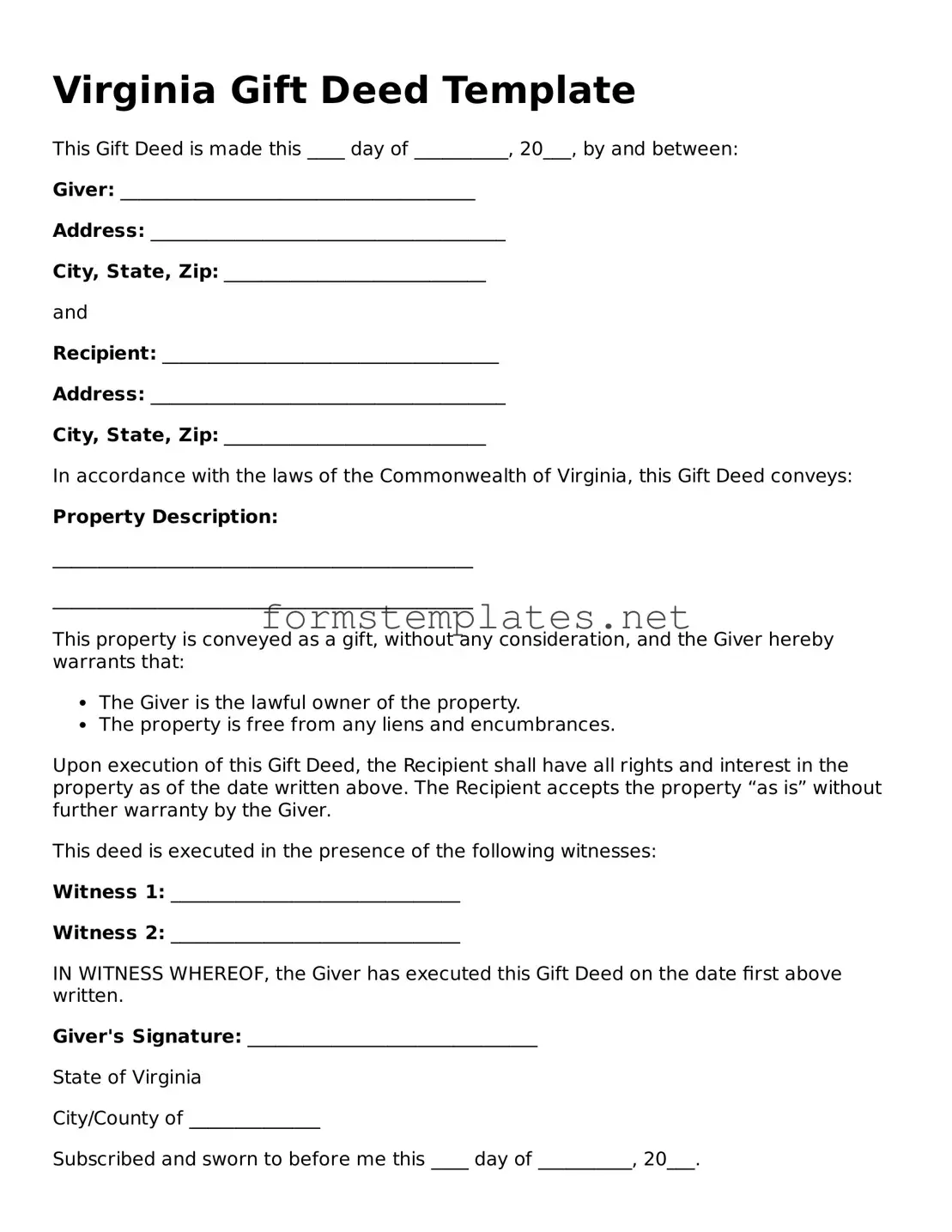

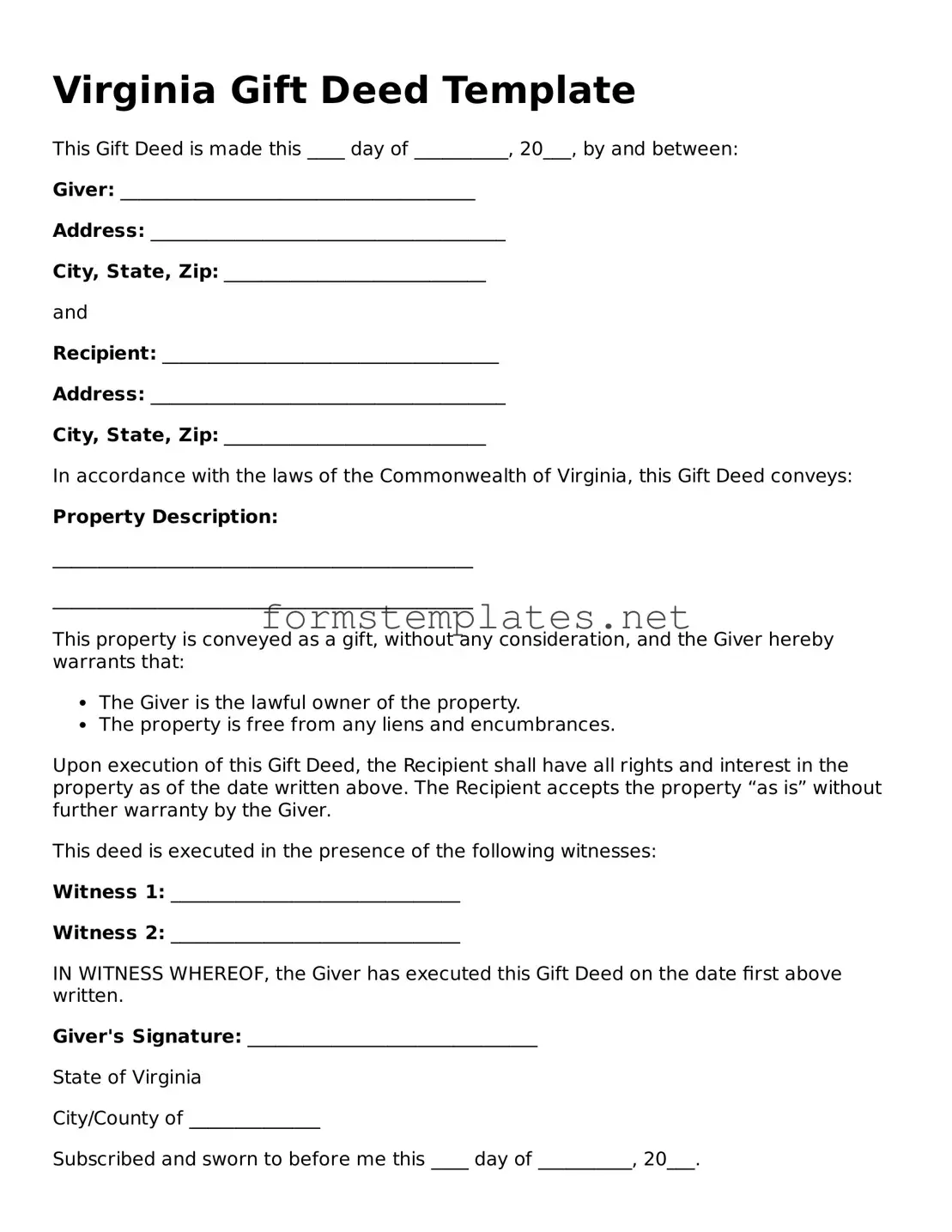

Attorney-Approved Virginia Gift Deed Template

A Virginia Gift Deed is a legal document that allows a property owner to transfer ownership of real estate to another person without receiving any payment in return. This form is essential for ensuring that the transfer is recognized by the state and protects the interests of both the giver and the recipient. Understanding the requirements and implications of this deed is crucial for anyone considering a property gift in Virginia.

Open Editor Now

Attorney-Approved Virginia Gift Deed Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Gift Deed online — simple edits, saving, and download.