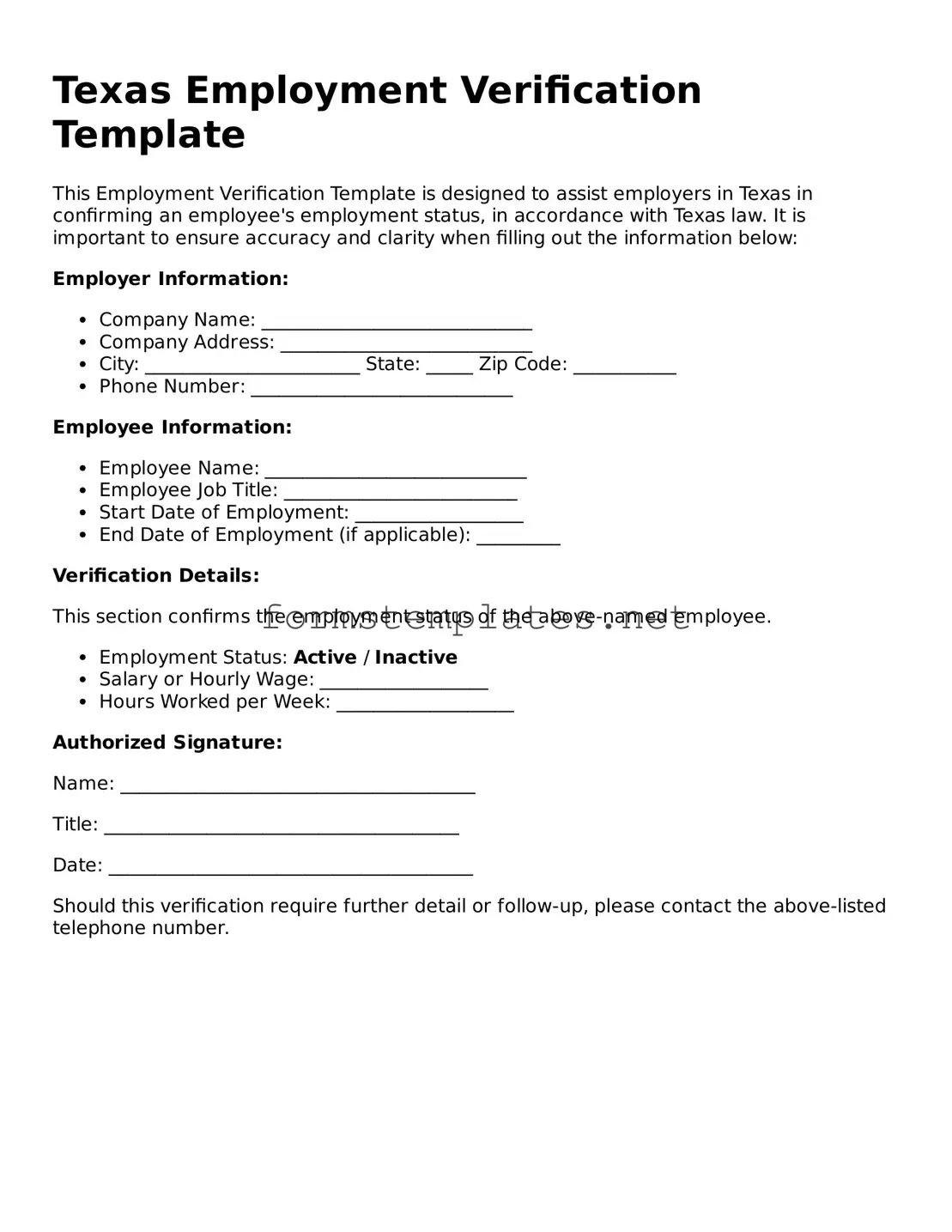

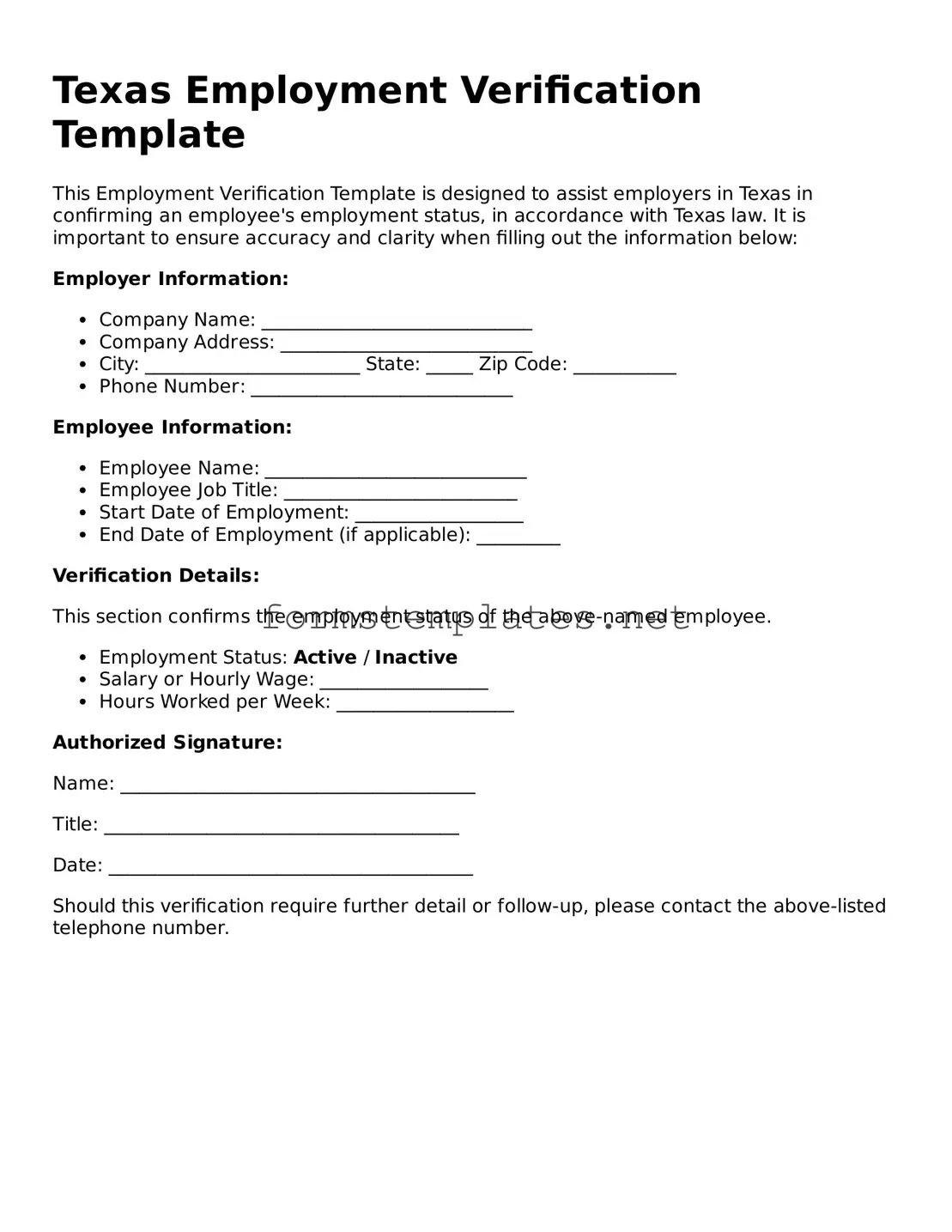

Attorney-Approved Texas Employment Verification Template

The Texas Employment Verification form is a document used by employers to confirm an employee's work history and current employment status. This form plays a crucial role in various situations, such as loan applications or rental agreements, where proof of employment is necessary. Understanding how to properly complete and submit this form can help streamline the verification process for both employees and employers.

Open Editor Now

Attorney-Approved Texas Employment Verification Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Employment Verification online — simple edits, saving, and download.