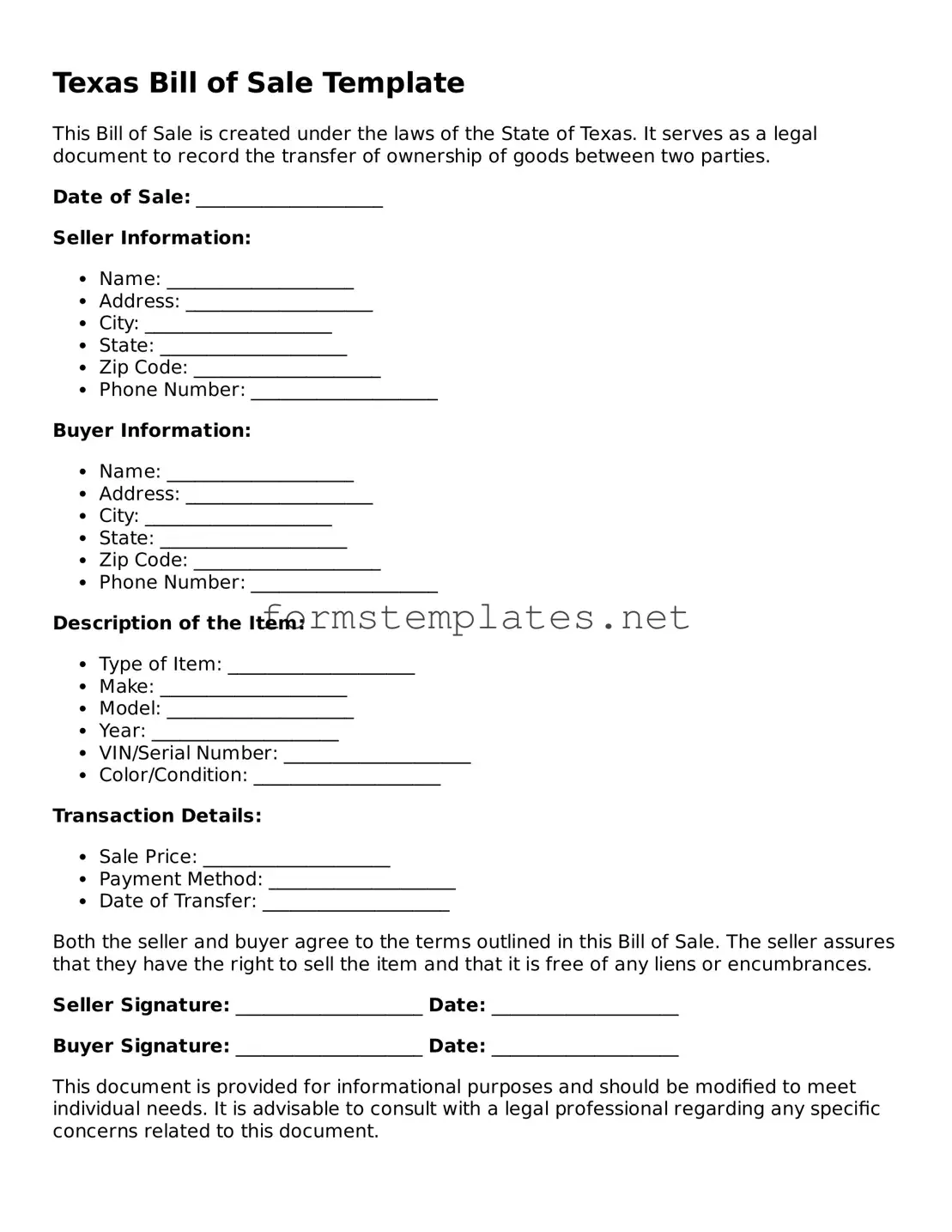

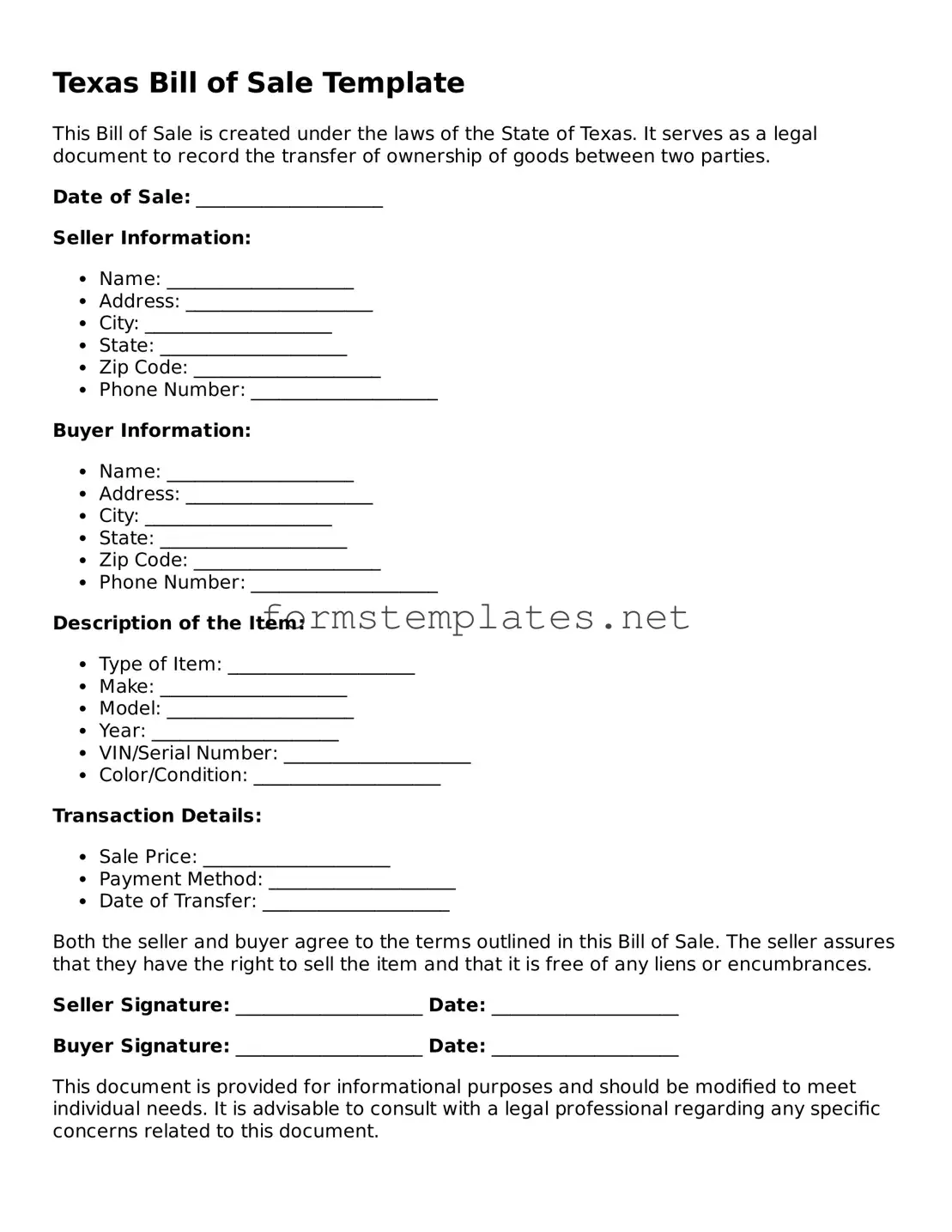

Attorney-Approved Texas Bill of Sale Template

The Texas Bill of Sale form is a legal document used to transfer ownership of personal property from one party to another. This form serves as a receipt for the transaction and provides essential details about the buyer, seller, and the item being sold. Understanding the importance of this document can help ensure a smooth transfer of ownership and protect the interests of both parties involved.

Open Editor Now

Attorney-Approved Texas Bill of Sale Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Bill of Sale online — simple edits, saving, and download.