What is a Virginia Promissory Note?

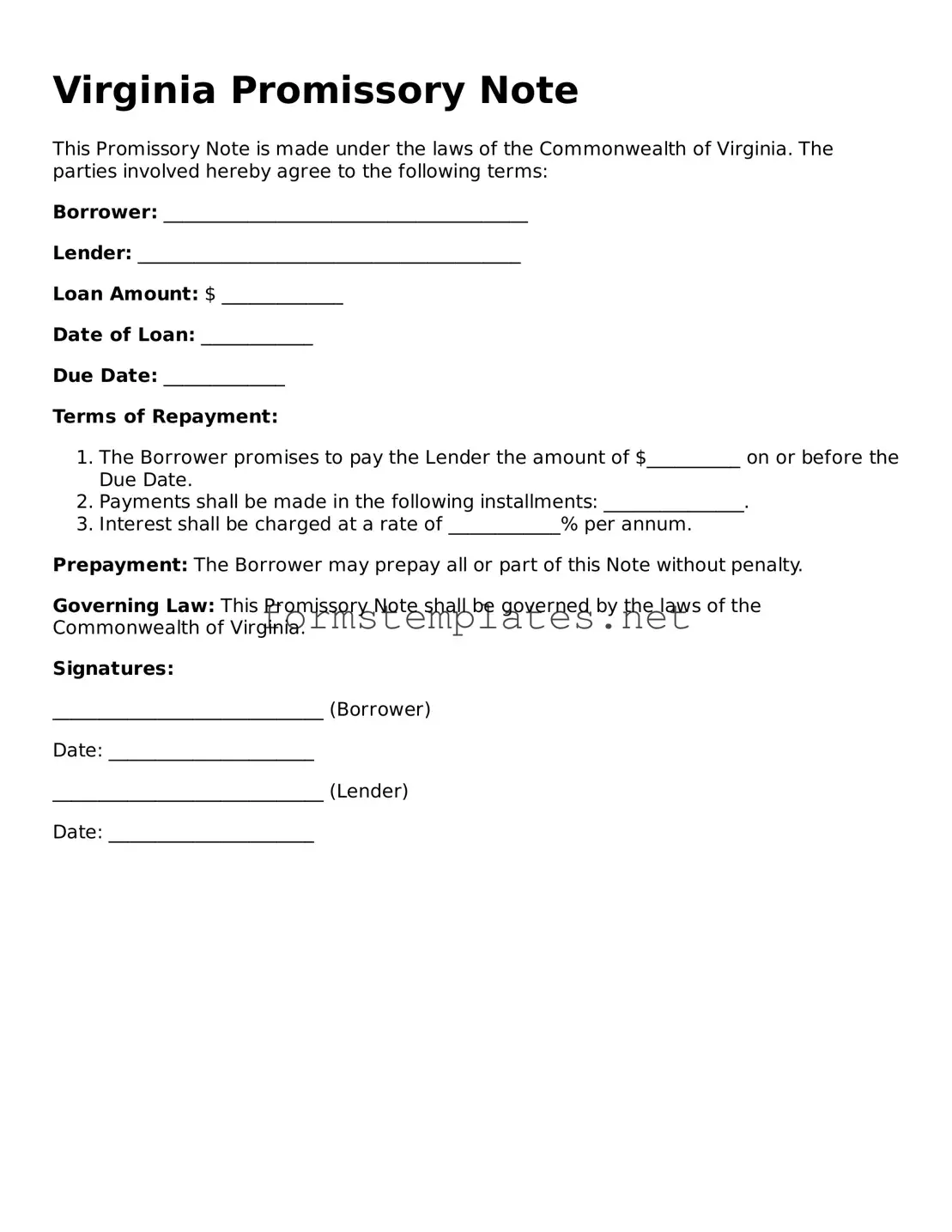

A Virginia Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document serves as a written record of the loan, including details such as the principal amount, interest rate, repayment schedule, and any applicable fees. It is essential for both parties to understand their rights and obligations as outlined in the note.

What are the key components of a Virginia Promissory Note?

Several important elements should be included in a Virginia Promissory Note:

-

Borrower and Lender Information:

Full names and addresses of both parties.

-

Principal Amount:

The total amount of money being borrowed.

-

Interest Rate:

The rate at which interest will accrue on the unpaid balance.

-

Payment Terms:

The schedule for repayment, including due dates and the frequency of payments.

-

Maturity Date:

The date by which the loan must be fully repaid.

-

Default Terms:

Conditions under which the borrower would be considered in default and the lender's rights in such an event.

Do I need to have the Promissory Note notarized?

While notarization is not strictly required for a Virginia Promissory Note to be valid, it is highly recommended. Having the document notarized can provide an additional layer of protection, as it verifies the identities of the parties involved and the authenticity of their signatures. This can be particularly important if a dispute arises in the future.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing, and ideally, have them signed and dated by both the borrower and lender. This helps to avoid misunderstandings and ensures that both parties are clear about the new terms.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. The lender may choose to:

-

Contact the borrower to discuss the missed payments and seek a resolution.

-

Assess any late fees as stipulated in the Promissory Note.

-

Initiate legal proceedings to recover the owed amount.

It is crucial for both parties to understand the default terms outlined in the note to avoid complications.

Is a Virginia Promissory Note enforceable in court?

Yes, a properly executed Virginia Promissory Note is generally enforceable in a court of law. If a borrower fails to repay the loan, the lender can file a lawsuit to recover the owed amount. To ensure enforceability, it is vital that the note is clear, comprehensive, and signed by both parties.

Can a Promissory Note be secured or unsecured?

A Promissory Note can be either secured or unsecured. An unsecured note does not have collateral backing it, meaning the lender relies solely on the borrower's promise to repay. In contrast, a secured note is backed by collateral, such as property or other assets. This can provide the lender with additional protection in case of default.

What should I do if I lose my Promissory Note?

If you lose your Promissory Note, it is important to take action promptly. Notify the other party of the loss and consider drafting a replacement note. Both parties should agree to the terms of the new note and sign it to ensure clarity and legal validity. Keeping a copy of any important financial documents is always advisable to prevent such situations.