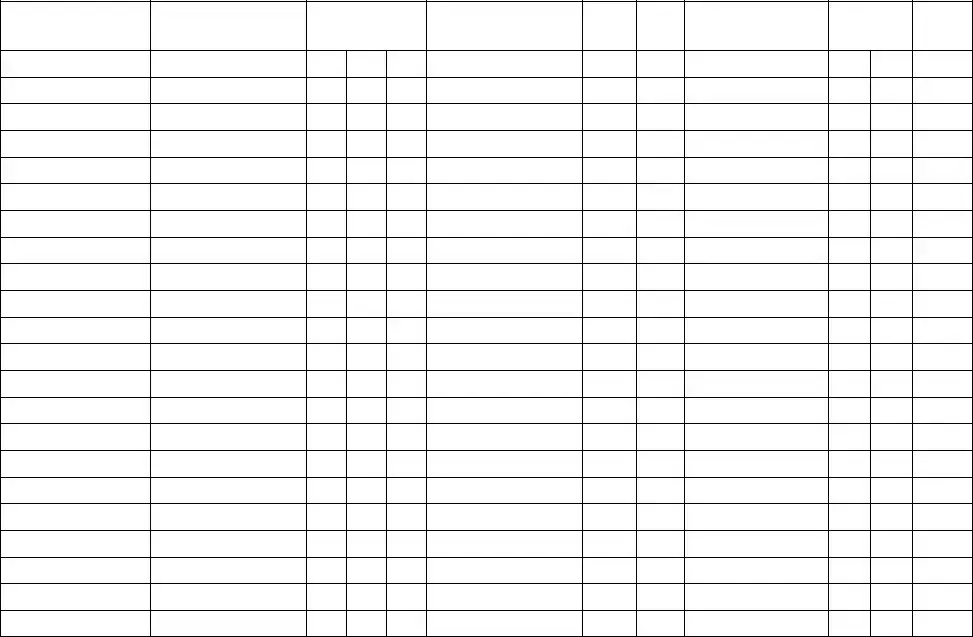

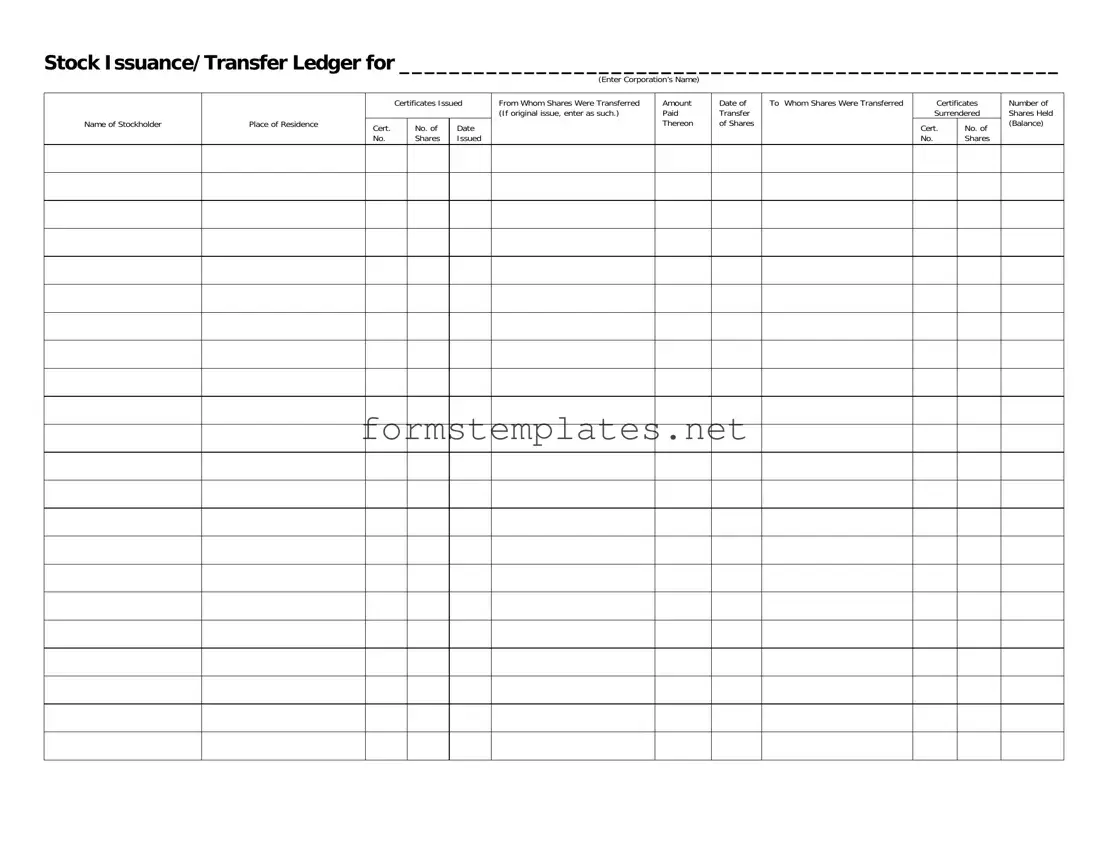

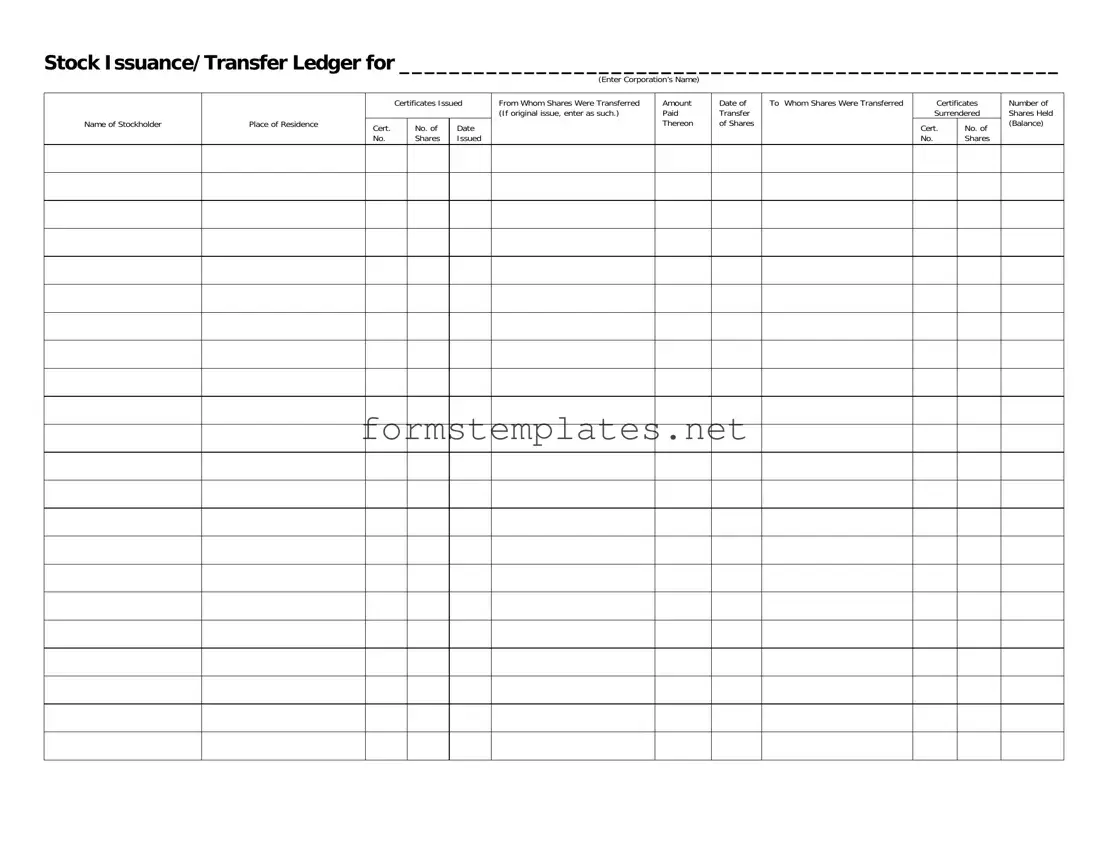

Free Stock Transfer Ledger Template

The Stock Transfer Ledger form is a crucial document used to track the issuance and transfer of shares within a corporation. This form records essential details such as the stockholder's name, the number of shares issued, and the dates of transfer. Maintaining an accurate ledger is vital for ensuring transparency and compliance with corporate regulations.

Open Editor Now

Free Stock Transfer Ledger Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Stock Transfer Ledger online — simple edits, saving, and download.