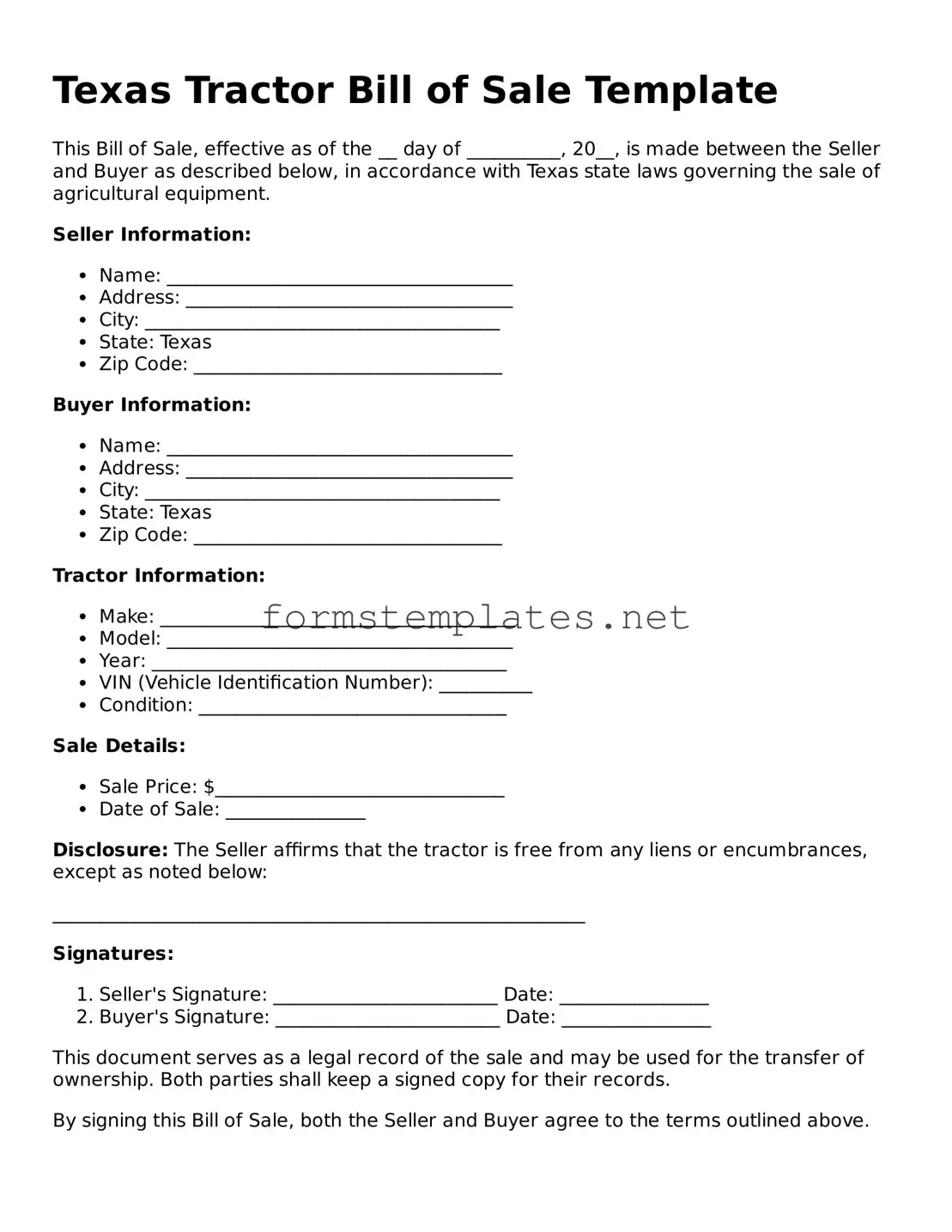

Attorney-Approved Texas Tractor Bill of Sale Template

A Texas Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor in Texas. This form is essential for both buyers and sellers, ensuring that the transaction is documented properly. Having a completed bill of sale protects both parties and provides proof of ownership.

Open Editor Now

Attorney-Approved Texas Tractor Bill of Sale Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Tractor Bill of Sale online — simple edits, saving, and download.