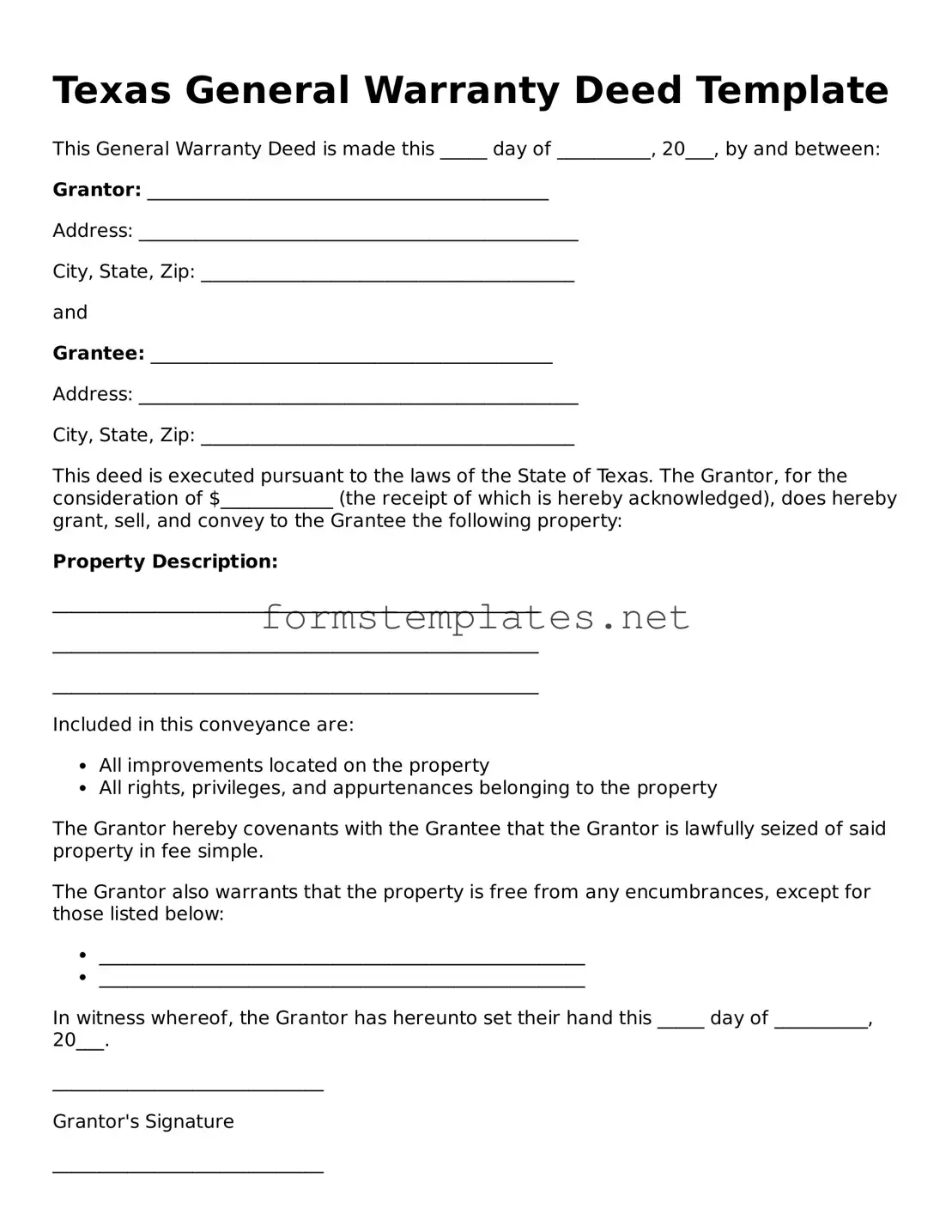

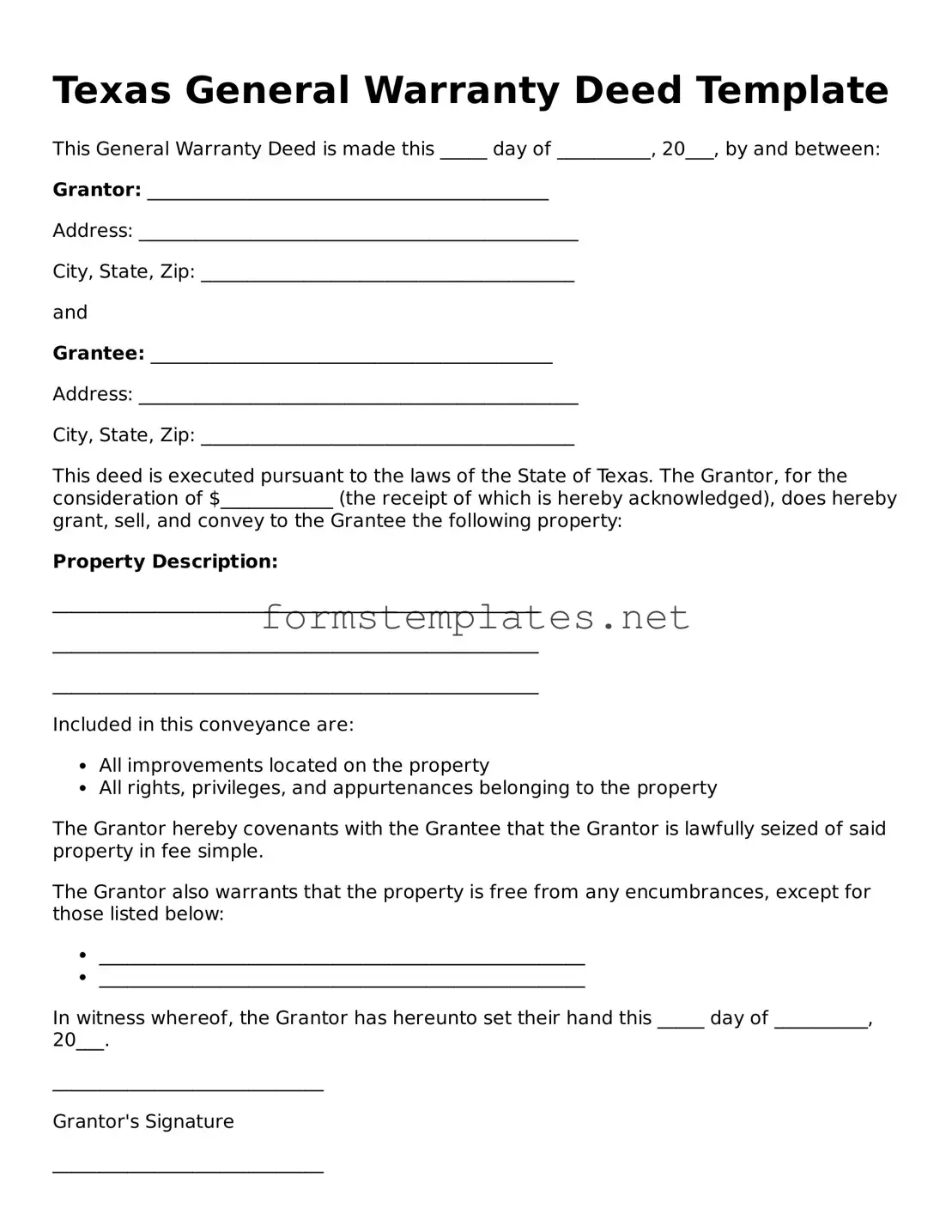

Texas General Warranty Deed Template

This General Warranty Deed is made this _____ day of __________, 20___, by and between:

Grantor: ___________________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

and

Grantee: ___________________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

This deed is executed pursuant to the laws of the State of Texas. The Grantor, for the consideration of $____________ (the receipt of which is hereby acknowledged), does hereby grant, sell, and convey to the Grantee the following property:

Property Description:

____________________________________________________

____________________________________________________

____________________________________________________

Included in this conveyance are:

- All improvements located on the property

- All rights, privileges, and appurtenances belonging to the property

The Grantor hereby covenants with the Grantee that the Grantor is lawfully seized of said property in fee simple.

The Grantor also warrants that the property is free from any encumbrances, except for those listed below:

- ____________________________________________________

- ____________________________________________________

In witness whereof, the Grantor has hereunto set their hand this _____ day of __________, 20___.

_____________________________

Grantor's Signature

_____________________________

Grantor's Printed Name

_____________________________

Grantee's Signature

_____________________________

Grantee's Printed Name

STATE OF TEXAS

COUNTY OF ______________________

Before me, the undersigned authority, on this _____ day of __________, 20___, personally appeared ____________________________________, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office, this the _____ day of __________, 20___.

_____________________________

Notary Public, State of Texas

My commission expires: _____________________________