax return and any relevant forms.

What should I do if I notice an error on my transcript?

If you find an error on your Sample Tax Return Transcript, you should contact the IRS as soon as possible. They can assist you in correcting any discrepancies. It may be necessary to provide documentation or further information to resolve the issue.

How does the Sample Tax Return Transcript affect my credit?

The Sample Tax Return Transcript itself does not directly affect your credit score. However, lenders may use the information within the transcript to assess your financial situation when making lending decisions. Accurate income verification can positively influence your ability to secure loans or credit.