What is a Washington Bill of Sale?

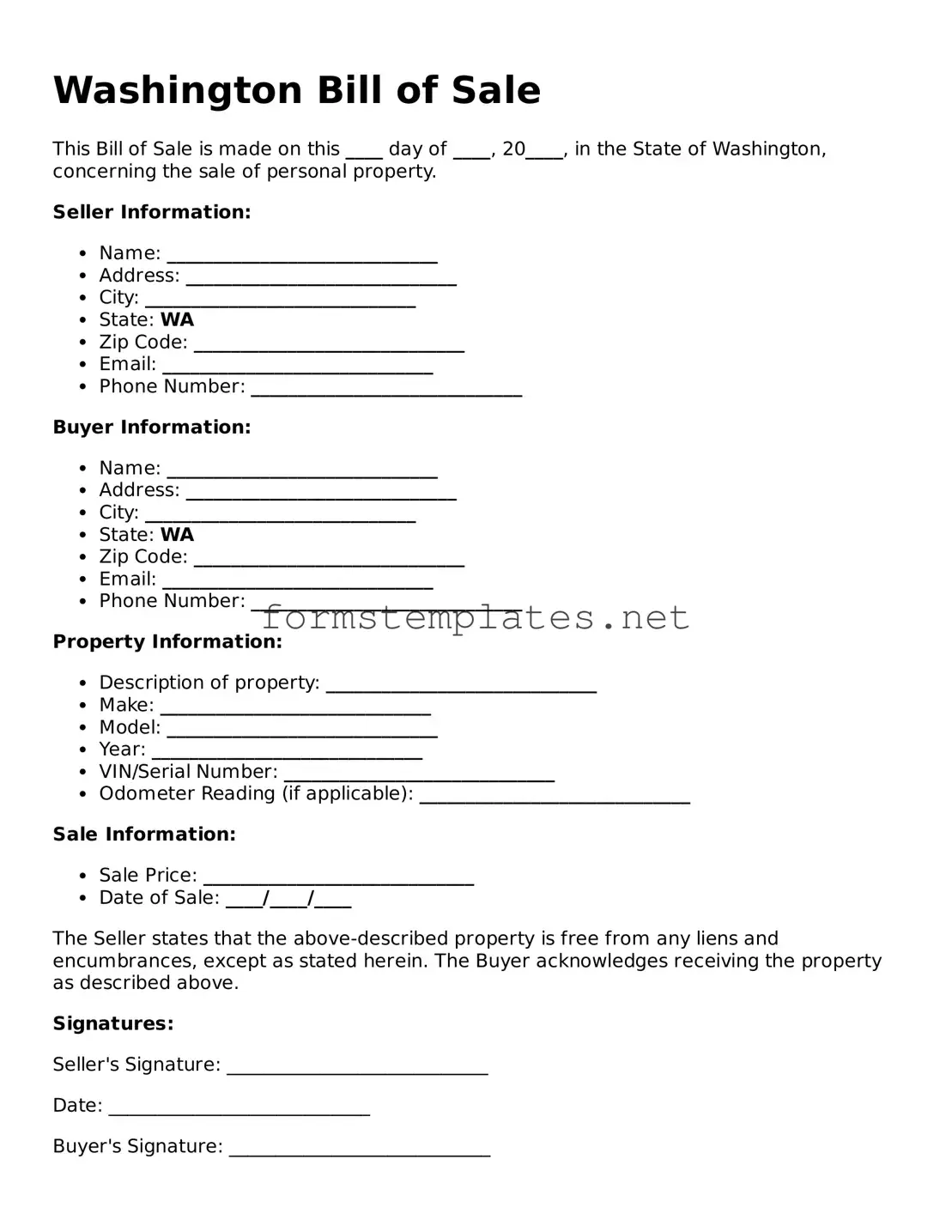

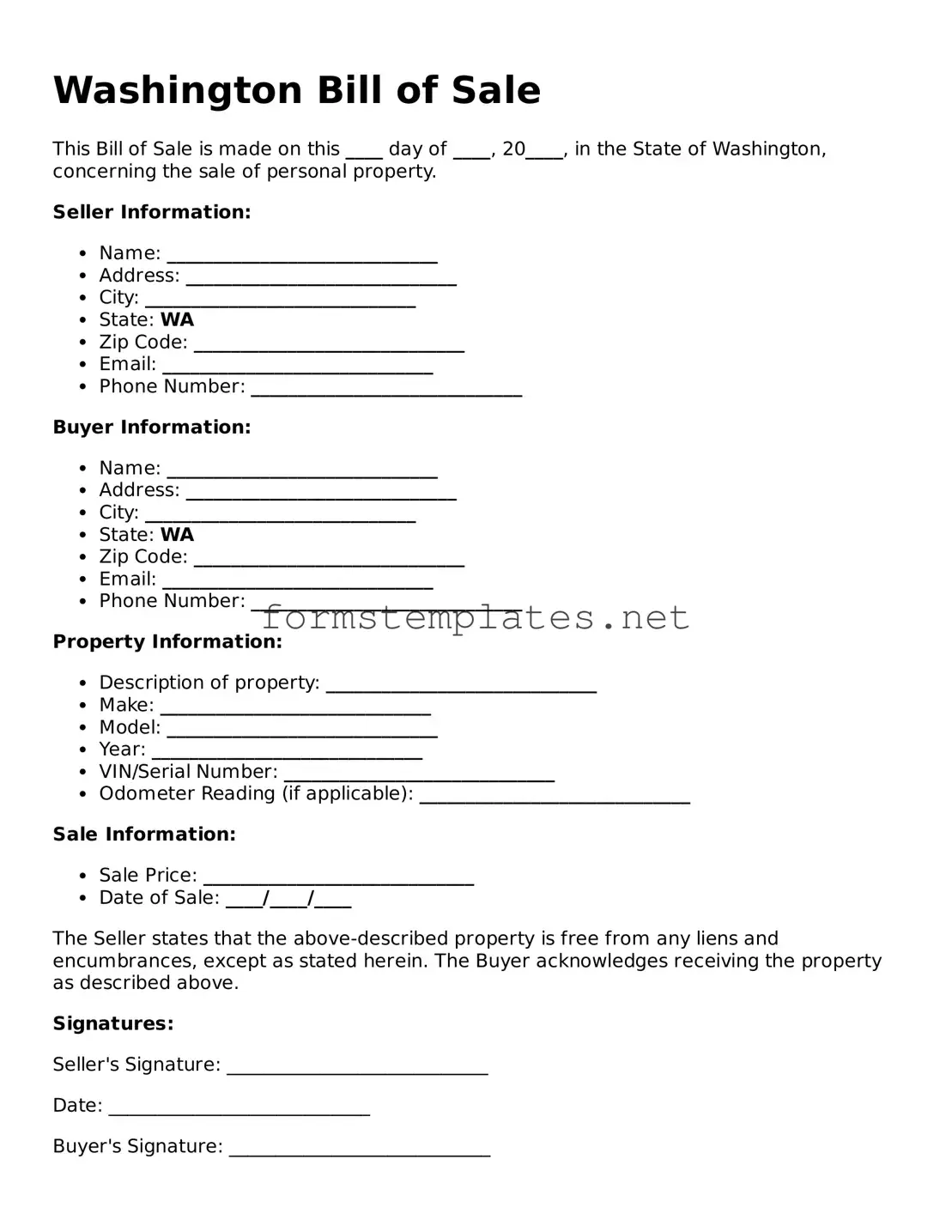

A Washington Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. It serves as proof of the transaction and can be used for various types of property, including vehicles, boats, and equipment.

Do I need a Bill of Sale in Washington?

While a Bill of Sale is not always required by law, it is highly recommended. This document provides evidence of the sale and can protect both the buyer and seller in case of disputes. For vehicles, the Washington Department of Licensing requires a Bill of Sale for registration purposes.

A comprehensive Bill of Sale should include the following details:

-

The names and addresses of the buyer and seller

-

A description of the item being sold, including make, model, and VIN for vehicles

-

The purchase price

-

The date of the transaction

-

Signatures of both parties

Is a Bill of Sale legally binding?

Yes, a Bill of Sale is legally binding as long as it includes all necessary information and is signed by both parties. It acts as a contract, ensuring that both the buyer and seller fulfill their obligations under the agreement.

Can I create my own Bill of Sale?

Absolutely! You can create your own Bill of Sale. Just make sure to include all the essential information mentioned earlier. There are also templates available online that can simplify the process for you.

Do I need to have the Bill of Sale notarized?

In Washington, notarization is not required for a Bill of Sale to be valid. However, having it notarized can add an extra layer of security and may be beneficial if you ever need to prove the authenticity of the document.

What should I do with the Bill of Sale after the transaction?

After the transaction is complete, both the buyer and seller should keep a copy of the Bill of Sale for their records. This document may be needed for future reference, especially for registration or tax purposes.

How does a Bill of Sale affect taxes?

A Bill of Sale can have tax implications, especially for vehicles. The buyer may need to pay sales tax based on the purchase price when registering the vehicle. It’s advisable to consult with a tax professional to understand the specific tax obligations associated with your transaction.

What if there are issues after the sale?

If problems arise after the sale, such as disputes over the condition of the item or failure to deliver, the Bill of Sale can serve as a crucial piece of evidence. It outlines the terms of the sale and can help resolve conflicts between the parties involved.