Attorney-Verified Tractor Bill of Sale Form

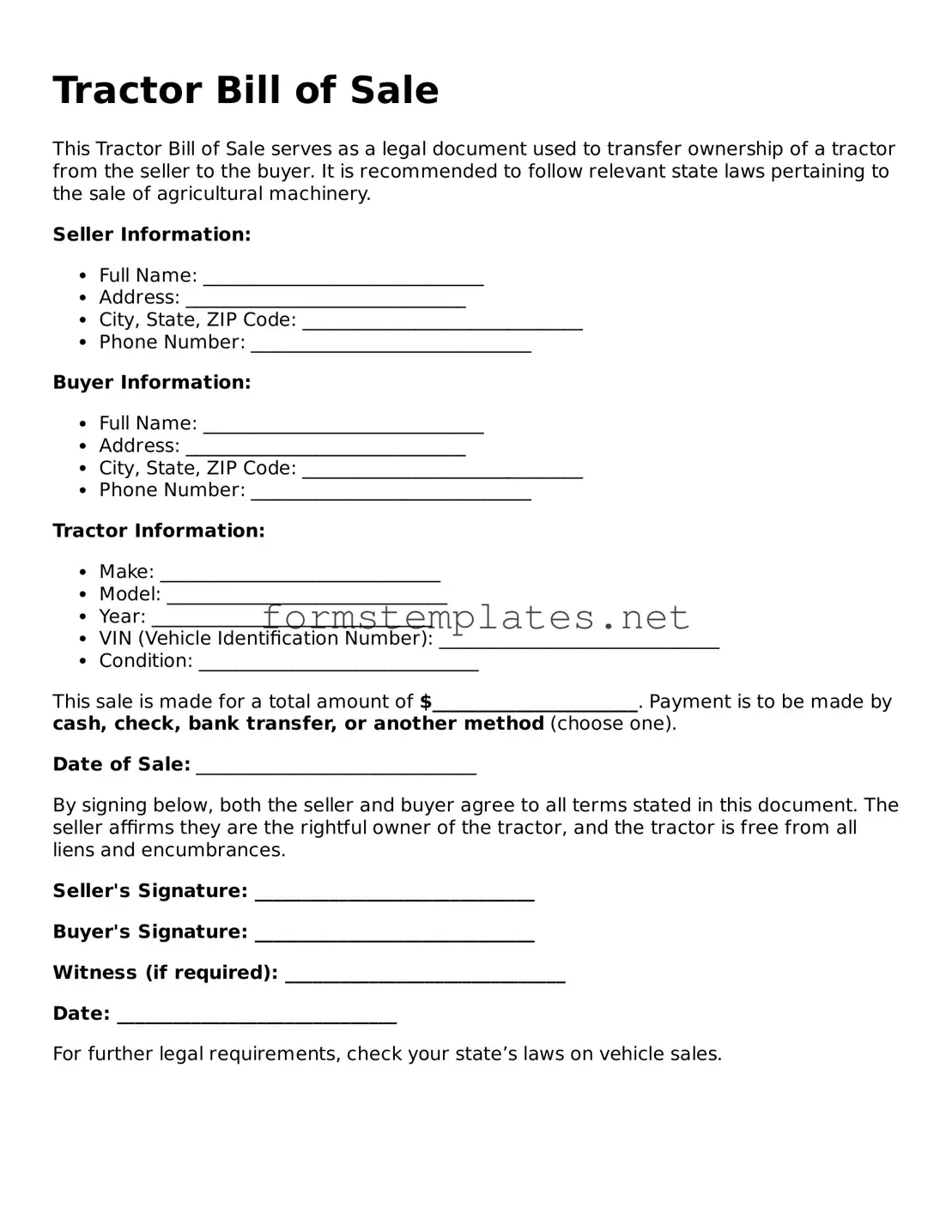

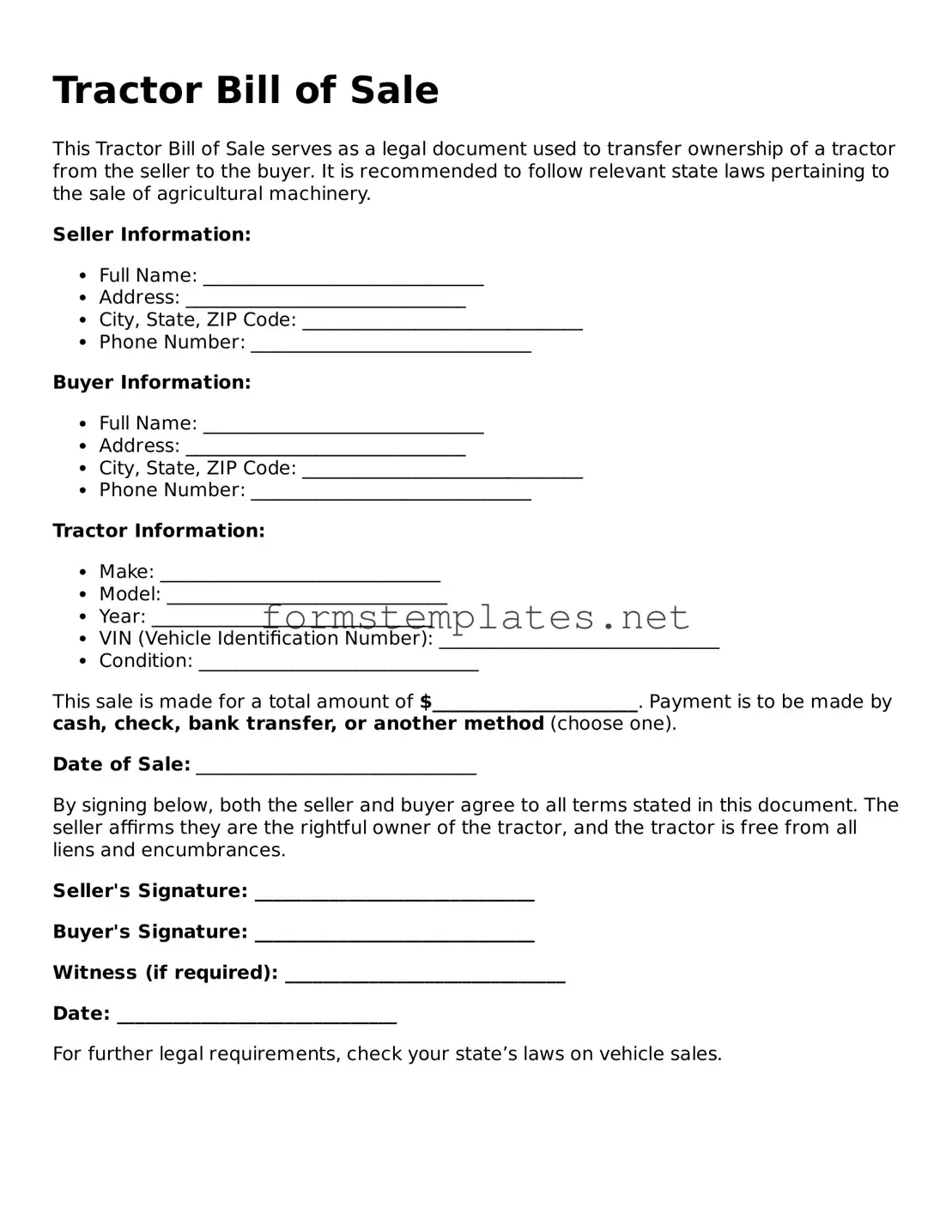

A Tractor Bill of Sale is a legal document that records the sale and transfer of ownership of a tractor from one party to another. This form includes essential details such as the buyer's and seller's information, the tractor's description, and the sale price. Having a properly completed bill of sale is crucial for both parties to ensure a smooth transaction and to protect their rights.

Open Editor Now

Attorney-Verified Tractor Bill of Sale Form

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Tractor Bill of Sale online — simple edits, saving, and download.