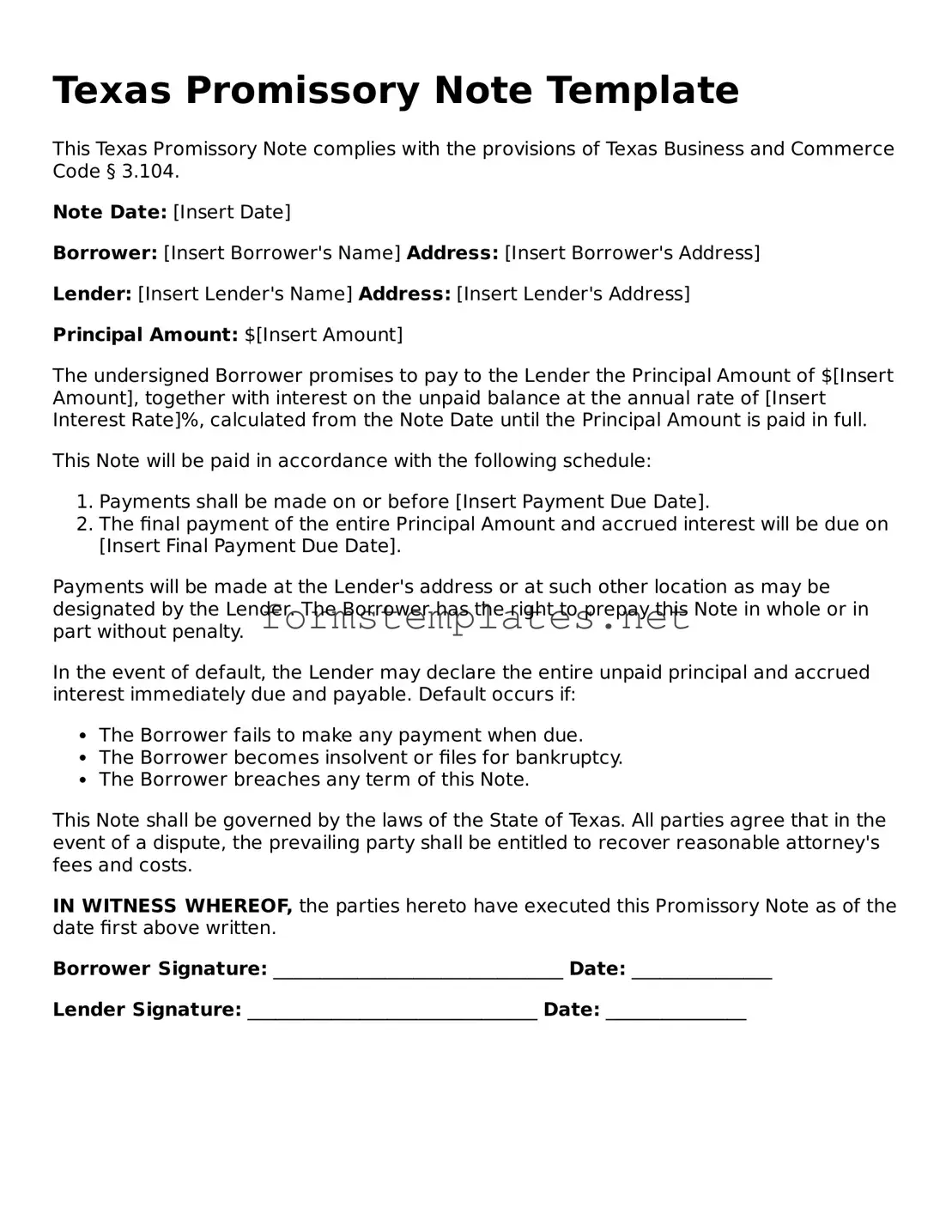

Attorney-Approved Texas Promissory Note Template

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a loan under specified terms. This form serves as a crucial tool for both lenders and borrowers, ensuring clarity and accountability in financial transactions. Understanding its components can help parties navigate their rights and obligations effectively.

Open Editor Now

Attorney-Approved Texas Promissory Note Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Promissory Note online — simple edits, saving, and download.